Ever see a headline screaming “Company X Made Record Profits!” and feel that little rush of FOMO? You think, “I’ve got to buy this stock!”

Hold on. ✋

That shiny profit number can be incredibly deceiving. It’s like judging a baker’s success just by how many cakes they sell, without knowing if they spent more on flour and sugar than they made back. A big profit number alone tells you almost nothing about the real health of the business.

But don’t worry. There’s a simple way to look under the hood, and you only need to understand three key ideas.

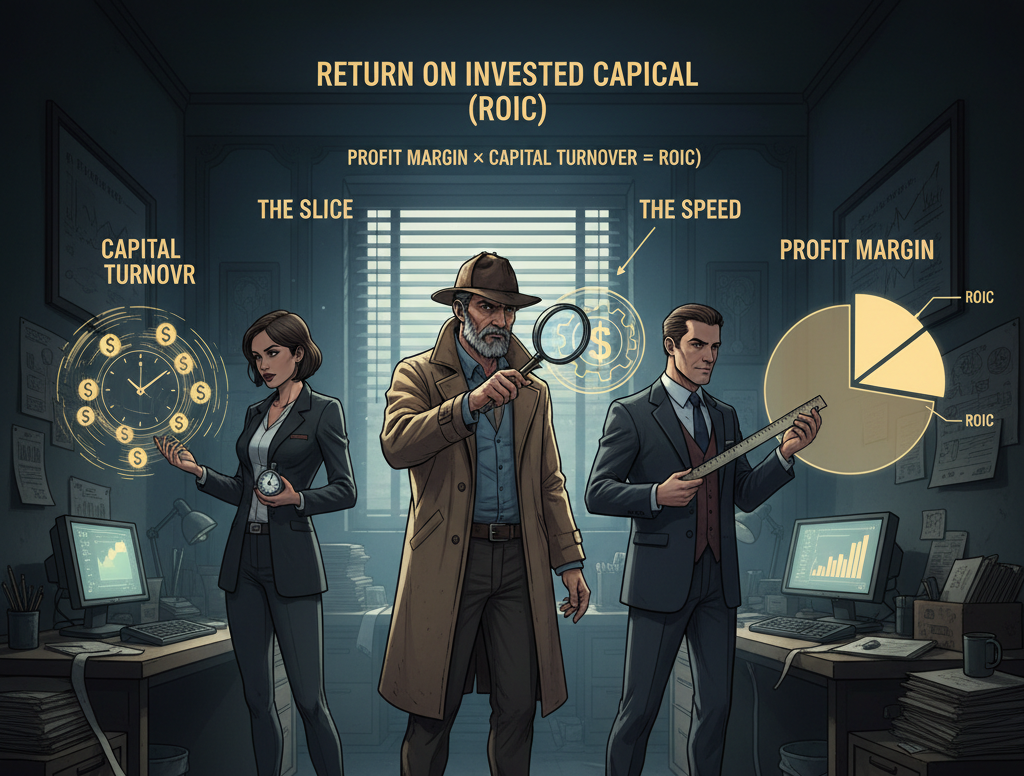

Meet Your 3 Profit Detectives 🕵️♀️

Instead of just asking “How much money did they make?”, smart investors ask better questions. Think of these three metrics as your secret detective kit for analyzing any company.

-

1. The ‘Slice’ Size (Profit Margin): What it is: For every dollar the company makes in sales, how many cents do they actually get to keep as pure profit? Why it matters: This shows how efficient a company is. A company like Apple has a huge profit margin; they keep a big slice of every iPhone sale. A grocery store like Kroger, on the other hand, has a razor-thin margin. They keep a tiny slice from each sale. Neither is “bad,” they’re just different business models.

-

2. The ‘Speed’ of Business (Capital Turnover): What it is: How quickly does the company use its invested money (its buildings, machines, cash) to generate sales? Why it matters: This measures how hard the company’s money is working. That grocery store, Kroger, has a low profit margin, but its capital turnover is incredibly high. They sell their entire inventory over and over again very quickly. Boeing, which builds giant airplanes, has a much slower turnover.

-

3. The ‘Engine’s’ Power (Return on Invested Capital – ROIC): What it is: This is the master metric. It combines the ‘Slice’ and the ‘Speed’ to give you the ultimate score of a company’s performance. The Magic Formula: Profit Margin × Capital Turnover = ROIC Why it matters: This number tells you how good the company is at turning $1 of its money into more money. A high and stable ROIC is often the sign of a fantastic, durable business.

How to Use This Knowledge Like a Pro 💡

So, how does this help you?

A company can be wildly successful with a tiny profit margin as long as its turnover is lightning-fast (think Costco). Another can be just as successful with slow turnover if its profit margin on each sale is massive (think a luxury brand like Ferrari).

The real secret is to look at the trend over 5-10 years.

-

Is the profit margin shrinking? 🚩 Red flag!

-

Is the company getting slower at turning its money into sales? 🚩 Red flag!

-

Is the overall ROIC consistently high or getting better? ✅ That’s a great sign!

By looking at these three numbers, you stop gambling on headlines and start investing based on the true quality and efficiency of a business. You’re no longer just a spectator; you’re an analyst.

What’s a company you’ve been looking at? Try to find its “Slice,” “Speed,” and “Engine Power” and see what story it tells! Drop your findings in the comments below.

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨