This was a strong quarter for Meta’s core business, but the financial results were heavily distorted by a one-time tax event. The core narrative for investors is not about the past quarter, but about management’s clear signal of a massive increase in AI-related spending for 2026 and beyond.

1. 📈 Income Statement (“Show Me the Money”)

Meta’s top-line growth remains robust, but the bottom line requires careful analysis due to a significant one-time, non-cash tax charge.

-

Revenue: $51.24 billion, up 26% year-over-year (YoY). This growth was driven by a 14% increase in ad impressions and a 10% increase in average price per ad.

-

Operating Income: $20.54 billion, for a 40% operating margin.

-

GAAP Net Income / EPS: $2.71 billion / $1.05 per share.

-

Adjusted Net Income / EPS: $18.64 billion / $7.25 per share.

MY READ: The GAAP net income is misleading. The company recorded a one-time, non-cash income tax charge of $15.93 billion related to the “One Big Beautiful Bill Act.” For understanding operational performance, the adjusted $7.25 EPS is the real figure to use, which comfortably beat expectations.

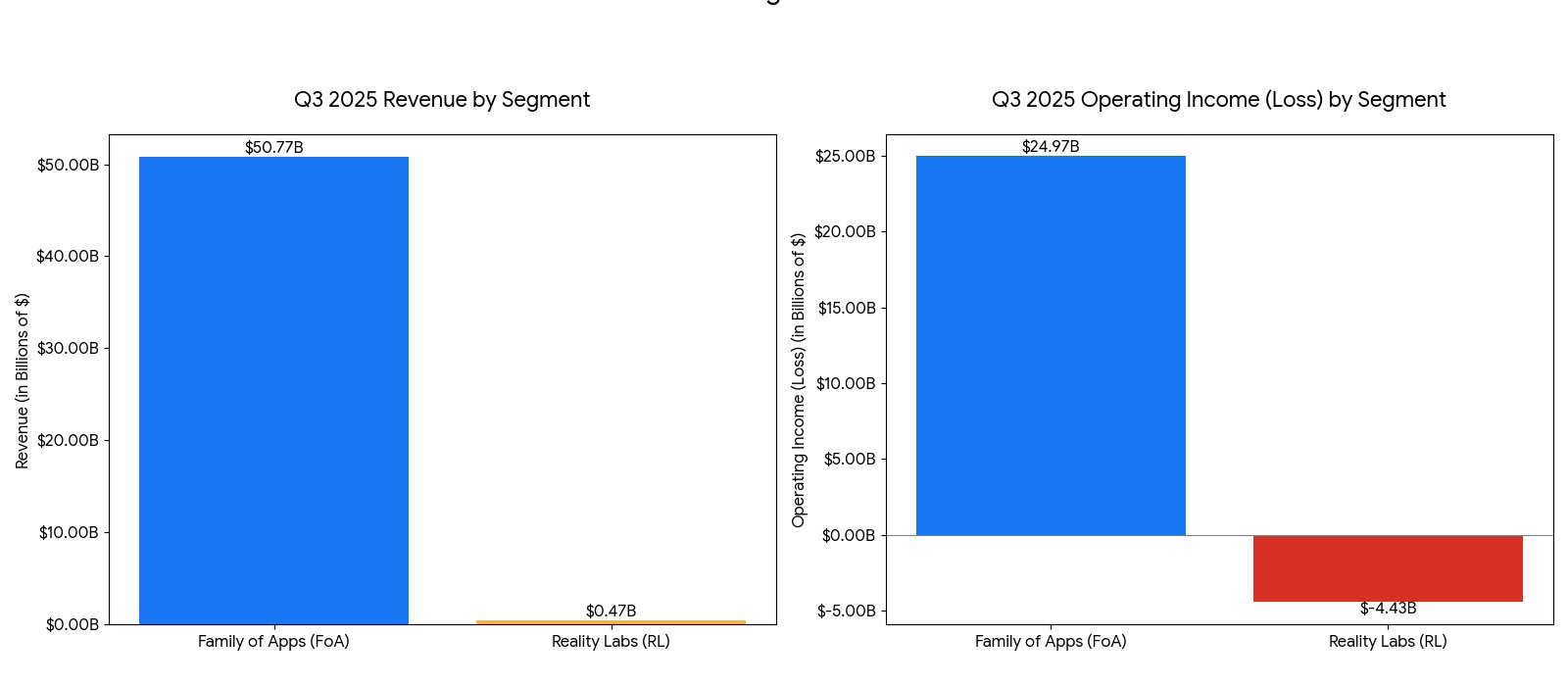

Segment Performance

The company’s two segments tell a familiar story: the Family of Apps (FoA) is an incredibly profitable engine that funds the massive, long-term bet on Reality Labs (RL).

2. 📊 Balance Sheet (“Strength or Stress?”)

Meta’s balance sheet remains a fortress, but a few key items show where the company is deploying its capital.

-

Cash & Marketable Securities: $44.45 billion. This is down from $77.82 billion ($43.89B Cash + $33.93B Securities) at the end of 2024.

-

Long-Term Debt: $28.83 billion, essentially flat.

-

Non-Marketable Equity Investments: $25.07 billion. This is a massive increase from $6.07 billion at the end of 2024.

MY READ: The drop in cash is not due to operational weakness. It’s a direct result of aggressive capital deployment (see Cash Flow section). The huge jump in “Non-Marketable Equity Investments” is almost entirely explained in the 10-Q’s notes: Meta made a $13.79 billion investment in Scale AI in June 2025.

3. 🌊 Cash Flow Statement (“Follow the Cash”)

The cash flow statement confirms the story: Meta is a cash-generation machine that is aggressively reinvesting in AI, infrastructure, and shareholder returns.

-

Cash from Operations (YTD): $79.59 billion.

-

Capital Expenditures (YTD): $48.31 billion.

-

Free Cash Flow (Q3 2025): $10.62 billion.

-

Key Uses of Cash (YTD): Share Repurchases: $26.25 billion. Dividends Paid: $3.99 billion. Non-Marketable Equity Investments: $18.26 billion (primarily the Scale AI investment).

4. 🗣️ MD&A (“Management’s Voice”)

Management’s discussion frames the business as successfully navigating headwinds while pivoting hard toward an AI-centric future.

-

Ad Business Drivers: The growth in ad impressions (volume) and price per ad (demand) indicates a healthy, robust marketplace. Management credits ongoing improvements to AI-driven ad targeting and measurement tools for mitigating platform-level headwinds.

-

Known Headwinds: Management continues to cite the difficult regulatory environment (especially in Europe with the GDPR and DMA) and platform changes (like Apple’s iOS updates) as persistent challenges.

-

Strategic Initiatives: The narrative is dominated by AI. Management states investments in AI are crucial for: Recommending relevant content (like Reels). Enhancing advertising tools (like the Advantage+ suite). Developing new products (generative AI, Meta AI).

5. ⚠️ Risk Factors (“Read the Fine Print”)

The 10-Q’s risk factor section introduces some new and heightened risks:

-

AI-Specific Risks: The company now explicitly details risks from its generative AI initiatives, including “harmful or illegal content, accuracy, misinformation and deepfakes… bias, discrimination, [and] intellectual property infringement”.

-

Regulatory Pressure (EU): The risk from European regulators is acute. Management states that challenges to its “subscription for no ads” model could result in “a materially worse user experience for European users and a significant impact to our European business and revenue as early as later in the fourth quarter of 2025”. This was also emphasized on the earnings call.

-

Youth-Related Litigation: The company highlights a growing number of lawsuits alleging “social media addiction” in users under 18, with several trials scheduled to begin in 2026.

-

CEO Risk: In a highly unusual disclosure, the company now lists Mark Zuckerberg’s “high-risk activities, such as combat sports, extreme sports, and recreational aviation, which carry the risk of serious injury and death” as a risk factor to the business.

6. 🔮 Compare to Expectations (Guidance & Outlook)

This is the most critical part of the report for investors. While Q3 was good and Q4 guidance is solid, the 2026 outlook signals a massive spending cycle.

-

Q4 2025 Guidance (Beat): Revenue: $56 – $59 billion. The midpoint of $57.5B is above consensus.

-

2025 Full-Year Outlook (Raised): Total Expenses: Raised to $116 – $118 billion (from $114-118B). Capital Expenditures (CapEx): Raised to $70 – $72 billion (from $66-72B).

-

The 2026 Pivot (The Big Story): Management warned that for 2026, CapEx dollar growth will be “notably larger” than in 2025. Total expenses in 2026 will grow at a “significantly faster percentage rate” than in 2025. This is being driven entirely by “infrastructure costs, including incremental cloud expenses and depreciation” to meet expanding AI compute needs.

7. 📞 Earnings Call Commentary (“What They Said Out Loud”)

The call transcripts confirm the AI pivot is the company’s central strategy.

-

Mark Zuckerberg (CEO): The Mission: “I’m very focused on establishing Meta as the leading frontier AI lab… building personal superintelligence for everyone”. The Strategy: “aggressively front-load building capacity” for AI, noting that even in the “worst case” (if superintelligence takes longer), the extra compute will be profitably used by the core ads business. Product Momentum: Zuckerberg highlighted several key metrics: Threads has passed 150 million daily actives, Reels’ revenue run-rate is over $50 billion, and the Advantage+ ad suite run-rate has passed $60 billion. The new AI glasses “sold out in almost every store within 48 hours”.

-

Susan Li (CFO): Justifying the Spend: Li directly tied the 2026 spending surge to AI, stating, “it has become clear that our compute needs have continued to expand meaningfully, including versus our expectations last quarter”. The Payoff: She framed this as a long-term revenue play: “We expect the set of investments we are making… will enable us to continue to deliver strong revenue growth in 2026”. The Near-Term Risk: Li issued a direct warning on Europe, stating, “we cannot rule out the Commission imposing further changes to that [Less Personalized Ads] offering that could have a significant negative impact on our European revenue, as early as this quarter”.

🎯 My Take

Q3 2025 was a “beat and raise” quarter, but the positive results were completely overshadowed by the 2026 outlook. The core Family of Apps business remains a fortress of profitability ($25B in quarterly operating income), proving the ad engine is firing on all cylinders.

However, management is using this strength to fund a massive, company-altering pivot. The message to Wall Street is clear: Meta is entering a new, heavy-spending investment cycle to win the AI race. The “significantly faster” expense growth and “notably larger” CapEx planned for 2026 signal that margins will be under pressure. This is a deliberate strategy to “aggressively front-load” the infrastructure needed for superintelligence, funded by the core ad business and supplemented by strategic investments like the $13.8B stake in Scale AI.

Investors are now faced with two clear risks: 1) A near-term, material revenue hit from EU regulators, and 2) A long-term, massive bet on AI that will compress margins before (and if) it generates new revenue streams.