Ever watched a hot, new company that everyone was talking about suddenly crash and burn? 📉 It’s a painful feeling, especially when your money is on the line. What if I told you there’s a secret that legendary investors like Warren Buffett use to avoid this exact trap?

It’s not about finding the next flashy trend. It’s about finding a castle with a deep, wide moat around it.

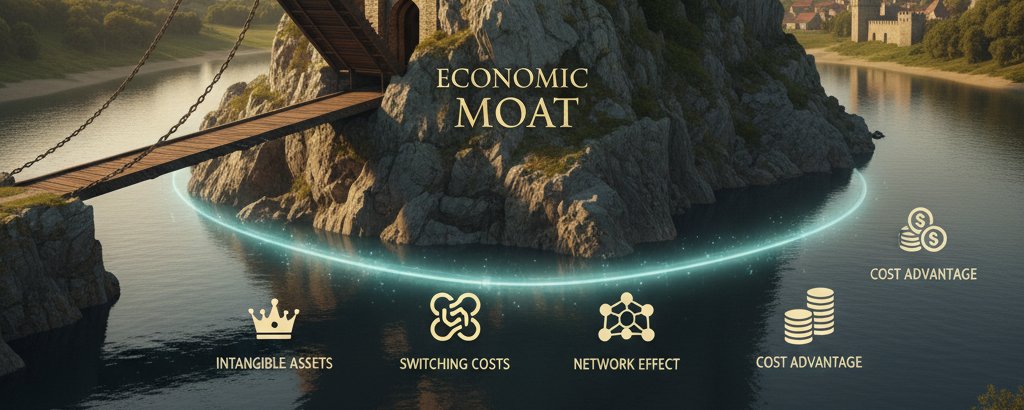

What in the World is an “Economic Moat”? 🏰

Warren Buffett didn’t literally mean castles and water. He was talking about a company’s sustainable competitive advantage. An economic moat is a special power a business has that protects it from competitors trying to steal its customers and profits.

Think about it: A company with a great new product but no moat is like a castle with no walls. It looks great for a minute, but invaders (competitors) will storm in and take over easily.

Remember the Palm Pilot? For a hot second, it was the gadget to have. But it had no real defense. Soon, rivals like Sony and Handspring released their own versions, Palm’s market share crumbled, and its profits vanished. It had a cool invention, but no moat to protect its kingdom.

A strong moat allows a company to fight off competition and generate solid profits for years and years. That’s the kind of company we want to invest in for the long haul.

How to Spot a Moat: The 4 Secret Defenses

So, what do these moats look like in the real world? They usually come in one of four forms:

-

👑 The “Can’t Copy This” Secret Sauce (Intangible Assets): This is a special brand name, patent, or regulatory approval that competitors can’t touch. Example: You can’t just create your own soda and call it Coca-Cola. Their brand is a powerful, globally recognized asset. Likewise, drug companies like Pfizer have patents that give them the exclusive right to sell a new medicine for years.

-

😩 The “Too Annoying to Leave” Trap (Switching Costs): This happens when it’s just too much of a pain or too expensive for a customer to switch to a competitor. Example: Consider the accounting software a small business uses, like Intuit’s QuickBooks. Once a company has years of financial history, payroll data, and tax information in that system, the thought of switching is a nightmare. They would have to migrate all the data and retrain the entire team on a new platform. The risk and hassle are so high that they’ll stick with it even if a slightly cheaper competitor comes along.

-

🚀 The “Everyone’s Here” Advantage (Network Effect): A business has a network effect when its service becomes more valuable as more people use it. Example: Why is Facebook (Meta) so dominant? Because all your friends and family are already on it. A new social media site is useless if you have no one to connect with. The massive network of users is the moat.

-

💰 The Low-Cost King (Cost Advantage): These companies have figured out how to operate so efficiently that they can offer a product or service cheaper than anyone else, crushing their rivals on price. Example: Think of Amazon. Their massive scale, warehouse network, and logistical prowess allow them to sell and ship goods at a cost that smaller retailers simply can’t match.

Finding companies with one or more of these powerful moats is the key to building a resilient, long-term portfolio. Instead of chasing hype, look for the castles with the strongest defenses.

What’s a company you think has an amazing moat? Let me know in the comments!

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨