Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Weekly Activity

Weekly Activity

No new stock trades this week.

• Sold CRCL put options as part of a small trial research position.

Steady and deliberate — continuing to balance income generation with risk control.

Performance Snapshot

Performance Snapshot

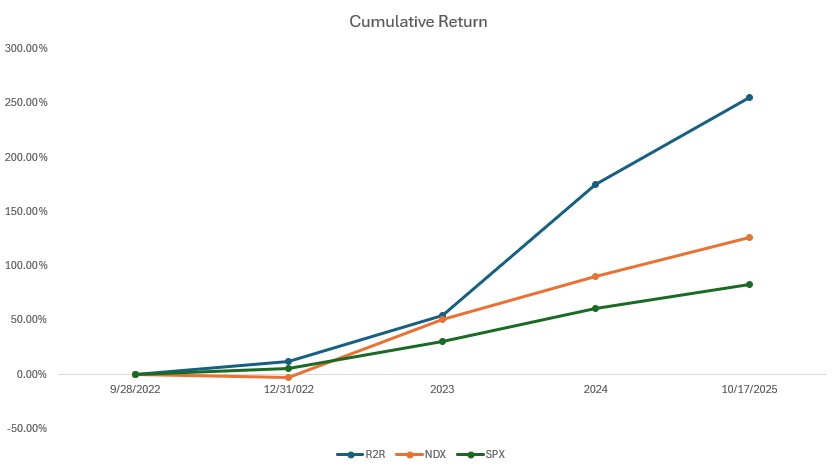

(From Sept 28, 2022, through Oct 17, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 10/17/2025 | 29.03% | 18.91% | 13.30% | 3.55 | 0.79 |

| Total Return | 255.34% | 125.94% | 82.71% | 3.05 | |

| Annualized Return | 51.50% | 30.61% | 21.83% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.55

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 439.31 | 8.78% |

| 2 | QQQ | 9% | 603.93 | 18.13% |

| 3 | Tencent (700.HK) | 17% | HKD 608.00 | 45.80% |

| 4 | Nvidia (NVDA) | 3% | 183.22 | 36.44% |

| 5 | Others | 7% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -64% | 6664.01 | 13.30% |

* Weights represent delta-adjusted exposure, which includes both stock and option positions.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. ISS Recommends Voting Against Musk’s $1 Trillion Pay Package

On Oct 17, Institutional Shareholder Services advised shareholders to reject Elon Musk’s proposed 10-year, $1 trillion compensation plan and Tesla’s investment in xAI.

My Take:

ISS’s stance underscores governance risk — not operational weakness. While the scale raises eyebrows, the package still directly ties Musk’s reward to Tesla reaching an $8.5 trillion valuation and major milestones. It aligns incentives with shareholders aiming for outsized long-term gains, even if it shakes short-term sentiment. I’ll be watching how institutional holders vote, it will shape confidence and volatility in coming weeks.

2. Cybertruck Sales Fell Sharply in Q3 2025

Tesla sold 5,385 units, down 63% YoY, far below its earlier ~250K annual target.

My Take:

The Cybertruck’s slump dents Tesla’s near-term growth narrative. It limits margin expansion and delays diversification benefits. Longer-term, it magnifies the importance of FSD, Robotaxi, and Optimus execution, where real growth lies.

3. Shanghai Gigafactory Ramping Up

Tesla’s largest facility is expanding production as China sales rose 2.8% YoY in September — reversing two months of decline.

My Take:

Positive signal. Operational leverage from Shanghai can offset softness elsewhere. Execution in China remains one of Tesla’s biggest global levers.

4. Delaware Supreme Court Hears Musk Compensation Appeal (Oct 15)

The ongoing legal debate around Musk’s 2018 pay plan, now worth $100B+, continues to highlight Tesla’s governance crossroads.

My Take:

Less about the courtroom, more about corporate culture. How Tesla structures CEO incentives now will influence governance standards for decades.

Tencent (700.HK)

Tencent (700.HK)

Buyback Pause Ahead of Earnings (Nov 13)

As Tencent Holdings will release its third-quarter earnings on November 13, it has entered a mandatory one-month quiet period, during which share buybacks are suspended.

As of October 12, Tencent’s total share repurchases for the year have reached HK$60.96 billion.

For 2025, the company plans to repurchase at least HK$80 billion worth of shares and increase its cash dividend by HK$41 billion, bringing the total shareholder return for the year to no less than HK$121 billion.

Tencent repurchased HK$2.6 billion worth of shares in 2021, HK$33.8 billion in 2022, HK$49.4 billion in 2023, and HK$112 billion in 2024.

As of now, Tencent’s total shares outstanding have fallen to 9.153 billion, the lowest level in the past decade.

| Consecutive Buyback Days | Date | Number of Shares (10,000 shares) | Amount (HK$ billion) |

| 1 | 18-Aug | 93.1 | 5.5 |

| 2 | 19-Aug | 93.2 | 5.5 |

| 3 | 20-Aug | 93.4 | 5.5 |

| 4 | 21-Aug | 92.8 | 5.5 |

| 5 | 22-Aug | 91.7 | 5.5 |

| 6 | 25-Aug | 89.5 | 5.5 |

| 7 | 26-Aug | 89.9 | 5.5 |

| 8 | 27-Aug | 90.9 | 5.5 |

| 9 | 28-Aug | 92.7 | 5.5 |

| 10 | 29-Aug | 91.9 | 5.5 |

| 11 | 1-Sep | 91 | 5.5 |

| 12 | 2-Sep | 91.3 | 5.5 |

| 13 | 3-Sep | 91.6 | 5.5 |

| 14 | 4-Sep | 92.5 | 5.5 |

| 15 | 5-Sep | 91.3 | 5.5 |

| 16 | 8-Sep | 89.7 | 5.5 |

| 17 | 9-Sep | 88.3 | 5.5 |

| 18 | 10-Sep | 86.6 | 5.5 |

| 19 | 11-Sep | 87.4 | 5.5 |

| 20 | 12-Sep | 85.2 | 5.5 |

| 21 | 15-Sep | 85.6 | 5.5 |

| 22 | 16-Sep | 85.3 | 5.5 |

| 23 | 17-Sep | 83.9 | 5.5 |

| 24 | 18-Sep | 84.8 | 5.5 |

| 25 | 19-Sep | 85.7 | 5.5 |

| 26 | 22-Sep | 86.2 | 5.5 |

| 27 | 23-Sep | 86.7 | 5.5 |

| 28 | 24-Sep | 85.8 | 5.5 |

| 29 | 25-Sep | 84.4 | 5.5 |

| 30 | 26-Sep | 85 | 5.5 |

| 31 | 29-Sep | 83.7 | 5.5 |

| 32 | 30-Sep | 83.2 | 5.5 |

| 33 | 2-Oct | 81.2 | 5.5 |

| 34 | 3-Oct | 81.7 | 5.5 |

| 35 | 6-Oct | 81.5 | 5.5 |

| 36 | 8-Oct | 81.7 | 5.5 |

| 37 | 9-Oct | 81.6 | 5.5 |

| 38 | 10-Oct | 83.9 | 5.5 |

My Take:

A cancellation-style share buyback is essentially like giving every shareholder a generous bonus at a premium.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.