Relax to Rich | Week 43 Recap (Ending Oct 24, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Performance Snapshot

Performance Snapshot

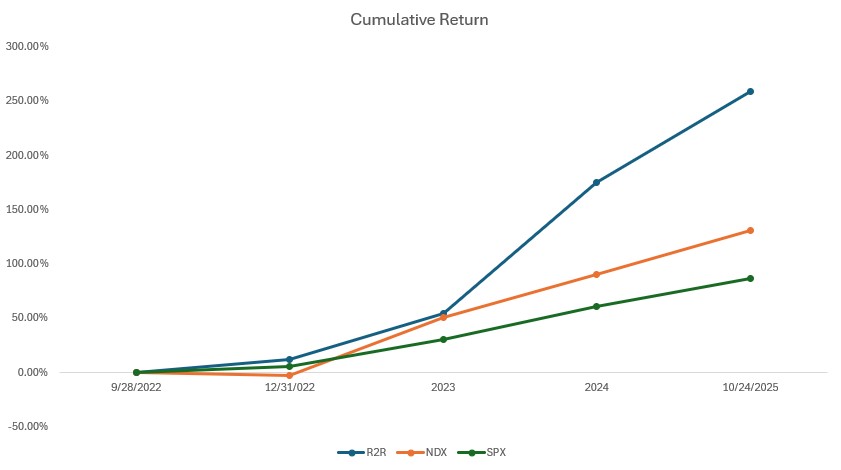

(From Sept 28, 2022, through Oct 24, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 10/24/2025 | 30.20% | 21.50% | 15.47% | 3.59 | 0.81 |

| Total Return | 258.56% | 130.86% | 86.21% | 3.07 | |

| Annualized Return | 51.55% | 31.31% | 22.44% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.59.

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 44% | 433.72 | 7.40% |

| 2 | QQQ | 7% | 617.10 | 20.71% |

| 3 | Tencent (700.HK) | 17% | HKD 637.50 | 52.88% |

| 4 | Nvidia (NVDA) | 3% | 186.26 | 38.70% |

| 5 | Others | 7% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -68% | 6791.69 | 15.47% |

* Weights = delta-adjusted exposures (stock + options).

Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

No new stock trades this week.

• Closed Tesla puts for profit and reopened new positions.

• Rolled SPX hedge to later expiration.

The Nasdaq and S&P 500 both hit record highs, a “happy problem” for me.

Even though I had to roll my hedges forward, the portfolio’s overall return rose, and with roughly 70% of my exposure hedged, I sleep soundly even if markets overheat and correct.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1.Q3 2025 Financial Results

-

Revenue $28.1 B (+12 % YoY, beat estimates)

-

Operating income $1.6 B (-40 % YoY)

-

Net income $1.3 B (-37 % YoY)

-

Adj. EPS $0.50 (-31 % YoY, missed expectations)

-

Drivers: higher costs, tariffs, and expanding OpEx.

My Take:

Cash flow remains solid, and Tesla’s manufacturing base is a durable foundation for the next big growth vectors, Optimus and FSD.

2. Earnings Call Focus: AI, Optimus, and FSD

-

-

Optimus V3 prototype targeted for Q1 2026, production by year-end.

-

CEO called Optimus an “infinite money glitch,” projecting it could represent 80 % of future value.

-

FSD pilot to expand from Austin to 8-10 metro areas by end 2025 (pending approval).

-

Next-gen AI5 chip to be dual-sourced from Samsung and TSMC.

-

My Take:

Management is clearly reframing Tesla as an AI and robotics company, not just an EV maker. Ambitious timelines bring execution and regulatory risk, but the direction is transformational.

3. CEO Compensation Package

CFO Vaibhav Taneja urged shareholders to approve the $1 trillion package (tied to AI and Optimus milestones).

My Take:

Tying Elon’s incentives to AI and robotics aligns his focus with long-term value creation, I strongly support it.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

U.S. Inflation Data

September CPI came in softer at 3.0 % YoY, boosting hopes for a Fed rate cut.

My Take:

Lower inflation reduces the discount rate used to value future earnings, fuel for tech stocks. This is another example of “bad news is good news.”

Q3 Earnings Season

- Intel beat sales forecasts and raised guidance.

-

IBM ran a quantum error-correction demo on AMD chips, lifting semis.

-

Alphabet and Nvidia gained ground.

-

FactSet: 87 % of S&P 500 companies beat EPS estimates (above 10-year avg).

My Take:

Macro momentum trumps mixed fundamentals, the market is rewarding rate optimism over earnings quality for now.

Tencent (700.HK)

Tencent (700.HK)

2025 R&D Report: AI Everywhere

Half of Tencent’s new code is AI-generated; 90 % of engineers use CodeBuddy (HunYuan-powered), cutting coding time by 40 % and errors by 30 %. AI now reviews 94 % of code submissions.

My Take:

This underscores Tencent’s execution strength, using AI to build AI. These productivity gains can expand margins and accelerate innovation, supporting a premium valuation among China tech leaders.

🧘♂️ Closing Thoughts

Markets are celebrating softer inflation and record highs. I see it as a time for discipline, not euphoria. With hedges in place and cash ready, I’m comfortable letting compounding work, quietly and consistently.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.