Two Minutes Reading for the Smart Investing Strategy

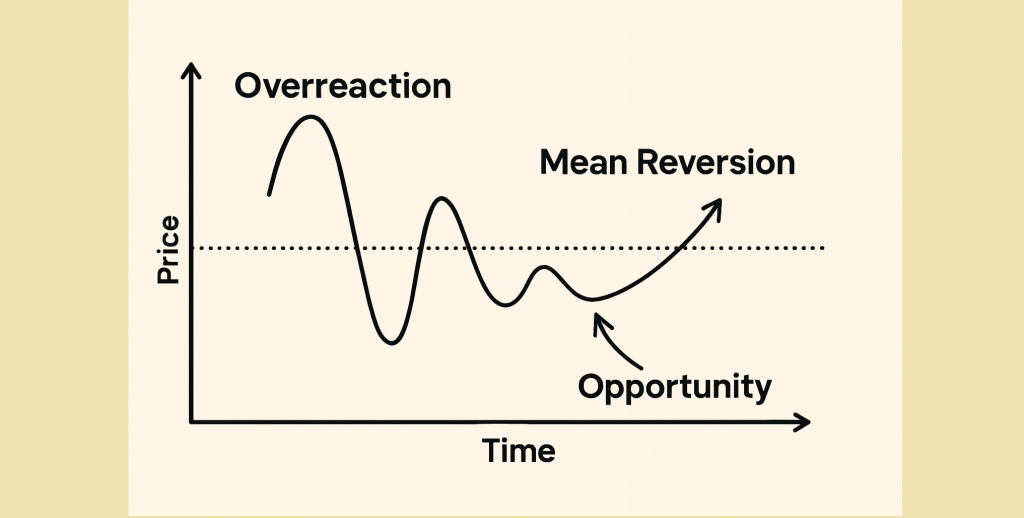

Markets are emotional places. Prices don’t just move on facts—they swing wildly on fear and greed. This creates a simple but powerful formula for investors:

👉 Overreaction + Mean Reversion = Opportunity

Why Overreaction Happens 😱

When bad news hits, investors often panic. They sell first, think later. On the flip side, when there’s hype, they rush in, pushing prices higher than reality justifies.

The key? Prices swing more than the underlying value of the business.

Why Mean Reversion Works 🔄

Businesses don’t usually change as fast as stock prices do. Earnings, customer demand, and competitive advantages tend to normalize over time. Eventually, prices “revert” closer to fair value.

Real-World Examples 📈

-

Meta (Facebook): In 2022, the stock crashed ~70% as investors panicked over spending and user growth fears. The business remained profitable and resilient. By 2023, sentiment improved and the stock more than doubled.

-

Wells Fargo (2009): During the financial crisis, even strong banks were dumped in fear. As panic subsided, quality banks rebounded sharply, rewarding patient investors.

What This Means for You 🧘♂️

-

Don’t get swept up by headlines.

-

When everyone is panicking, ask: Has the business really changed that much?

-

Be ready to act when emotion creates a gap between price and value.

As Warren Buffett put it: “Be fearful when others are greedy, and greedy when others are fearful.”

👉 Follow me for more simple, smart investing strategy. 🌱 Join the Relax to Rich Club—where we grow wealth the calm, thoughtful way.