Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

This week’s snapshot highlights why discipline matters:

-

The portfolio carries over 20% in cash, giving flexibility and safety.

-

More than 60% of holdings are hedged, reinforcing stability.

-

My biggest holding, Tesla (TSLA), makes up 43% of the portfolio and is down –15.81% year-to-date

-

Yet despite these headwinds, R2R continues to outperform the Nasdaq and the S&P 500.

Weekly Activity

Weekly Activity

No new stock trades this week.

No options trades either—sometimes the best move is no move. This week was about staying disciplined and letting the portfolio do its work.

Performance Snapshot

Performance Snapshot

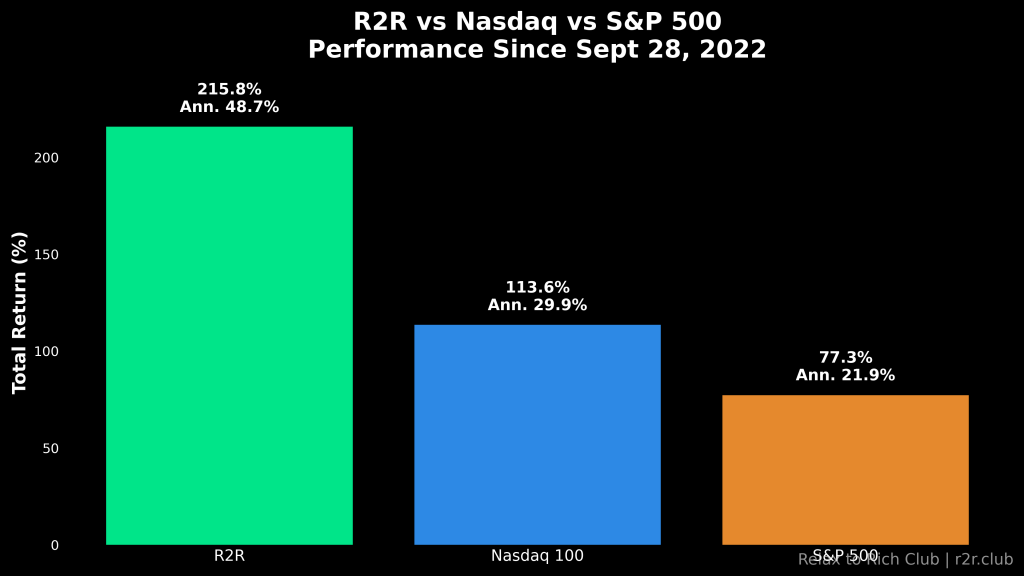

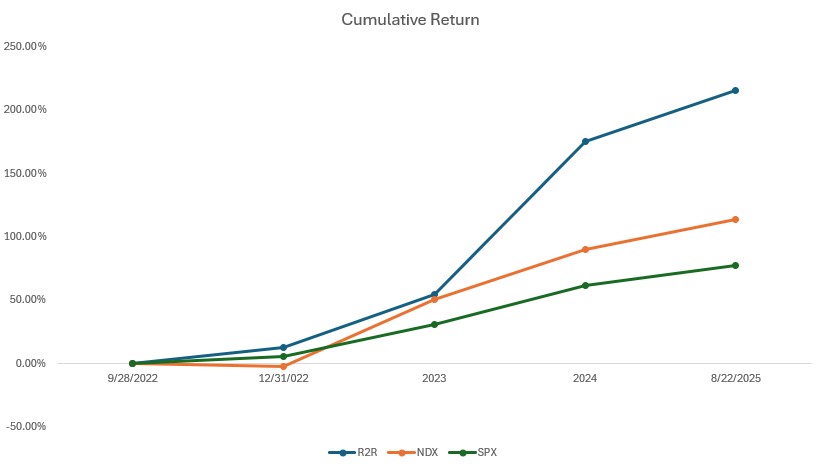

(From Sept 28, 2022, through August 22, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 8/22/2025 | 14.69% | 12.40% | 9.95% | 3.16 | 0.64 |

| Total Return | 215.85% | 113.57% | 77.31% | 2.90 | |

| Annualized Return | 48.70% | 29.92% | 21.85% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.16

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 340.01 | -15.81% |

| 2 | QQQ | 11% | 571.97 | 11.88% |

| 3 | Tencent (700.HK) | 18% | HKD 600.00 | 43.88% |

| 4 | Nvidia (NVDA) | 3% | 177.99 | 32.57% |

| 5 | Others | 5% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -61% | 6466.91 | 9.95% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

-

Six-Seat Model Y Launch in China

Tesla introduced a six-seat “Model Y L” in China, starting at ¥339,000 ($47,200). Deliveries begin in September.

👉 My Take: Smart move for the family segment. Good for Asia volume growth, but global impact may be limited.FSD Testing in Japan

Tesla rolled out FSD (Supervised) testing on public roads in Japan for employees, with plans to expand pending regulatory approval.

👉 My Take: Expanding autonomy to Japan strengthens the international roadmap and could boost recurring software revenue.Model S/X Price Hike with “Luxe Package”

Tesla raised Model S/X prices, bundling FSD and premium features into the upfront cost.

👉 My Take: Bundling FSD drives higher margins and perceived value, but watch for demand elasticity at higher price points.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

-

-

Powell’s Jackson Hole Pivot

On Aug 22, Fed Chair Powell signaled rate cuts may be warranted, with markets pricing a potential 25 bps cut in September.

👉 My Take: Lower rates = cheaper capital for AI and semiconductor leaders in the Nasdaq 100, helping sustain valuations even with slower earnings growth.

-

Tencent (700.HK)

Tencent (700.HK)

-

Gamescom 2025 Showcase

Tencent unveiled Fate Trigger and a new Honor of Kings fantasy RPG, plus AI-powered dev tools (GoSkinning, MotionBlink, VISVISE) to streamline game creation.

👉 My Take: A bold display of global ambition. AI-driven efficiency could lift margins while diversifying Tencent’s gaming portfolio.

Closing Thought

Closing Thought

That’s a wrap for Week 34.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.