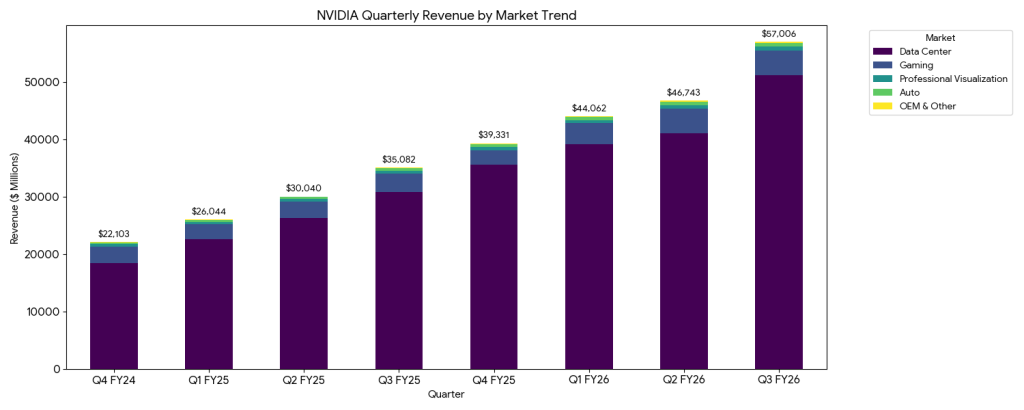

NVIDIA delivered a record-breaking Q3 with revenue hitting $57.0 billion, a 62% year-over-year increase driven by insatiable demand for Data Center AI infrastructure. Profitability remains robust with net income rising 65% to $31.9 billion, while gross margins stabilized sequentially at 73.4% as Blackwell production yields improved. Management signaled immense confidence in future demand, citing visibility into $500 billion of Blackwell and Rubin revenue through calendar year 2026. The balance sheet reflects aggressive preparation for this ramp, with inventory nearly doubling year-to-date to $19.8 billion to secure long lead-time components. Despite the strength, concentration risk remains high with four customers accounting for 61% of revenue, though geopolitical headwinds from China have largely faded to insignificance.

1. Income Statement: “Show Me the Money”

NVIDIA continues to operate at a scale that defies normal large-cap physics.

-

Revenue: $57.0 Billion (+62% YoY, +22% QoQ). This beat their own guidance of $54B from last quarter.

-

Gross Margin: 73.4% GAAP (down from 74.6% YoY, but up from 72.4% in Q2).

-

The “Why”: Margins dipped YoY because they are transitioning from the mature Hopper architecture (highly optimized manufacturing) to the new Blackwell architecture (initial ramp costs). However, margins improved sequentially as Blackwell yields improved.

-

-

Operating Income: $36.0 Billion (+65% YoY).

-

Net Income: $31.9 Billion (+65% YoY).

-

EPS: $1.30 (+67% YoY).

-

Drivers: Data Center revenue is now $51.2B (90% of total revenue), driven by demand for Hopper and the initial ramp of Blackwell.

2. Balance Sheet: “Strength or Stress?”

The balance sheet shows a company preparing for a massive product launch (Blackwell) while sitting on a mountain of cash.

-

Cash & Securities: $60.6 Billion (up significantly from $38.5B a year ago).

-

Debt: $8.5B (Long-term debt is $7.5B, Short-term is $1.0B). This is negligible compared to their cash pile.

-

Inventories: $19.8 Billion (Up from $10.1B at the start of the year).

-

Yellow Flag or Strategic? Inventory nearly doubled this year. Management explicitly states this is to “secure long lead-time components” and “meet the demand for Blackwell”. This suggests confidence in future sales rather than unsold goods sitting on shelves.

-

-

Accounts Receivable: $33.4 Billion. DSO (Days Sales Outstanding) is 53 days, an improvement from 54 days last quarter.

💡 My read: The fortress is getting stronger. The inventory build is aggressive, but given the “insatiable” demand narrative, it represents pre-built capacity for the Q4/FY27 ramp.

3. Cash Flow: “Follow the Cash”

In Q2, we saw a dip in Operating Cash Flow (OCF) due to working capital swings. Q3 shows a return to form.

-

Operating Cash Flow: $23.8 Billion (Up from $15.4B in Q2).

-

The “lumpiness” from the previous quarter has smoothed out as revenue collection timing normalized.

-

-

Capital Return: Returned $12.7 Billion to shareholders in Q3 alone ($12.5B in buybacks + $243M in dividends).

-

Free Cash Flow: $22.1 Billion.

4. MD&A: “Management’s Voice”

Reading the Management’s Discussion & Analysis reveals where they are placing their chips:

-

The “Agentic” Shift: Management is pushing a new narrative beyond just Generative AI. They highlight “Agentic applications” (AI that acts/reasons) as a key driver alongside accelerating computing.

-

China is Fading: Revenue from China is shrinking in relevance. H20 (the China-specific chip) sales were explicitly called “insignificant” in Q3.

-

Networking is Massive: It’s not just GPUs. Networking revenue hit a record $8.2B (+162% YoY) driven by the need to connect massive GPU clusters (NVLink, InfiniBand).

-

Supply Constraints: They bluntly state, “We are ordering to secure long lead-time components”. They are effectively pre-ordering the global supply chain capacity.

5. Risk Factors: “Read the Fine Print”

This section contains some specific geopolitical warnings that investors should watch closely.

-

The “15%” Tax Risk: There is a specific disclosure regarding the US Government (USG) and export licenses. USG officials have expressed an expectation to receive “15% or more of the revenue generated from licensed sales” of products to restricted markets (like the H20 to China). While not a regulation yet, this would directly hit margins on those specific sales.

-

Regulatory Uncertainty: The “AI Diffusion” rule was rescinded, but a replacement rule is coming. The scope remains “uncertain” but could impose new restrictions.

-

Concentration Risk: Four customers accounted for 22%, 15%, 13%, and 11% of total revenue respectively. That means ~61% of their revenue comes from just four entities (likely the major Hyperscalers).

-

Investment Risk: They are actively investing in partners (OpenAI, Anthropic), which carries valuation risks if those startups falter.

6. Compare to Expectations

-

Reality: Revenue $57.0B vs Guidance of ~$54B. A clear beat.

-

Guidance: Q4 Revenue expected to be $65.0 Billion (+/- 2%).

-

Context: This implies the growth engine is not slowing down sequentially.

-

-

Margins: Guidance for Q4 Gross Margin is 74.8% (GAAP) and 75.0% (Non-GAAP). This is a return to peak margins, suggesting the Blackwell yield issues are largely solved.

7. Earnings Call Commentary: “What They Said Out Loud”

-

The $500 Billion Number: Colette Kress dropped a massive forward-looking number: “We currently have visibility to $500 billion in Blackwell and Rubin revenue from the start of this year through the end of Calendar Year 2026.”

-

Demand vs. Supply: Jensen reiterated that “Demand for AI infrastructure continues to exceed our expectations” and “The clouds are sold out.”

-

Physical AI: Jensen is seeding the next narrative, calling “Physical AI” (robotics/industrial) the “next leg of growth.”

-

Sovereign AI: Significant deals with nations (like Japan/Softbank and the Middle East) are mentioned as a growing layer on top of Hyperscalers.

🎯 MY’s Take

NVIDIA is executing a high-wire act with incredible precision.

-

The Numbers: The bounce-back in Cash Flow and the sequential margin improvement proves Q2 was a blip, not a trend.

-

The Moat: The disclosure of $500B in visibility for future architectures (Blackwell/Rubin) is an attempt to tell investors that the “AI Bubble” isn’t popping anytime soon.

-

The Risk: The concentration risk is getting higher (4 customers = 61% of revenue). If one Hyperscaler taps the brakes, NVIDIA will feel it immediately. However, the “insignificant” China revenue removes a major geopolitical overhang, they are growing despite losing their biggest historic market.