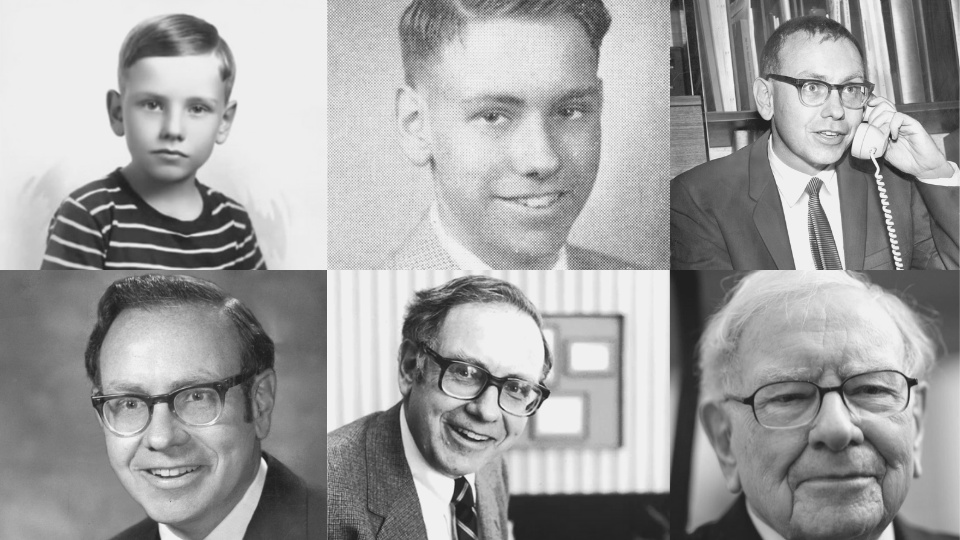

In what marks the end of an era, Warren Buffett has released his final letter to shareholders, announcing he will no longer be writing Berkshire’s annual report or “talking endlessly at the annual meeting”. He’s “going quiet”, and in this final “episode,” he gives shareholders a clear look at the company’s succession, his accelerated philanthropic plans, and some powerful parting wisdom.

Buffett’s final letter is packed with insights, but for us as investors, a few key themes stand out. Here are the top takeaways from his farewell message.

1. The Torch is Officially Passed

There is no more ambiguity: Greg Abel is the designated leader. Buffett states clearly that “Greg Abel will become the boss at yearend”. More importantly for shareholders, this transition comes with Buffett’s strongest possible endorsement. He notes that Abel “understands many of our businesses and personnel far better than I now do” and, in a striking line, says, “I can’t think of a CEO, a management consultant, an academic, a member of government – you name it – that I would select over Greg to handle your savings and mine”. This is designed to give shareholders supreme confidence in the post-Buffett era.

2. Brace for Volatility, But Trust the Business

In a classic message to value investors, Buffett reminds us to have a strong stomach. He directly states that Berkshire’s “stock price will move capriciously, occasionally falling 50% or so as has happened three times in 60 years”. His advice is simple and timeless: “Don’t despair; America will come back and so will Berkshire shares”. This confidence comes from his belief that Berkshire has “less chance of a devastating disaster than any business I know” and “a more shareholder-conscious management and board than almost any company”.

3. A Final Warning on “Look-at-Me” CEOs

Buffett has never been shy about his distaste for excessive executive compensation, and he takes a final shot here. He argues that compensation disclosure rules, while well-intentioned, “backfired”. Instead of fairness, “The new rules produced envy, not moderation”. He cautions that “Envy and greed walk hand in hand” and that Berkshire’s future leaders should “particularly avoid those whose goal is to… become look-at-me rich or to initiate a dynasty”. He also gives a stark warning that boards must be willing to act when a loyal CEO succumbs to “dementia, Alzheimer’s or another debilitating” disease, admitting it’s a mistake he and Charlie Munger made in the past.

4. The Philanthropy is Accelerating (For a Practical Reason)

The news release itself was about Buffett converting shares to donate to four family foundations. In his letter, he explains why he’s speeding things up. It’s not a change in philosophy, but a practical matter of aging. His children, who run these foundations, are “all above normal retirement age, having reached 72, 70 and 67”. He wants to “step up the pace of lifetime gifts” so they can manage this massive wealth distribution while they are still at their “prime in respect to experience and wisdom”. As he puts it, “Ruling from the grave does not have a great record, and I have never had an urge to do so”.

5. Live a Life, Not Just a Ledger

This final message is deeply personal. Buffett reflects at length on his own “dumb luck,” from surviving a misdiagnosed appendicitis in 1938 to simply being “born in 1930 healthy, reasonably intelligent, white, male and in America. Wow!”. His final advice to us is less about investing and more about living. “Don’t beat yourself up over past mistakes – learn at least a little from them and move on”. His most powerful charge is this: “Decide what you would like your obituary to say and live the life to deserve it”.

The actionable advice from this final “episode” is clear for investors: don’t panic in a downturn, and trust the deep-rooted, shareholder-conscious culture that has been built at Berkshire. Buffett’s parting thoughts are a powerful reminder that character is the ultimate asset. As he says, “Kindness is costless but also priceless”.

He also left us with a profound definition of success: “Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government. When you help someone in any of thousands of ways, you help the world.”

That line truly resonated with me. It’s a powerful encouragement to continue the work we’re doing at the r2r club, helping others grow their wealth without so much struggle. It’s a mission that feels perfectly aligned with this final message.

Buffett’s last piece of guidance is perhaps his best: “Choose your heroes very carefully and then emulate them”.

For more of my insights on this topic, be sure to follow me.