Relax to Rich | Week 47 Recap (Ending Nov 21, 2025)

Hi friends,

💡 Investing Doesn’t Have to Be Complicated

R2R is built on simple, time-tested principles:

✅ Focus on high-quality assets

✅ Keep a Margin of Safety

✅ Use options with intention

✅ Stay patient, let time and compounding do the heavy lifting

Performance Snapshot

Performance Snapshot

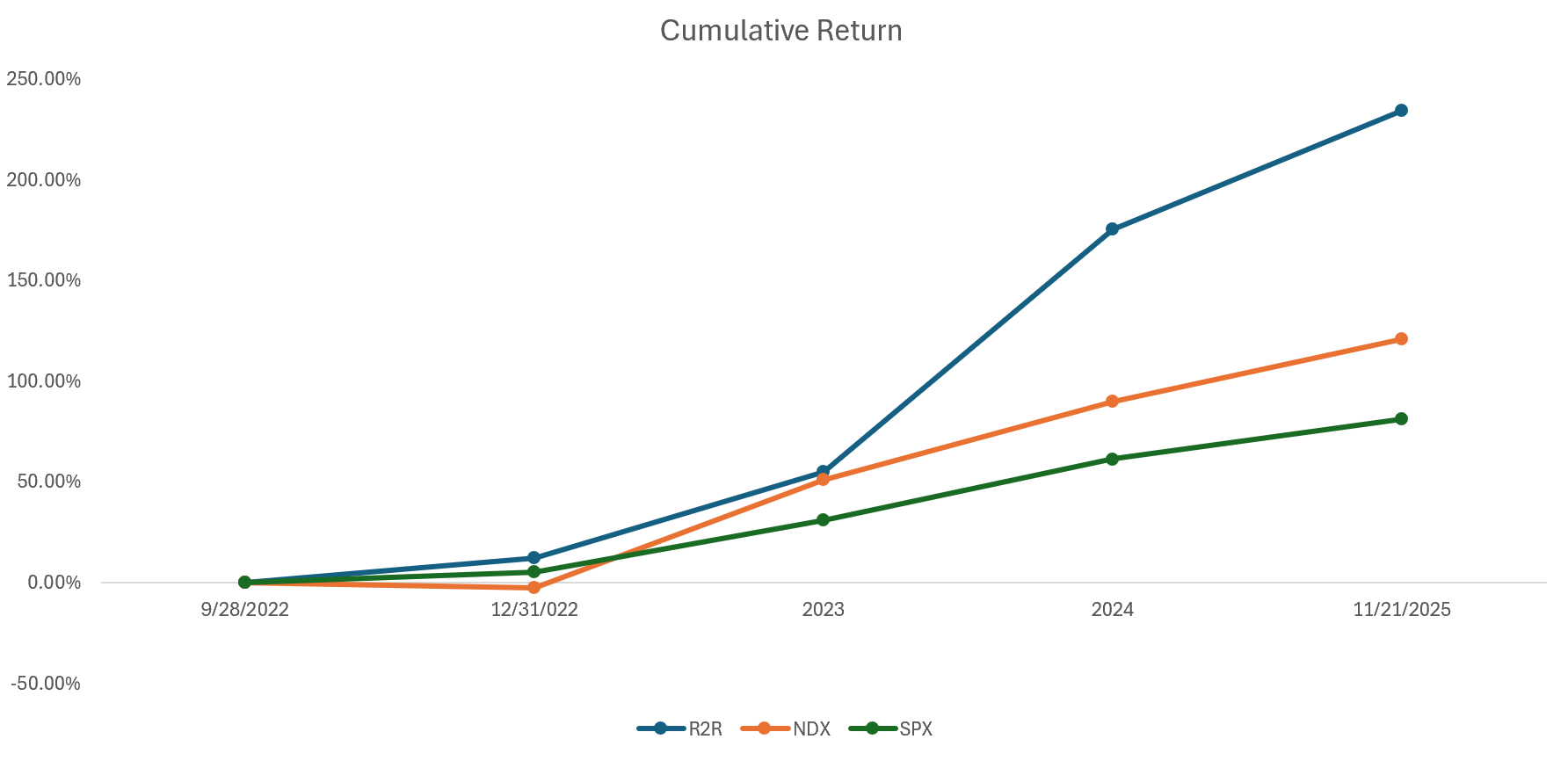

(From Sept 28, 2022, through Nov 21, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 11/21/2025 | 21.43% | 16.15% | 12.26% | 3.34 | 0.89 |

| Total Return | 234.40% | 120.68% | 81.04% | 3.15 | |

| Annualized Return | 46.74% | 28.59% | 20.75% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.34

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 391.09 | -3.16% |

| 2 | QQQ | 12% | 590.07 | 15.42% |

| 3 | Tencent (700.HK) | 15% | HKD 610.00 | 46.28% |

| 4 | Nvidia (NVDA) | 4% | 178.88 | 33.20% |

| 5 | Others | 9% | ||

| 6 | Cash Equivalents | 19% | ||

| 7 | SPX | -45% | 6602.99 | 12.26% |

- Weights = delta-adjusted exposures (stock + options).

- Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

No new stock trades this week.

However, I stayed active on the options side, consistent with the R2R playbook:

-

-

Closed TSLA calls for profit

-

Closed META calls for profit

-

Rolled META puts to later expirations to capture more premium

-

💬 MY Thoughts

Weeks like this remind me why the Relax to Rich philosophy matters.

Markets will always hand us noise: delays, headlines, politics, macro data, unexpected volatility. But when you strip all that away, what’s left are the only things that matter: the quality of the businesses you own, the strength of their long-term trajectories, and your ability to stay disciplined while everything around you tries to pull you off course.

This week, I didn’t chase anything. I didn’t panic. I simply followed the plan:

• Let great companies execute on multi-year roadmaps

• Use options to turn volatility into cash flow instead of stress

• Stick to position sizes grounded in risk management, not emotion

• Give compounding the time it needs to work its quiet magic

One of the biggest advantages individual investors have is emotional patience. Institutions can’t do it. Algorithms can’t do it. But we can. And when we do, we turn market turbulence into opportunity, not anxiety.

If Tesla dips into my strike zone, I’ll buy.

If it chops, I’ll collect premium.

If it runs, I’ll ride.

Simple. Intentional. Repeatable.

That’s how we get from Relax… to Rich: not by predicting the next headline, but by staying grounded while the world swings from fear to greed and back again.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. Arizona Permits Tesla Ride-Hailing Operations

Arizona approved Tesla’s Transportation Network Company (TNC) permit, initially requiring human drivers but enabling FSD-equipped fleet operations.

My Take:

This is a logical stepping stone toward Tesla’s robotaxi network.

-

Reinforces the value of the FSD software stack

-

Supports higher utilization of the existing fleet

-

Opens a path toward recurring mobility revenue

Human-driver requirements remind us:

Regulators move slower than tech, but momentum matters.

2. AI5 Chip Delayed to Mid-2027

Elon confirmed AI5 design review is done but availability is pushed to mid-2027. AI6 work has already begun.

My Take:

A delay like this doesn’t break the thesis, but it does shift the robotics/autonomy timeline.

-

Slower hardware efficiency gains = slower Optimus scaling

-

Custom silicon strategy still strengthens long-term moat

-

Near-term AI monetization might cool, but long-term upside remains intact

Execution risk goes up slightly, but the big vision remains unchanged.

3. FSD Supervised v14.2 Rolls Out

More visualizations, improved lane changes, pedestrian logic, and prioritized rollout to AMD Ryzen vehicles.

My Take:

Another turn of Tesla’s data flywheel.

Every incremental improvement supports:

-

Software margins that could exceed 90%

-

Future licensing deals

-

Long-term autonomy optionality

Still, regulatory scrutiny remains a headwind, especially the NHTSA probe.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Low volatility week despite macro data:

-

NY Fed Manufacturing: –5.8 (better than –6.2 expected)

-

FOMC minutes: No near-term cuts

-

Jobless claims: 213,000 (improvement)

-

QQQ: Up ~0.5% and holding above the 200-day MA

My Take:

Soft-landing signals continue to support Nasdaq’s growth profile.

-

Lower recession risk = supportive for high-R&D tech

-

Dollar strength still pressures multinationals

-

Watch CPI/PCE: sticky inflation could hit tech-heavy indices

Resilience is encouraging, but we remain selective.

Tencent (700.HK)

Tencent (700.HK)

1. Tencent Completes Stake in Ubisoft’s Vantage Studios

€1.16B for 26.32% economic stake.

My Take:

This deepens Tencent’s Western gaming footprint.

-

Improves global IP pipeline

-

Potential for cross-platform monetization via WeChat ecosystem

-

Execution risk depends on Ubisoft’s future delivery

The valuation looks reasonable, though the console/PC segment is still secondary to Tencent’s mobile strength.

2. Tencent Cloud Day Singapore

Key highlights:

-

64 AZs across 22 regions

-

Doubled international client base

-

AI-powered fraud prevention and payments

-

Big branding push at Changi Airport

My Take:

Tencent’s cloud strategy is shifting toward Southeast Asia, a smart move.

-

Growth vector outside China

-

Sticky recurring revenue

-

But chip constraints cap near-term scaling

Execution efficiency will determine if Tencent can take meaningful share in the fast-growing ASEAN cloud market.

Stay patient. Stay focused. Turn volatility into cash flow. Let compounding do the heavy lifting.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.