Relax to Rich | Week 35 Recap (Ending August 29, 2025)

Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

This week was quiet on the trading front—nothing much to do except keep reading and keep struggling with my golf swing. The portfolio still outperformed the Nasdaq 100, and I’m happy about it. That’s the amazing part of strategic options trading: when you have positive theta, time is on your side. Even if you do nothing, the money keeps coming in—kind of like FSD… haha.

Weekly Activity

Weekly Activity

-

No new stock trades this week

-

Closed several Tesla (TSLA) call options for profit

-

Rolled Google (GOOGL) call options to later expirations

Performance Snapshot

Performance Snapshot

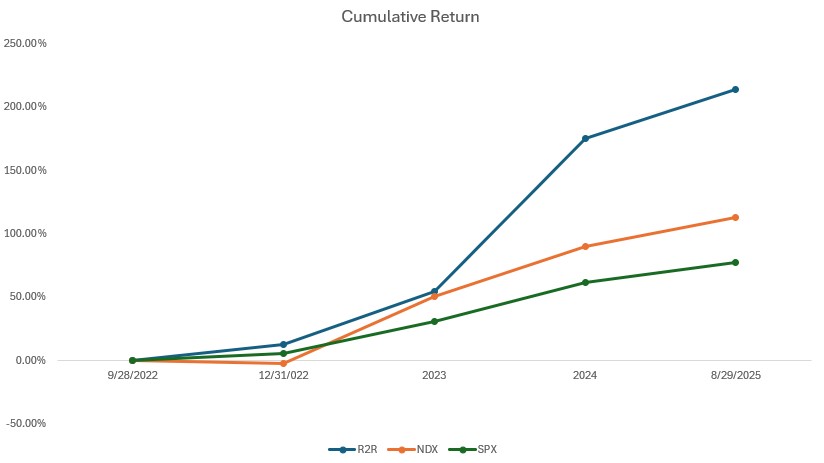

(From Sept 28, 2022, through August 29, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 8/29/2025 | 14.01% | 12.02% | 9.84% | 3.14 | 0.66 |

| Total Return | 213.98% | 112.84% | 77.12% | 2.92 | |

| Annualized Return | 48.01% | 29.55% | 21.64% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.14

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 333.87 | -17.33% |

| 2 | QQQ | 12% | 570.40 | 11.57% |

| 3 | Tencent (700.HK) | 18% | HKD 596.00 | 43.05% |

| 4 | Nvidia (NVDA) | 3% | 174.18 | 29.70% |

| 5 | Others | 5% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -59% | 6460.26 | 9.84% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

-

Nothing major this week—just noise around legal actions and European sales declines.

The real highlight: FSD expansion to Australia and New Zealand.

-

Excited for what FSD v14 will brings—could it finally crack the long-tail problem? We’ll wait and see.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Core PCE Inflation Data (July)

-

Core PCE rose 0.3% MoM and 3.5% YoY (vs. 3.4% expected).

-

Tech sector sold off sharply after the release.

-

Weak guidance from Marvell Technology and Dell added to the pressure.

My Take:

Sticky inflation is a headwind for growth stocks. Higher-for-longer rates make future earnings less attractive in valuation models. Combine that with company-specific weakness, and the Nasdaq 100 had a tough week. It’s a dynamic I’ll keep watching closely.

Closing Thought

Closing Thought

That’s a wrap for Week 35.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.