Relax to Rich | Week 22 Recap (Ending May 30, 2025)

Simple, steady investing — no hype, no stress.

💡 Investing Doesn’t Have to Be Complicated

With a long-term mindset grounded in value investing—and the smart use of options for either boosting returns or managing risk—you can build wealth steadily, without chasing hot trends or falling for the next big thing.

Each week, I’ll share a quick update on how my personal portfolio is doing. I call it “Relax to Rich” (R2R). The philosophy is simple:

✅ Stay patient ✅ Focus on high-quality assets ✅ Use options thoughtfully ✅ Let time and compounding do the heavy lifting

If you’re someone who wants to grow wealth calmly and intentionally, I hope this series offers insight, encouragement, and a bit of inspiration.

📌 Weekly Activity

This week was quiet in terms of stock trades—no buying or selling.

However, I did actively manage my options book:

- Closed several Tesla call and put positions

- Rolled Nvidia call options to later dates

This is part of a steady rhythm—using options to generate income, hedge risk, or extend my exposure in a controlled way.

📈 Performance Snapshot

As of May 30, 2025

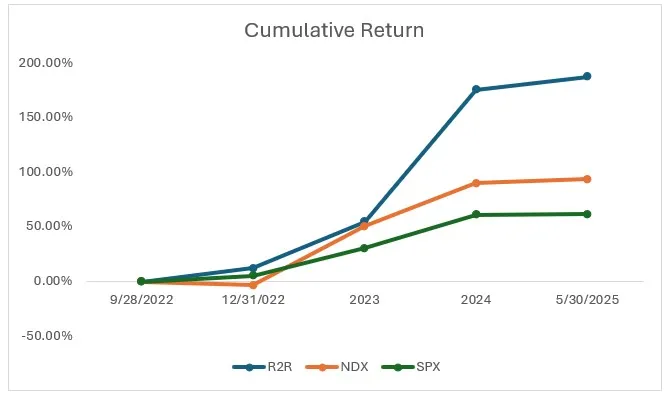

Performance Comparison: R2R vs. NDX and SPX Over the Same Period

note: Performance is measured using Time-Weighted Return (TWR), based on real data from Interactive Brokers. R2R started on Sept 28, 2022 with NAV = 1. Today, NAV = 2.88.

📊 Current Portfolio Snapshot

R2R Holding

What does this mean?

- “Weight” is based on delta exposure—which includes stock + options.

- “Others” = small positions I’m watching.

- “Cash Equivalents” = for liquidity and flexibility.

- SPX is used as a hedge, via options on the S&P 500.

💬 Curious about “delta” or “cash equivalents”? Drop a comment, and I’ll gladly explain these terms in plain language.

Key Events This Week

🚗 Tesla

1. Elon Leaves Government to Refocus on Tesla Elon officially ended his 130-day role in Washington leading the Department of Government Efficiency (DOGE). During his tenure, he slashed thousands of federal jobs and saved $160 billion—far below the $2 trillion target. Many investors (including me) are relieved. 👉 Elon back full-time at Tesla is exactly what I want to see.

2. Robotaxi Launch Set for June 12 Tesla will launch a fully driverless robotaxi service in Austin with 10–20 Model Ys under remote supervision. Testing has been successful so far. 👉 This could be the real beginning of a new era for transportation—and a major growth lever for Tesla.

3. New U.S. Manufacturing Mandates The Trump administration now requires automakers to manufacture all vehicles and parts in the U.S. within a year. Tesla hasn’t commented yet, but it could impact supply chains. 👉 It’s a big challenge—but possibly a blessing in disguise if Tesla localizes and strengthens its base.

📦 QQQ / Nasdaq 100

1. Tariff Whiplash Trade policy keeps bouncing—Trump’s global tariffs were briefly blocked, then reinstated by a federal appeals court. He also accused China of violating its trade truce. 👉 This back-and-forth is exhausting. I wish there was more stability in policy—it matters a lot for tech.

2. Earnings Season About 51% of Nasdaq 100 companies have now reported Q1 earnings.

- 78% beat EPS expectations

- 73% beat revenue

👉 Nvidia and a few other giants are clearly driving the market. Their results ripple through everything.

3. Mixed Economic Data

- Jobless claims rose to 240,000

- PCE index (a key inflation gauge) cooled more than expected

👉 Encouraging inflation data, but the rising jobless numbers remind me to stay cautious.

🎮 Tencent

1. SM Entertainment Stake Tencent is acquiring a 9.7% stake in K-pop agency SM Entertainment for $177 million—becoming its 2nd-largest shareholder. 👉 If China really eases its K-pop restrictions, Tencent could be in the sweet spot.

2. Big AI Spending Tencent will allocate a low double-digit % of its 2025 revenue to capital expenditures, mainly for AI. Their large language model “Hunyuan” (T1 version) is now public. Features have been integrated into WeChat and other apps. 👉 This is a long-term bet, and I like it. AI is where the puck is going.

💻 NVIDIA

1. Record Q1 Results, but China Risks Loom Nvidia posted $44.1B in revenue (+69% YoY), with data center revenue at $39.1B (+73%). However, export restrictions on its H20 chips led to a $4.5B charge and an expected $8B shortfall in Q2. 👉 Massive growth—yet it’s a reminder how vulnerable even great companies are to political risk.

2. U.S. Lawmakers Question Shanghai Plans Nvidia is leasing a logistics facility in Shanghai. U.S. senators are skeptical, citing national security. Nvidia says no sensitive tech is involved. 👉 Tech and geopolitics are getting more intertwined than ever.

3. DOE Supercomputer Partnership Nvidia and Dell are building a new U.S. supercomputer named “Doudna” for advanced scientific research. It will use Nvidia’s newest AI chips and liquid-cooled servers. 👉 These kinds of projects show how Nvidia’s chips go beyond gaming—they’re core to science and defense.

4. RTX 5090 Prototype Leak A leaked design of Nvidia’s RTX 5090 GPU shows extreme specs—4 power connectors and extra voltage regulation. 👉 This card looks like it’s built for AI labs, not home desktops. Still—very cool.

If you made it this far—thank you for reading!

Stay calm. Stay patient. Keep learning. That’s how we go from Relax… to Rich.

— William | Relax to Rich Club Investing made calm, clear, and compounding.

⚠️ Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.