🚀 Is Elon Musk a Good Leader?

This isn’t a simple yes-or-no question. Your answer depends on where you stand. If you’re a dreamer, Elon Musk might be your hero. If you’re a long-term shareholder, however, things are far more complicated.

Let’s look at it from multiple angles — as an innovator, a manager, a public CEO, and ultimately, from a shareholder’s seat.

1. A Visionary of Our Time 🔭

There’s no denying Elon Musk is one of the most revolutionary leaders of the 21st century. His companies don’t just create products; they aim to reshape the future.

- Tesla made electric vehicles mainstream, challenging a century of combustion engine dominance.

- SpaceX dramatically slashed rocket launch costs and reignited public excitement about space.

- Neuralink, xAI, and The Boring Company tackle audacious frontiers that most CEOs wouldn’t dare touch.

Musk isn’t just building businesses; he’s trying to build the future. That places him in the same league as historical figures like Edison, Ford, and Jobs.

2. The Management Style: All Gas, No Brakes ⚙️

Musk’s leadership style within Tesla is defined by intensity, speed, and relentless drive.

- He is personally involved in design, hiring, and production—even sleeping at the factory during the Model 3 crisis.

- He promotes a mission-first, “move fast, break things” culture.

- He believes innovation requires extreme pressure and high stakes.

But this intensity comes with a cost:

- High employee turnover due to burnout.

- Centralized decision-making that relies heavily on one person’s judgment.

- An unsustainable pace for many teams—it’s certainly not for everyone.

His style undoubtedly works for launching rockets. Whether it’s ideal for scaling a mature public company is less clear.

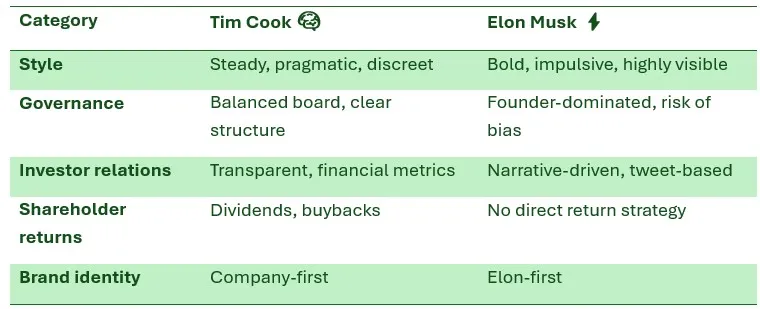

3. Tim Cook vs. Elon Musk: A Study in Two Leadership Philosophies 🧠⚡

Let’s compare two contrasting approaches to leadership:

🧠 Tim Cook (Apple CEO): The Master of Operational Excellence

- Built the world’s most efficient global supply chain.

- Expanded Apple’s service revenue (App Store, Apple Music, iCloud).

- Returned over $600 billion to shareholders through buybacks and dividends.

- Rarely courts controversy, maintaining a laser focus on execution and shareholder value.

Cook is the quintessential CEO for shareholders who prioritize predictability, consistent returns, and strong governance.

⚡ Elon Musk: The Force of Nature

- No dividends, no stock buybacks, and minimal traditional financial guidance.

- Communicates primarily via tweets and memes, not conventional investor relations.

- Manages multiple ventures simultaneously, with blurred lines between them.

- Personal projects (xAI, Mars colonization) don’t always directly benefit Tesla shareholders.

Where Cook separates himself from the brand, Musk is the brand—for better or worse. This “cult of personality” can be a powerful asset for marketing and attracting talent, but it also means his companies are uniquely vulnerable to his personal controversies or erratic behavior.

4. Shareholder Perspective: Faith vs. Risk 💸

✅ The Rewards: A Wild Ride to Riches

If you bet on Elon early, you’ve likely seen remarkable returns:

- Tesla stock surged over 100x between 2012–2021.

- Musk attracted legions of retail investors with his visionary appeal and charisma.

- His presence alone has often slashed capital costs and fueled Tesla’s rapid growth.

- He communicates directly with the public, bypassing traditional intermediaries.

⚠️ The Risks: Vision Can Overshadow Discipline

However, as Tesla matures, new risks emerge:

- Distraction: His attention is split across Tesla, SpaceX, X, xAI, Neuralink, and more.

- Governance: Tesla’s board includes close allies, leading to concerns about independent oversight. Furthermore, for a company so intrinsically linked to its founder, the question of long-term succession planning remains a significant, often unaddressed, concern for investors. It’s challenging to envision a clear successor who could replicate his unique combination of vision, engineering acumen, and public charisma.

- Volatility: A single tweet can send the stock reeling or trigger an SEC investigation. His audacious vision sometimes pushes the boundaries of regulation, leading to increased scrutiny from bodies like the SEC or NHTSA, potentially resulting in fines, legal battles, or delays that can impact company operations and investor confidence.

- No Clear Return Plan: No dividends and inconsistent shareholder guidance mean less predictability.

🔄 Case in Point: Musk’s Political Flip-Flop

One notable example is his political involvement. Musk initially voiced strong support for Donald Trump’s 2024 run, aligning himself with deregulation and business-friendly policies.

But when Trump proposed the “Big Beautiful Infrastructure Bill” — a major federal spending plan — Musk sharply opposed it, citing U.S. debt concerns and fiscal irresponsibility.

While Musk may have been principled in opposing runaway debt, this shift wasn’t about Tesla. It was a personal stance — and it exemplifies how his actions can unpredictably impact public sentiment, media attention, and shareholder confidence.

5. Balancing the Trade-Offs: A Shareholder’s Dilemma 🤹♂️

Elon might make you rich, but he could also risk it all. He’s the kind of leader who will bet every company he owns to fulfill what he believes is right. If he’s right, shareholders could become extraordinarily wealthy alongside him.

If he’s wrong? The outcome could be entirely different.

That’s the Tesla shareholder dilemma in a nutshell: you’re not just investing in cars—you’re investing in conviction. And conviction cuts both ways.

If we’re being honest:

- Elon Musk is not a conventional CEO.

- Tesla is not a conventional company.

- And being a Tesla shareholder is not a conventional experience.

You’re not just investing in an automotive company; you’re participating in a mission. That’s inspiring, but it also carries uncertainty and volatility that more traditional companies work hard to minimize.

6. My Take: I’ll Fly with Elon — Just Not with Everything I Own ✈️

Personally, I ,as a small Tesla shareholder, admire Musk and am excited by the future he’s trying to build. I’m willing to fly with Elon—but I won’t bet my entire life savings on the journey.

This is the essence of the “Relax to Rich” philosophy:

- ✅ Chase innovation—but wear a seatbelt.

- ✅ Take risks—but manage exposure.

- ✅ Invest in the future—but protect your present.

I’m not here to worship Elon. I’m here to understand him—and position myself wisely around him. That means knowing when to believe, when to diversify, and when to step back.

Final Words

Here’s a quick comparison of leadership styles:

Different leaders. Different philosophies. Different outcomes.

Just make sure you know which game you’re playing.