We all see the headlines: Warren Buffett, the “Oracle of Omaha,” has famously poured billions into banks like Bank of America, treating them as long-term fortresses for his portfolio.

It’s a powerful vote of confidence.

But… there is a completely different school of thought. Many other successful investors and top analysts, including those who, like Terry Smith, were once #1-rated bank analysts themselves, argue that investing in banks is a fundamentally flawed strategy for everyday investors.

They believe that even Buffett’s “fortress” approach overlooks risks that just aren’t worth the potential reward. Here is their case for avoiding the entire sector.

1. 💣 The “Black Box” of Leverage

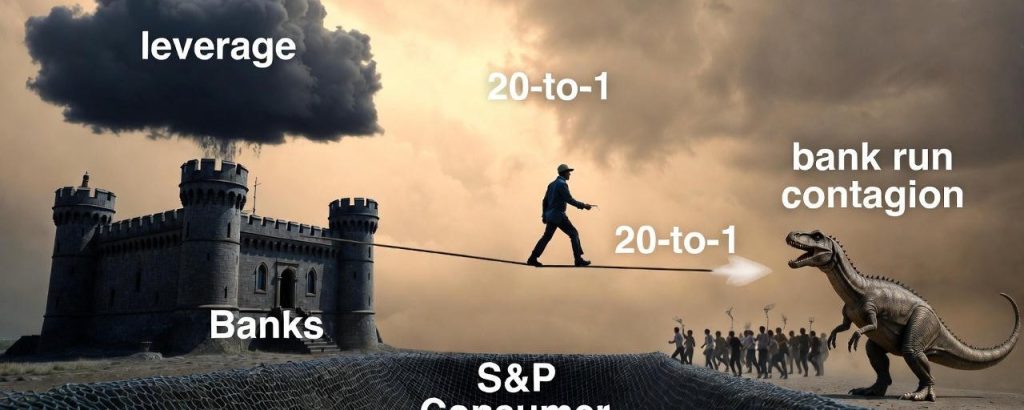

The number one argument against banks: they run on terrifying, opaque leverage.

To make money, a typical bank might have only $5 of its own money (equity) for every $100 in assets it holds (mostly loans). That’s 20-to-1 leverage.

-

The Danger: If just 5% of those assets turn bad—a small recession, a property downturn, the bank’s entire equity is wiped out.

-

The Contrast: A normal company in the S&P 500 is geared closer to 3-to-1.

Critics of bank investing argue that this high-wire act is simply too risky. A small, unpredictable shock (like the 2023 Silicon Valley Bank collapse) can lead to a total wipeout.

2. 📉 A Bad Deal: All the Risk, None of the Reward

If you’re going to take on that kind of explosive risk, you should be paid handsomely for it, right?

The data shows the opposite.

-

Over a recent five-year period (2018-2023), the S&P Banks Sector delivered a negative total return of -15.1%.

-

During that same time, the “boring” S&P Consumer Staples Sector (think soap, snacks, and soda) returned +12.1% per year.

This leads many to ask: Why would anyone take on 20-to-1 leverage and catastrophic risk for returns that are worse than just buying a “boring” company?

3. 🏃♂️ The Contagion Problem: Your “Good” Bank Isn’t Safe

This is the key point that challenges the “just pick a good one” strategy. In the world of banking, fear is contagious, and your investment can be destroyed by a panic at a different bank.

There’s a classic anecdote from 1980s Hong Kong. Amid a nervous property market, a heavy rainstorm caused a bus queue to shelter under a local bank’s awning. Passersby saw the “crowd,” assumed it was a bank run, and started an actual bank run that nearly toppled the bank.

That’s banking. As a former Bank of England Governor famously said, it makes no sense to start a bank run, but it makes perfect sense to join one. This “systemic risk” means even a well-run bank can be brought down by its peers.

4. 📱 The “Dinosaur” Problem: Fintech is Eating Their Lunch

Finally, even if banks manage all that risk, they face a new threat: they are becoming obsolete.

What are the essential functions of a bank?

-

Taking deposits

-

Making loans

-

Processing payments

Today, peer-to-peer platforms handle loans. You can get paid directly to a Visa or Mastercard. You use Apple Pay, Google Pay, or other apps to send money.

Technology is steadily supplanting the traditional bank, leaving them with legacy systems while fintech startups steal their most profitable business. As former Fed Chair Paul Volcker noted, the only major innovation from banks in 20 years was the ATM… and now, we don’t even need those.

For many investors, the conclusion is simple: high risk, low returns, and a business model that’s under attack. It’s a strategy of avoidance that stands in stark contrast to the Buffett approach.

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨