Relax to Rich | Week 48 Recap (Ending Nov 28, 2025)

Hi friends,

💡 Investing Doesn’t Have to Be Complicated, R2R is built on simple, time-tested principles:

✅ Focus on high-quality assets

✅ Keep a Margin of Safety

✅ Use options with intention

✅ Stay patient, let time and compounding do the heavy lifting

Performance Snapshot

Performance Snapshot

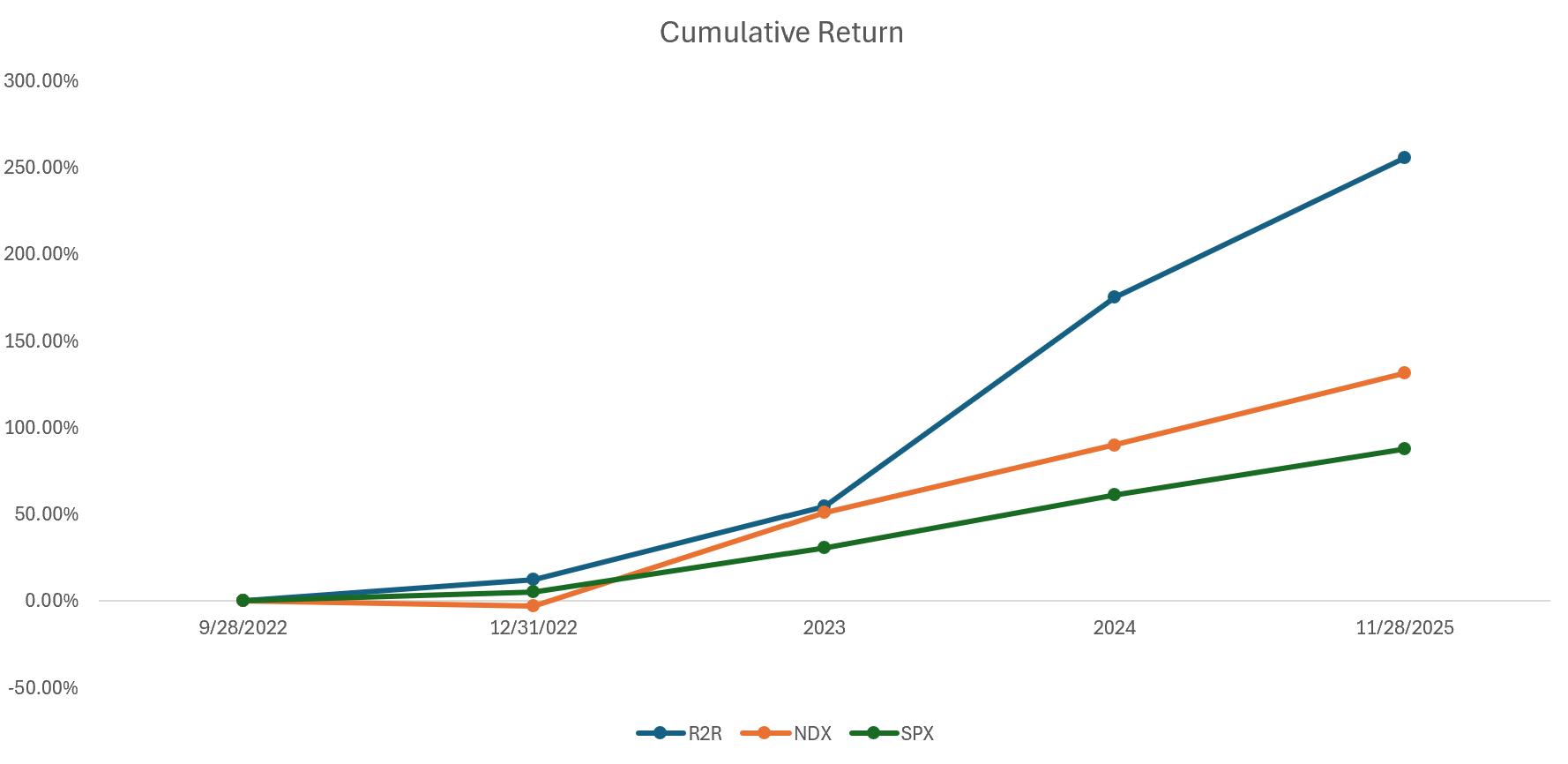

(From Sept 28, 2022, through Nov 28, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 11/28/2025 | 29.16% | 21.98% | 16.45% | 3.56 | 0.91 |

| Total Return | 255.69% | 131.59% | 87.79% | 3.17 | |

| Annualized Return | 49.28% | 30.36% | 22.01% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.56

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 44% | 430.17 | 6.52% |

| 2 | QQQ | 8% | 619.25 | 21.13% |

| 3 | Tencent (700.HK) | 16% | HKD 611.50 | 46.64% |

| 4 | Nvidia (NVDA) | 4% | 177.00 | 31.80% |

| 5 | Others | 8% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -64% | 6849.09 | 16.45% |

- Weights = delta-adjusted exposures (stock + options).

- Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

• No stock trades this week

• Closed TSLA puts for profit: continuing the R2R rhythm of harvesting volatility into cash flow

💬 MY Thoughts

This week reinforced a pattern I’ve seen again and again: the headlines move fast, but fundamentals move slow. Tesla’s news flow was noisy, macro sentiment turned sharply positive, and futures markets literally broke, yet none of this changes the core of the R2R approach.

I don’t react to every bump in the road.

Instead, I focus on managing risk, harvesting cash flow, and holding long-duration assets where time works for me, not against me.

Volatility isn’t something to fear, it’s something to convert into income. And as long as the underlying businesses keep executing, my job is simply to stay patient and let compounding work.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. China & Europe Sales Decline (October 2025)

China sales fell 36% YoY; Europe registrations nearly halved.

My Take:

This adds near-term pressure on Tesla’s automotive unit, especially in markets with brutal price competition. It reinforces the reality that Tesla’s valuation premium relies increasingly on AI, autonomy, and software, not just vehicle volumes.

But I stay focused on Tesla’s long-duration optionality rather than single-month datapoints.

2. Robotaxi Fleet Target Miss

Musk now expects ~60 vehicles by year-end vs. the previously stated 500+.

My Take:

This is a sizable miss and highlights real bottlenecks in production, regulatory coordination, or software readiness.

It pushes meaningful Robotaxi revenue expectations into 2026–2027, but doesn’t change the long-term thesis. In R2R, I treat these as timeline adjustments, not thesis breakers.

3. FSD v14.2 Rollout + 30-Day Trial

HW4 vehicles receive v14.2/14.2.1; free trial launched to boost adoption.

My Take:

Smart move. If the software is truly improving, trials can immediately lift high-margin revenue.

But fragmentation between HW3 vs. HW4 bears watching, it may affect upgrade cycles and resale values.

4. Powerwall 2 Recall, Class-Action Lawsuit

~10,500 units were remotely disabled for safety.

My Take:

Financial impact = low

Reputation + legal precedent = worth monitoring

The risk is not the recall itself; it’s the precedent of disabling hardware via OTA. It challenges Tesla’s “software-defined hardware” model and may shape future regulatory boundaries.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

1. Rate Cut Probability Surges

PCE cooled as expected; December cut odds jumped from 40% → 87%.

My Take:

This is the macro “green light” markets were waiting for.

But this also creates asymmetry:

If the Fed doesn’t cut on Dec 10, the unwind could be swift.

For now, the wind is at tech’s back.

2. CME Futures Outage

Cooling issue halted U.S. futures trading for hours.

My Take:

Price impact: zero

Risk-management lesson: massive

In a bearish market, this could have triggered a flash crash.

I treat events like this as reminders that liquidity isn’t guaranteed, and stop-loss orders can fail when you need them most, another reason I lean on options, not stop-losses.

Tencent

Tencent

1. Hunyuan 3D AI Engine Global Launch

New engine generates 3D assets from text or images; integrated into Tencent Cloud.

My Take:

This is a cost-slashing weapon for gaming and content creation.

If Hunyuan can automate even 20–30% of 3D asset work, margins improve meaningfully.

More importantly, Tencent is emerging as a true industrial-AI player, not just a consumer-internet giant.

Stay patient. Stay focused. Turn volatility into cash flow. Let compounding do the heavy lifting.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.