Relax to Rich | Week 36 Recap (Ending Sep 5, 2025)(4 minutes of reading)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

✅ Stay patient

✅ Focus on high-quality assets

✅ Use options with intention

✅ Let time and compounding do the heavy lifting

Looking back at the past eight months, I feel grateful for the results: my portfolio is up +17.73%, outpacing the Nasdaq 100 (+13.19%) and the S&P 500 (+10.20%)—even though my largest holding, Tesla (43%), is still -13.12% YTD. The key has been balance: about 60% of my portfolio is hedged, which means I don’t have to worry whether the market is “too high” or “too low.” Instead, I can keep working on my golf swing and occasionally harvest option profits.

This combination of long-term value investing and strategic option trading really is amazing—it lets compounding and time do their quiet work, while options provide steady income and risk control.

Weekly Activity

Weekly Activity

-

No new stock trades this week

-

Closed several Tesla (TSLA) call and put options for profit

-

Closed Google (GOOGL) call and put options for profit

Performance Snapshot

Performance Snapshot

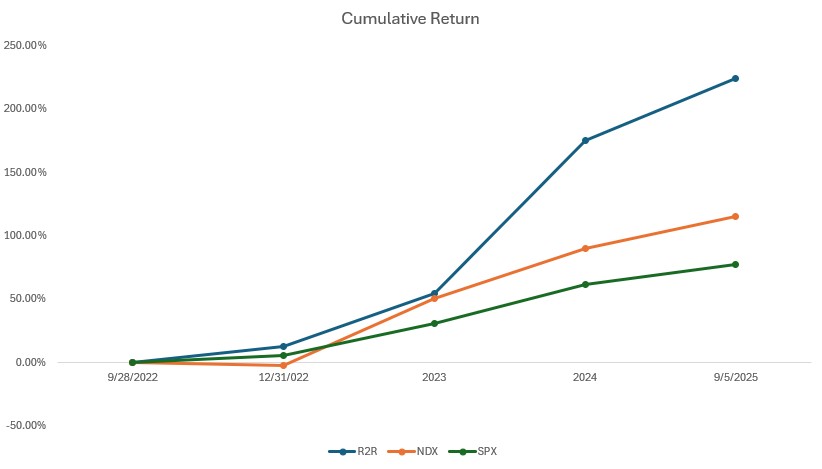

(From Sept 28, 2022, through Sep 5, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 9/5/2025 | 17.73% | 13.19% | 10.20% | 3.24 | 0.68 |

| Total Return | 224.23% | 115.07% | 77.71% | 2.94 | |

| Annualized Return | 49.26% | 29.79% | 21.63% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.24

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 350.84 | -13.12% |

| 2 | QQQ | 11% | 576.06 | 12.68% |

| 3 | Tencent (700.HK) | 18% | HKD 605.50 | 45.20% |

| 4 | Nvidia (NVDA) | 3% | 167.02 | 24.37% |

| 5 | Others | 4% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -61% | 6481.50 | 10.20% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

Musk’s Compensation Plan

Tesla’s board proposed a performance-based package for Elon Musk worth up to $87.75B if Tesla reaches an $8.5T market cap by 2035. A shareholder vote is set for Nov 6, 2025.

My Take: Audacious but aligned. It ties Musk’s incentives directly to shareholder value creation. High hurdles (market cap + gross profit growth) keep the focus on long-term profitable expansion.

Robotaxi App Launch

Tesla launched its Robotaxi app on the Apple App Store, now with a public waitlist. Service is live in Austin (safety drivers still required) and partially in San Francisco.

My Take: A real inflection point for autonomy. Success here could redefine Tesla’s valuation narrative—execution and regulation will decide the pace.

Model Y L Deliveries

China deliveries of the long-wheelbase Model Y L begin Sept 11 at RMB 339,000 (~US$47K).

My Take: Expands Tesla’s appeal to family buyers in China. Strong demand here supports volume and brand strength against local rivals.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Weak Jobs Report

Only 22,000 jobs were added in August vs. 75,000 expected; unemployment rose to 4.3%. Markets priced in higher odds of a Fed rate cut.

My Take: Lower rates favor growth stocks, but weak labor data could foreshadow slowing earnings. A classic double-edged sword.

Tencent (700.HK)

Tencent (700.HK)

New Game License

Tencent’s high-budget mobile game Stellar Odyssey won NPPA approval—its fourth major license of 2025.

My Take: A signal of regulatory stability. Execution and user adoption will show if it’s a new franchise pillar or just incremental revenue.

Ongoing Share Buyback

Repurchased 913,000 shares (HK$550.8M) on Sept 5. Tencent has bought back over 0.5% of its capital since May as part of an $80B program.

My Take: Strong shareholder alignment. Buybacks at scale reinforce management’s confidence and create long-term compounding power.

Closing Thought

Closing Thought

That’s a wrap for Week 36.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.