This is a real, live portfolio—actively managed and fully transparent. All data comes directly from Brokers and can be independently verified

Relax to Rich | Week 33 Recap (Ending August 15, 2025)

Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

✅ Stay patient

✅ Focus on high-quality assets

✅ Use options with intention

✅ Let time and compounding do the heavy lifting

Weekly Activity

Weekly Activity

No new stock trades this week, but I stayed active in risk management:

-

Rolled several QQQ call options to later expirations.

It’s not about being busy—it’s about being intentional. Options aren’t just income tools; they’re levers for portfolio stability.

Performance Snapshot

Performance Snapshot

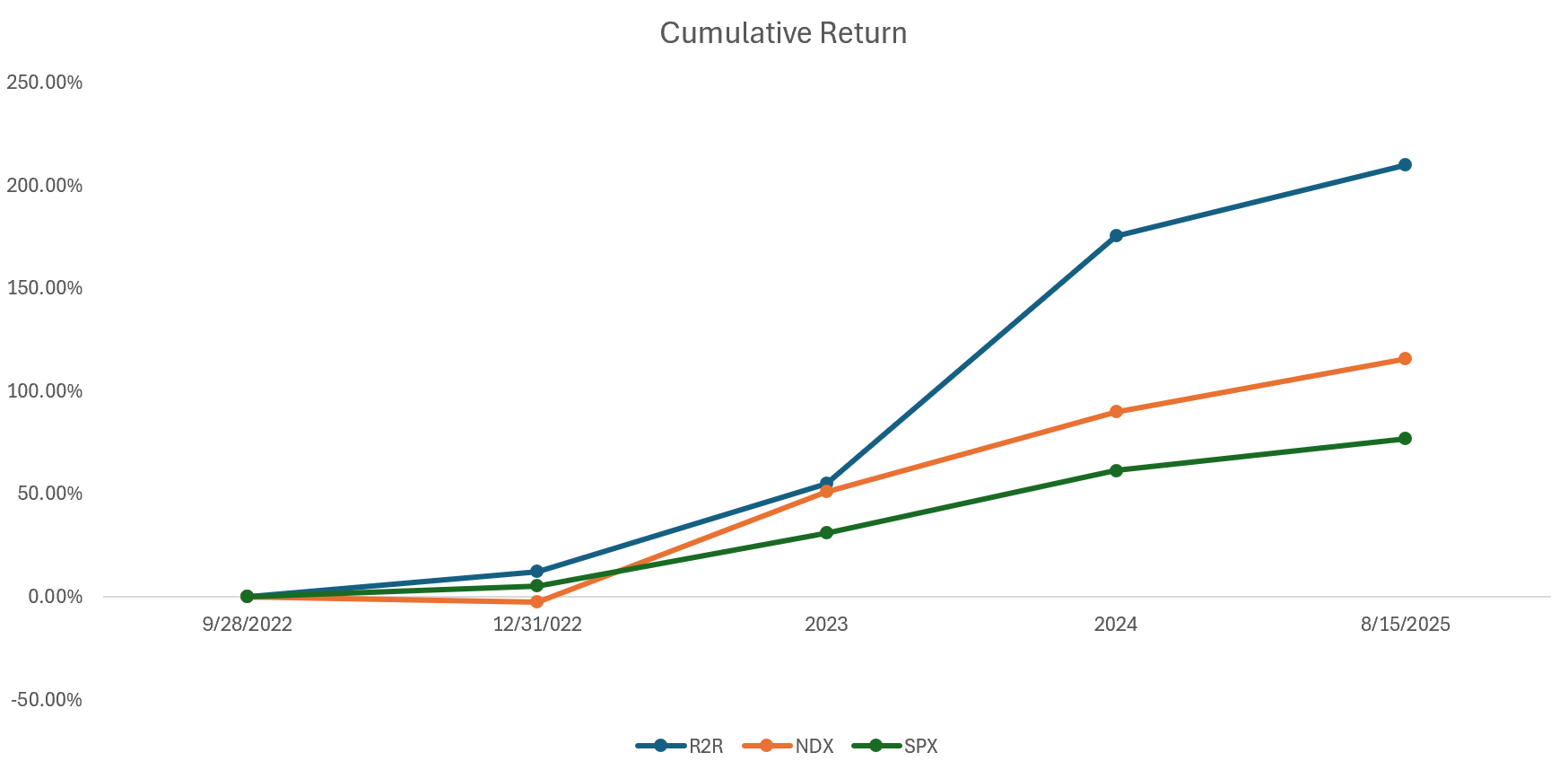

(From Sept 28, 2022, through August 15, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 8/15/2025 | 12.54% | 13.39% | 9.66% | 3.10 | 0.62 |

| Total Return | 209.3% | 115.45% | 76.84% | 2.88 | |

| Annualized Return | 48.12% | 30.55% | 21.89% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.10

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 330.56 | -18.15% |

| 2 | QQQ | 10% | 577.34 | 12.93% |

| 3 | Tencent (700.HK) | 18% | HKD 592.00 | 41.97% |

| 4 | Nvidia (NVDA) | 2% | 180.45 | 34.37% |

| 5 | Others | 5% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -62% | 6449.80 | 9.66% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

-

Robotaxi and Software Updates – Tesla received a statewide license to operate its Robotaxi service in Texas, with public rollout planned for September.

-

The 2025.26.7 software update began wide release.

My Take: Robotaxi licensing is a pivotal milestone in Tesla’s long-term valuation story. The ability to generate recurring revenue from autonomous fleets is central to the thesis. The broad software rollout reinforces Tesla’s edge in improving products over the air—a competitive advantage that compounds with scale.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

-

Tariff Escalation – The Trump administration imposed reciprocal tariffs: 39% on Swiss goods, and 100% on imported semiconductors unless firms commit to U.S. manufacturing.

-

Macro Trends & Fed Speculation – Weak economic data increased expectations of rate cuts. Trump temporarily appointed a Fed governor as the Powell succession remains open.

My Take: Higher tariffs raise risks for multinational Nasdaq-100 firms, especially semis and hardware. At the same time, potential Fed cuts could provide liquidity tailwinds. Balancing growth with geopolitical and regulatory risks is key to navigating tech-heavy exposure.

Tencent (700.HK)

Tencent (700.HK)

-

Q2 2025 Earnings – Revenue up 15% YoY to ¥184.5B, beating forecasts. Net profit +16–17% to ~¥55.6B. Gaming surged: +17% (domestic), +35% (international). Ads grew strongly on AI upgrades. Operating margin rose to 33% (vs. 31%).

-

AI & Gaming Expansion – AI integrated into top titles (Honour of Kings, Peacekeeper Elite). New launches like Delta Force showed strong engagement. AI upgrades boosted Weixin ads and the Yuanbao app.

My Take: Tencent’s double-digit growth in both revenue and profit reinforces its platform strength. AI-driven gaming and advertising momentum highlight durable competitive advantages. Margin expansion plus ecosystem synergies position Tencent as a resilient leader in tech and entertainment.

✨ Closing Thought

That’s a wrap for Week 33.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.