This is a real, live portfolio—actively managed and fully transparent. All data comes directly from Brokers and can be independently verified

Relax to Rich | Week 32 Recap (Ending August 8, 2025)

Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

✅ Stay patient

✅ Focus on high-quality assets

✅ Use options with intention

✅ Let time and compounding do the heavy lifting

Weekly Activity

Weekly Activity

No new stock trades this week, but I stayed active in risk management:

-

Closed several Tesla put options and Amazon call options for profits.

-

Rolled several QQQ call options to later expirations.

It’s not about being busy—it’s about being intentional. Options aren’t just income tools; they’re levers for portfolio stability.

Performance Snapshot

Performance Snapshot

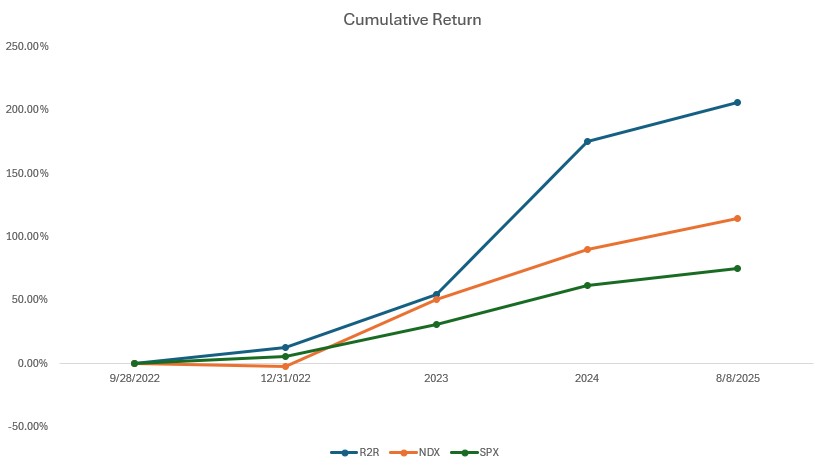

(From Sept 28, 2022, through August 8, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 8/8/2025 | 11.29% | 12.86% | 8.63% | 3.06 | 0.60 |

| Total Return | 206.49% | 114.44% | 75.18% | 2.86 | |

| Annualized Return | 47.93% | 30.57% | 21.59% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.06

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 44% | 329.65 | -18.37% |

| 2 | QQQ | 10% | 574.55 | 12.39% |

| 3 | Tencent (700.HK) | 17% | HKD 561.00 | 34.53% |

| 4 | Nvidia (NVDA) | 3% | 182.70 | 36.05% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -58% | 6389.45 | 8.63% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

🔍 Key Events This Week

🚗 Tesla (TSLA)

-

Dojo Team Disbanded – Tesla shut down its internal Dojo supercomputer team, with lead Peter Bannon departing. The company will now lean on external partners like Nvidia, AMD, and Samsung, including a $16.5B deal with Samsung for next-gen AI chips.

My Take: This is a notable pivot in Tesla’s AI strategy. Outsourcing chip development could speed scalability but may erode competitive advantage in custom hardware—a key factor for autonomy margins. -

$29B Equity Grant to Musk – The board approved a 96M-share award (~$29B) for Elon Musk, just months after his previous pay plan was revoked in court.

My Take: This aligns leadership incentives with long-term performance but will be closely watched for governance optics and milestone achievement. -

FSD Software Update for September – A major update is coming to improve performance in rare driving conditions, further reducing the need for driver input.

My Take: Key for pushing toward full autonomy. Regulatory approval and consistent safety performance remain the gating factors.

🌐 QQQ / Nasdaq 100

The Nasdaq 100 gained 3.9%, hitting its 18th record high of 2025, powered largely by Apple’s +13.3% surge. Economic data was mixed:

-

ISM Services PMI fell to 50.1% (barely in growth territory).

-

Jobless claims rose.

-

S&P Global’s Services PMI hit a 7-month high.

-

Productivity growth beat expectations.

Optimism for a September Fed rate cut increased.

My Take: This was a classic “bad news is good news” rally. Rate cut hopes plus mega-cap strength drove the move, but slowing economic data and tariff risks are still lurking.

🐉 Tencent (700.HK)

-

Unveiled a dozen new AI agents at China’s largest AI event.

-

Partnered with Visa on palm-recognition payments.

-

Launched CodeBuddy IDE for AI-driven app development.

-

Earnings due August 13, after a strong last quarter (EPS +3.27% surprise).

My Take: Tencent continues to innovate in AI and diversify revenue. If earnings momentum holds, valuation upside remains.

🤖 Nvidia (NVDA)

-

H20 Chip Export Licenses to China – The U.S. Commerce Dept. granted licenses for Nvidia’s H20 AI chips, reversing an earlier ban.

My Take: Reopens a major market but geopolitical risk is still high. -

CUDA-Q v0.12 Released – Incremental step in quantum-classical computing integration.

My Take: Strengthens Nvidia’s developer ecosystem—small today, potentially big tomorrow.

That’s a wrap for Week 32.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.