Relax to Rich | Week 44 Recap (Ending Oct 31, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

✅ Focus on high-quality assets

✅ Keep a Margin of Safety

✅ Use options with intention

✅ Stay patient, let time and compounding do the heavy lifting

Performance Snapshot

Performance Snapshot

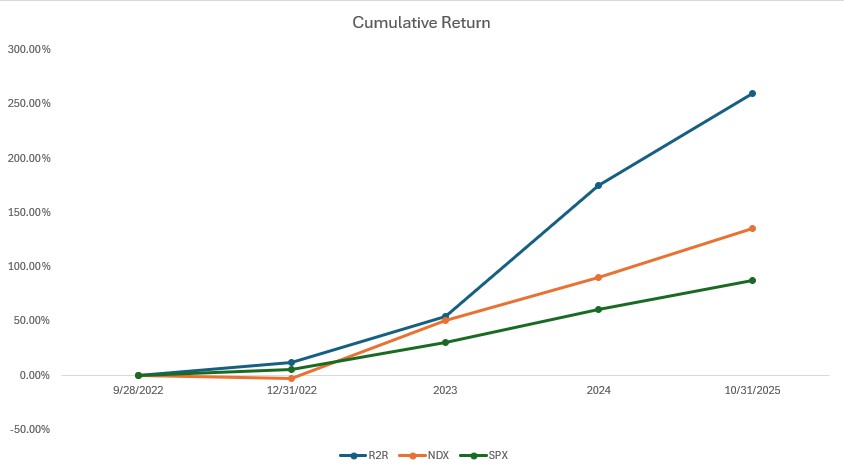

(From Sept 28, 2022, through Oct 31, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 10/31/2025 | 30.54% | 23.83% | 16.30% | 3.59 | 0.83 |

| Total Return | 259.49% | 135.28% | 87.54% | 3.09 | |

| Annualized Return | 51.29% | 31.90% | 22.57% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.59.

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 456.56 | 13.05% |

| 2 | QQQ | 7% | 629.07 | 23.05% |

| 3 | Tencent (700.HK) | 18% | HKD 629.00 | 50.84% |

| 4 | Nvidia (NVDA) | 4% | 202.49 | 50.79% |

| 5 | Others | 8% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -73% | 6840.20 | 16.30% |

- Weights = delta-adjusted exposures (stock + options).

Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

No new stock trades this week.

• Closed Tesla puts for profit and reopened new positions

• Rolled QQQ calls to later expirations

• Closed and reopened NVDA, GOOGL, and AMZN option positions

🪞Markets remain choppy and reactive. When sentiment swings wildly, I go back to fundamentals: focus on quality and demand a Margin of Safety.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. Musk on the All-In Podcast (Oct 31)

Elon Musk discussed Tesla’s upcoming shareholder vote on his compensation, potential departure if rejected, robotaxi plans, FSD progress, and the Cybercab design with no steering wheel or pedals. He also teased a demonstration of the new Roadster’s “flying” feature by late 2025.

My Take:

The compensation debate highlights leadership-continuity risk. But the robotaxi and Roadster updates reinforce Tesla’s long-term optionality expanding beyond cars into autonomy, software, and hardware ecosystems. Execution will determine how much of this optionality converts into sustained valuation.

2. Cybertruck Recall (real one, physically)

Tesla recalled 6,197 Cybertrucks due to improperly primed off-road light panels that could detach. Repairs will be handled free of charge.

My Take:

Minor, but production recalls test Tesla’s operational maturity. Quick resolution without major margin impact would reaffirm confidence in its rapid-iteration culture.

3. Expansion of Ride-Hailing Service

Tesla expanded its Bay Area unsupervised FSD ride-hailing to include San Jose International Airport (SJC).

My Take:

Real-world FSD deployment continues to grow quietly. Every route and rider adds valuable data fuel for the autonomy engine and future robotaxi monetization.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

1. Fed Rate Cut: 25 bps to 3.75–4.00 %

The Fed cited labor-market risks and limited data due to the government shutdown.

My Take:

A softening policy backdrop benefits tech and growth names. Lower financing costs support R&D-heavy firms and sustain high valuations longer.

2. Big-Tech Earnings Pulse

-

Amazon: Revenue +13 % YoY → $180 B; Net Income +39 % → $21.2 B ( AWS +20 %)

-

Meta: Capex guidance raised to $70–72 B for AI data-center build-out

My Take:

AI capex may compress near-term margins but expands long-term competitive moats. The AI-infrastructure thesis remains intact: compute is the new oil.

3. U.S.–China Trade Progress

Leaders advanced toward a framework deal to ease tariffs on $350 B in goods.

My Take:

Lower trade friction reduces supply-chain risk for semis and hardware. That supports both margins and confidence in global tech exposure.

Tencent (700.HK)

Tencent (700.HK)

1. AI-Driven Efficiency Gains

Tencent reported a 20 % boost in R&D productivity using internal AI coding tools, now adopted by 90 % of engineers.

My Take:

That’s real leverage. A 20 % cost-efficiency gain in its largest expense base (engineer salaries) could meaningfully lift operating margins an under-appreciated driver of future earnings.

2. Cloud Monetization Shift

Tencent Cloud will end free access to its “image-understanding” plug-in and move to paid post-usage billing from Nov 6.

My Take:

A subtle but important shift from user growth to monetization. Turning AI platform tools into paid products signals confidence that demand is real and sticky.

💬 Final Thoughts

The market feels tense, valuations rich, sentiment fragile.

But that’s when discipline matters most.

Ask yourself: Do I still have a Margin of Safety?

If yes, relax. Let time and compounding do the work.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.