Relax to Rich | Week 46 Recap (Ending Nov 14, 2025)

Hi friends,

💡 Investing Doesn’t Have to Be Complicated

R2R is built on simple, time-tested principles:

✅ Focus on high-quality assets

✅ Keep a Margin of Safety

✅ Use options with intention

✅ Stay patient, let time and compounding do the heavy lifting

Each week, I share what’s happening in my personal portfolio and how I’m navigating the markets. If you prefer investing that’s calm, clear, and grounded in fundamentals, you’re in the right place.

Performance Snapshot

Performance Snapshot

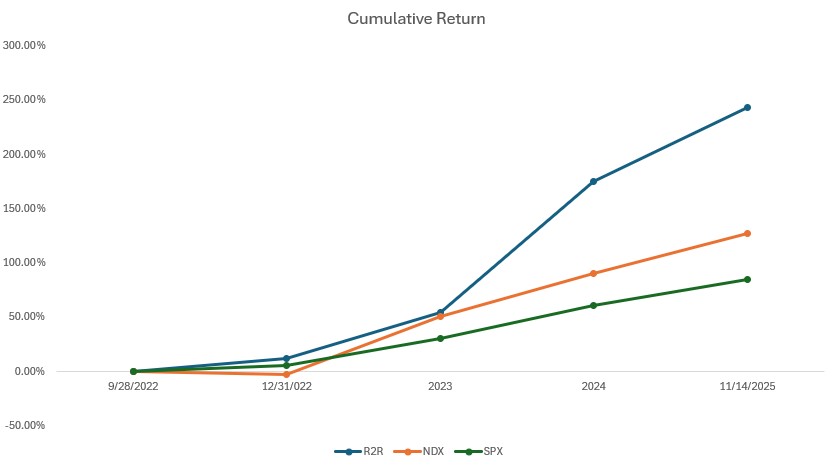

(From Sept 28, 2022, through Nov 14, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 11/14/2025 | 24.63% | 19.79% | 14.49% | 3.43 | 0.87 |

| Total Return | 243.22% | 127.61% | 84.63% | 3.13 | |

| Annualized Return | 48.31% | 30.07% | 21.65% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.43

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 404.35 | 0.13% |

| 2 | QQQ | 9% | 608.86 | 19.10% |

| 3 | Tencent (700.HK) | 16% | HKD 641.00 | 53.72% |

| 4 | Nvidia (NVDA) | 4% | 190.17 | 41.61% |

| 5 | Others | 9% | ||

| 6 | Cash Equivalents | 19% | ||

| 7 | SPX | -56% | 6734.11 | 14.49% |

- Weights = delta-adjusted exposures (stock + options).

Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

-

No new stock trades this week.

-

Closed TSLA calls for profit

-

Rolled TSLA puts into later expirations to capture more premium

The market’s noise becomes my income, this is where an options overlay shines.

Volatility = opportunity. -

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1.Tesla Begins Removing China-Made Components From U.S. Production

A WSJ report confirmed Tesla is pushing suppliers to eliminate China-sourced parts for U.S.-built cars within 1–2 years.

My Take:

A strategic de-risking move. Higher short-term complexity, stronger long-term resilience. This is how you protect margins in a world of tariffs and geopolitical shocks.

2. Cybertruck Program Manager Departs

Siddhant Awasthi, who led Cybertruck through development and launch, left Tesla after 8 years.

My Take:

High-profile departures are always worth watching. Cybertruck is a multi-year scaling challenge, leadership continuity matters. Execution risk modestly rises here.

3. FSD v14.1.7 Rolls Out Widely to HW4 + Cybertruck

Tesla expanded its latest FSD (Supervised) update to more vehicles.

My Take:

Small step, big implication: more real-world data. More data → better autonomy → stronger moat → higher optionality for Robotaxi.

4. Volkswagen EVs Get Supercharger Access Starting Nov 18

VW joins the NACS ecosystem.

My Take:

Another validation of Tesla’s charging standard. This is a quiet but powerful revenue engine, predictable, recurring, high-margin services.

5. Tesla China Sales Hit 3-Year Low

October deliveries fell 12% YoY to 64,000, the weakest since Nov 2022.

My Take:

China is 20% of Tesla’s revenue. This soft patch is a reminder: competition is fierce, pricing is sensitive, and hardware alone won’t defend market share.

Software (FSD) is the differentiator.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

1. AI Sector Sell-Off

Nvidia dropped >3.5%, and weakness spread across AI leaders (AVGO, PLTR, SMCI). SoftBank’s sale of its entire $5.8B Nvidia stake accelerated the slide.

My Take:

This wasn’t about deteriorating fundamentals, it was about valuation pressure and repositioning. AI is real, but expectations were extended. The next major catalyst is Nvidia earnings.

2. Interest Rate Repricing Hits Tech

Hawkish Fed comments slashed odds of a December rate cut from 65% → below 50%.

My Take:

Growth stocks live and die by discount rates. The market got ahead of itself pricing in a pivot.

This is normalization, not doom, but volatility will stay elevated.

Tencent (700.HK)

Tencent (700.HK)

1. Strong Q3 Earnings: Revenue +15%

-

Gaming +14%

-

Advertising +17%

-

FinTech/Business Services +13%

-

Operating profit +18%

EPS beat expectations (8.28 HKD vs 7.65 HKD).

My Take:

A clean beat across the board. The multi-engine model (gaming + ads + fintech) is working. AI capex remains elevated, but strategically necessary. Here are more insights about Q3: Walk-through of TENCENT’s Q3 2025 10-Q

2. Tencent–Apple 15% Fee Agreement

WeChat mini-games will now pay a standardized 15% fee on in-app purchases.

My Take:

Slight margin pressure, big regulatory clarity. This removes uncertainty and strengthens the long-term stability of Tencent’s ecosystem.

💬 Final Thoughts

Markets corrected. Headlines were loud. The portfolio dipped.

But nothing changed about the long-term thesis.

This is the Relax to Rich way:

Stay patient. Stay focused. Turn volatility into cash flow. Let compounding do the heavy lifting.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.