Relax to Rich | Week 45 Recap (Ending Nov 7, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

✅ Focus on high-quality assets

✅ Keep a Margin of Safety

✅ Use options with intention

✅ Stay patient, let time and compounding do the heavy lifting

Performance Snapshot

Performance Snapshot

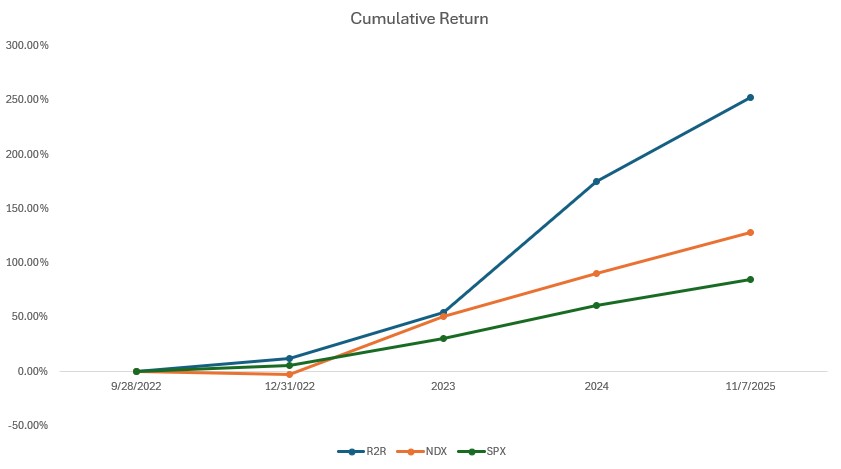

(From Sept 28, 2022, through Nov 7, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 11/7/2025 | 28.01% | 20.01% | 14.40% | 3.53 | 0.85 |

| Total Return | 252.52% | 128.02% | 84.49% | 3.11 | |

| Annualized Return | 49.96% | 30.35% | 21.77% |

Measured using Time-Weighted Return (TWR). Starting NAV = 1.00 → Current NAV = 3.53.

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 429.52 | 6.36% |

| 2 | QQQ | 10% | 609.74 | 19.27% |

| 3 | Tencent (700.HK) | 16% | HKD 634.00 | 52.04% |

| 4 | Nvidia (NVDA) | 4% | 188.15 | 40.11% |

| 5 | Others | 9% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -58% | 6728.80 | 14.40% |

- Weights = delta-adjusted exposures (stock + options).

Curious about “delta” or “cash equivalents”? Drop me a note, I’ll gladly explain.

Weekly Activity

Weekly Activity

-

No new stock trades this week.

-

Closed MSFT puts for profit and re‑opened new positions.

-

Rolled select TSLA (and one smaller CRCL) puts to later expirations for risk/cash‑flow management.

As I noted last week, the market isn’t cheap; this week’s pullback felt healthy, and SPX options offset much of the drawdown—so overall impact to the portfolio was modest.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1.Shareholder approval of CEO performance award (Nov 6):

Investors approved a stock‑based package for Elon Musk (≈75% support), with significant upside if stringent performance targets are hit.

My Take:

This more tightly aligns incentives with long‑term execution in autonomy/energy. It can support governance stability and multiples tied to leadership continuity.

2. Product and Technology Roadmap Updates

During the shareholder meeting, several updates on future products were provided:

- AI Chips: The company is developing a new “AI5” chip, with limited production expected in 2026 and mass production in 2027. A potential collaboration with Intel was mentioned.

- Next-gen Roadster: The vehicle’s demo has been delayed to April 1 (2026), with production now projected for 2027 or 2028.

- Cybercab: The production start is confirmed for the second quarter of 2026.

- FSD in China: Management stated they expect to receive full approval for Full Self-Driving (FSD) in China during the first quarter of 2026.

- Optimus Robot: The CEO reiterated that the humanoid robot is viewed as the company’s most important future product.

My Take:

The Cybercab and China FSD timelines matter most to the model—both are material TAM unlocks if met. The internal AI5 effort underscores vertical integration for autonomy. Roadster slippage is low impact (niche volume). The narrative continues shifting from “automaker” to AI/robotics platform

QQQ / Nasdaq 100

QQQ / Nasdaq 100

1.Key Driver: Shift in Sentiment on AI and Megacap Valuations

the week’s decline was led by the “Magnificent Seven” and other AI-related stocks that have been the primary drivers of the market’s gains this year. This pullback followed public comments from several Wall Street executives earlier in the week warning that a market correction could be approaching due to “sky-high valuations.”

My Take:

This is a classic sentiment shift. The narrative is pivoting from “unquestioned growth” to “price-conscious.” The fact that the selloff is concentrated in the market’s biggest winners suggests a rotation rather than a panic. Investors are assessing how much of the future AI-driven growth is already reflected in current stock prices

2. Macroeconomic Data Uncertainty

With the ongoing U.S. government shutdown, the official payrolls report scheduled for Fri, Nov 7 was postponed; traders leaned on private datasets (e.g., Challenger job‑cuts at the highest October level since 2003).

My Take:

Less official data = more volatility. It complicates reading the Fed path, always a key input for long‑duration tech.

Tencent (700.HK)

Tencent (700.HK)

1. The Shifting AI and Semiconductor Landscape

Reports indicate Beijing directed new state‑funded data centers to use only domestic AI chips, effectively banning foreign chips in those projects; in the same news cycle, NVIDIA’s CEO publicly said China could “win” AI due to lighter regulation and energy costs.

My Take:

A protected, home‑grown compute stack could insulate cloud leaders like Tencent from geopolitical swings—and catalyze local ecosystems. The swing factor is performance/efficiency gap versus global leaders: if domestic chips lag materially, the AI cost curve could rise near term, affecting cloud AI unit economics.

💬 Final Thoughts

-

Process over headlines. Pullbacks are normal; position sizing + hedges are doing their job.

-

Execution > promises. For Tesla, watch the Cybercab and China FSD timelines; for QQQ, keep an eye on breadth and whether leadership broadens beyond the usual suspects.

-

China tech: Policy evolution can be a tailwind or tax; Tencent’s buybacks and ecosystem depth keep me constructive

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.