Relax to Rich | Week 37 Recap (Ending Sep 12, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

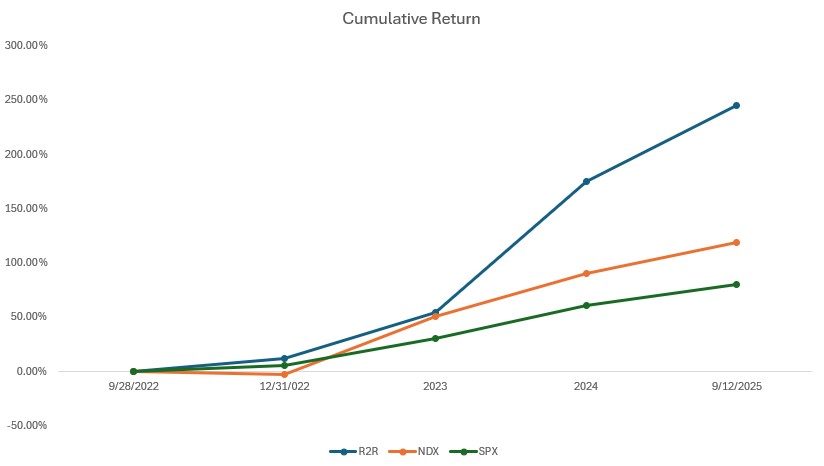

This week, my portfolio once again outpaced the broader market. Year-to-date, the Nasdaq 100 is up 15.31% and the S&P 500 has gained 11.95%. My portfolio has returned 25.26% YTD, well ahead of both benchmarks. Since inception (Sept 28, 2022), the total return is 244.95%, compared with 119.10% for the Nasdaq 100 and 80.53% for the S&P 500.

To be clear, my goal is not to “beat the market,” though I certainly enjoy seeing that outcome. My true focus is riding alongside companies I deeply believe in studying them, understanding them, and letting fundamentals drive my conviction. Outperformance confirms that my direction isn’t wrong. If returns lag, I go back to the fundamentals: if the thesis is intact, I stay patient; if the story changes, I restructure.

Tesla (TSLA) stood out this week, jumping 12.85%. Still, YTD the stock is down 1.96%, and I don’t lose sleep or get too excited over short-term swings. What matters is the long game.

Tesla’s board recently proposed the largest pay package in corporate history, up to $1 trillion for Elon Musk (click for details) over the next decade. The target: lifting Tesla’s market cap to around $8.5 trillion. With today’s valuation around $1 trillion, that means roughly an 8x climb in 10 years or doubling every three years. If the math holds, Tesla’s share price could be around $600 in three years, a path that aligns closely with my own valuation model. The real drivers? Successful delivery and scaling of FSD (Full Self-Driving) and Optimus.

That’s why I don’t mind if the stock takes its time. The best outcome is for the price to rise in tandem with real progress on these breakthrough projects. If it races too far ahead, some investors inevitably get burned.

My approach is simple: enjoy the ride with FSD leading the way. That’s the essence of Relax to Rich: calm conviction over noise, and discipline over distraction.

📌 Weekly Activity

-

No new stock trades this week

-

Closed several Tesla (TSLA) put options for profit

-

Rolled SPX and QQQ calls to later expirations

Performance Snapshot

Performance Snapshot

(From Sept 28, 2022, through Sep 12, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 9/12/2025 | 25.26% | 15.31% | 11.95% | 3.45 | 0.70 |

| Total Return | 244.95% | 119.10% | 80.53% | 2.96 | |

| Annualized Return | 52.02% | 30.39% | 22.12% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.45

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 395.94 | -1.96% |

| 2 | QQQ | 10% | 586.66 | 14.75% |

| 3 | Tencent (700.HK) | 19% | HKD 643.50 | 54.32% |

| 4 | Nvidia (NVDA) | 3% | 177.82 | 32.41% |

| 5 | Others | 5% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -69% | 6584.29 | 11.95% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

Nevada DMV Approves Tesla for Autonomous Vehicle Testing

On Sept 12, 2025, Nevada’s DMV granted Tesla approval to test autonomous vehicles on public roads, following earlier driverless pilots in Austin, Texas.

My Take:

This is a critical step in Tesla’s robotaxi ambitions. Regulatory progress strengthens the long-term thesis by positioning Tesla as a leader in a market with massive potential.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Macro / Economic Backdrop

-

Markets expect the Fed to cut rates (likely 25 bps) at the next meeting, supported by softening labor data and easing inflation.

-

Consumer sentiment has declined for two straight months, adding weight to rate-cut expectations.

-

Treasury yields remain volatile, creating valuation headwinds for equities.

My Take:

Rate cuts are a major tailwind for growth-heavy indexes like QQQ. Lower rates boost valuations and capital access. Still, risks remain if inflation or labor surprises to the upside, the Fed may disappoint, putting pressure on multiples.

Tencent (700.HK)

Tencent (700.HK)

Recruitment of OpenAI Researcher

Tencent hired Yao Shunyu, a former OpenAI researcher, bolstering its AI capabilities.

My Take:

Strategic hires like this strengthen Tencent’s long-term AI pipeline and reinforce its competitive edge in both consumer and enterprise AI.

Key Video Game Approval

On Sept 9, China’s NPPA approved Tencent’s new mobile title Dynasty Warriors: Ascend. Tencent announced an Oct 1 launch timed with Golden Week. Shares gained on the news.

My Take:

The approval plus a holiday-timed launch supports Q4 gaming revenue visibility. It also signals that China’s game approval process remains stable, which is critical for valuing Tencent’s core gaming business. Performance of this title will be an important Q4 metric.

Closing Thought

Closing Thought

That’s a wrap for Week 37.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.