My wife has been telling me for years that we should buy rental properties. She loves the tangible feeling of owning a physical asset, of being a landlord and building a portfolio.

And for years, I’ve resisted.

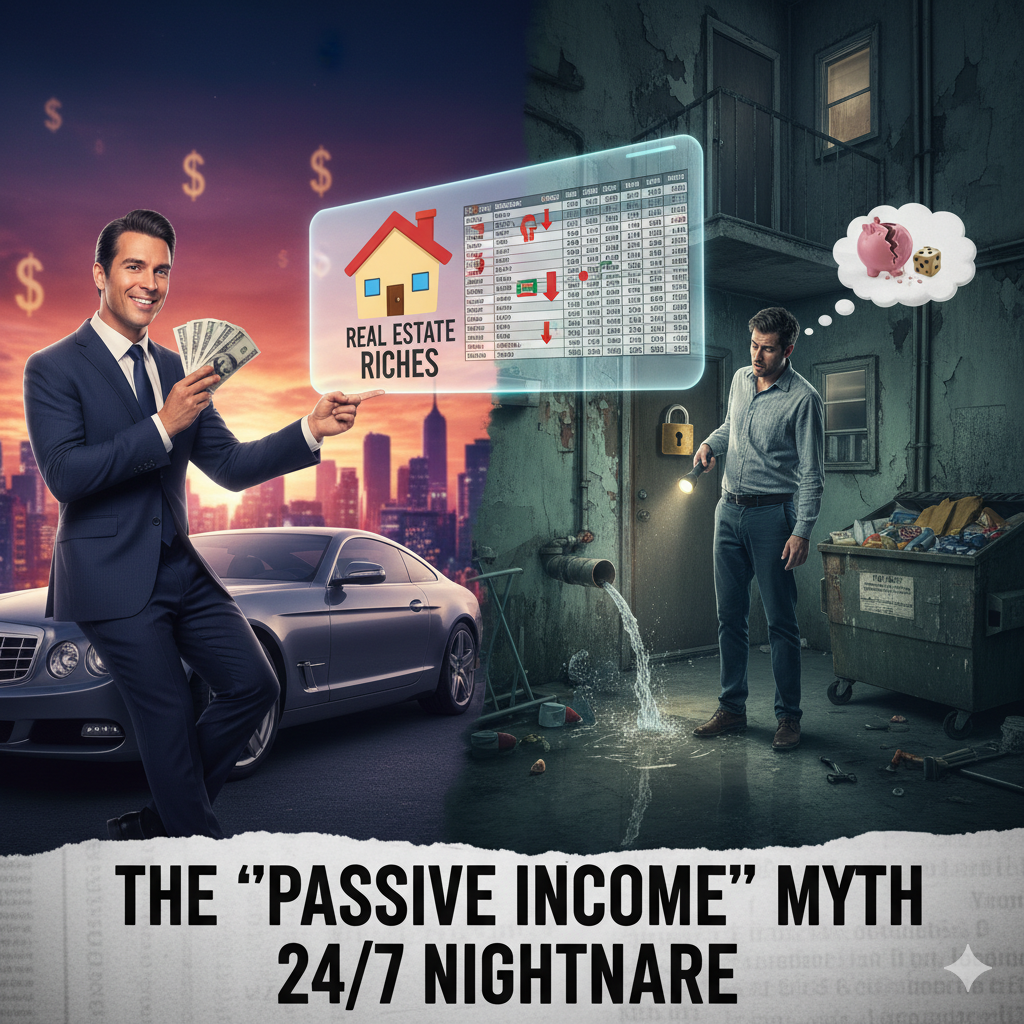

It’s not that I think she’s wrong, real estate has built incredible wealth. It’s that I see the hidden traps, the ones that turn the “passive income” dream into a 24/7 nightmare. This article explains all the reasons I held back… (plus one big one: I knew there was a better, simpler option for me).

We’ve all seen the late-night infomercial or the “guru” on social media. They’re standing in front of a rented Lamborghini, promising you can get rich in real estate with “no money down” and “secret hacks.”

This advice isn’t just misleading; it’s actively dangerous.

Real estate is one of the most powerful ways to build wealth, but it’s also the most unforgiving. The difference between building a legacy and going bankrupt is paper-thin. It’s not about finding secrets; it’s about avoiding the same, repeating mistakes that wipe out beginners.

Here are the critical traps you must learn to see and avoid.

1. You’re Gambling, Not Investing

The most common mistake is buying a property and just… waiting. You’re hoping the market goes up so you can sell for a profit.

That’s not investing. That’s pure speculation. 🎲

Real estate moves in brutal, long-term cycles. Just ask anyone who was “investing” in 2007. They were completely wiped out.

A true investment is profitable from Day 1. The rent you collect must cover the mortgage, taxes, insurance, and repairs with money left over in your pocket every single month. This is called cash flow.

Market appreciation should only ever be the cherry on top, not the entire sundae.

2. You’re Lying to Yourself About Profit

Your “profit” is probably a fantasy, and you’re the last one to know it. Amateurs hide from the numbers, but pros are masters of their spreadsheets.

Here’s how you’re lying to yourself:

-

You ignore big-ticket items: You brag about $400/month in cash flow, but you “forget” to set aside money for the $15,000 roof you’ll need in six years or the $8,000 HVAC system. Your $400/month isn’t profit; it’s just a slow-motion savings account for the next disaster.

-

You ignore your own time: Buying an S&P 500 index fund is 100% passive. Real estate is a job. You spend hundreds of hours finding, financing, fixing, and managing. If you’re “profiting” $5,000 a year but spent 200 hours doing it, you’ve just created a $25/hour part-time job for yourself. Be honest about that.

-

You misunderstand inflation: You bought a house for $200,000 in 2010 and sold it for $300,000 in 2024. You think you made $100,000. But in real terms, $200,000 from 2010 has the same buying power as ~$285,000 today. Your real profit, before any costs, was just $15,000.

3. You Don’t Understand Risk (Until It’s Too Late)

In the stock market, your risk is that your stock goes to zero. In real estate, you can lose more than your entire investment.

-

Leverage is a loaded gun: Gurus love “OPM” (Other People’s Money). But using 95% leverage means a small 5% drop in the market completely wipes out 100% of your investment. You’re now underwater, and the bank owns you. Leverage amplifies gains, but it also amplifies losses.

-

You have no exit plan: You’re so focused on how to buy that you have no idea how to sell. What if you need cash fast? What if the market turns? What if a new law passes (like rent control) that kills your profit? A pro has three exit strategies before they even make an offer.

-

You don’t know history: Investors who think “it’s different this time” are the ones who get destroyed. We’ve had the S&L crisis, the 1986 Tax Reform Act, the 2008 subprime mortgage crisis, and the 2022 interest rate shock. History always repeats. Those who don’t study it are doomed to lose their shirts.

4. You Want the Asset, But Not the Business

This is the most important lesson, and it’s at the heart of my conversations with my wife: When you buy a rental property, you are not an investor. You are a small business owner, a real one!

This single mindset shift changes everything.

-

You’re not cut out for the job: Not everyone is built to be a landlord. Can you handle a 2 AM call about a burst pipe? Can you look a family in the eye and evict them for non-payment? If you hate conflict, you will be a “wimpy” landlord, your rents will fall behind market, and your property will be run into the ground.

-

You “fix” the wrong things: The profit is not in the fixing. The profit is made when you buy. You don’t make money by adding crown molding. You make money by buying a property at 20% below its market value. That discount is your profit and your protection. Most beginners over-improve properties and “fix” away their entire margin.

-

You build a bad reputation: Using unethical clauses or being a “slumlord” doesn’t just feel bad; it’s bad business. Real estate is a small community. Your reputation for being fair and reliable is the only way you’ll get access to the best deals and partners.

For me, understanding these risks confirmed that the high-hassle landlord path wasn’t the right one for my family, especially when I knew I had a better, simpler option that fit my personality and goals.

What’s the biggest real estate mistake you’ve ever made or seen someone else make? Share your story in the comments.

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨