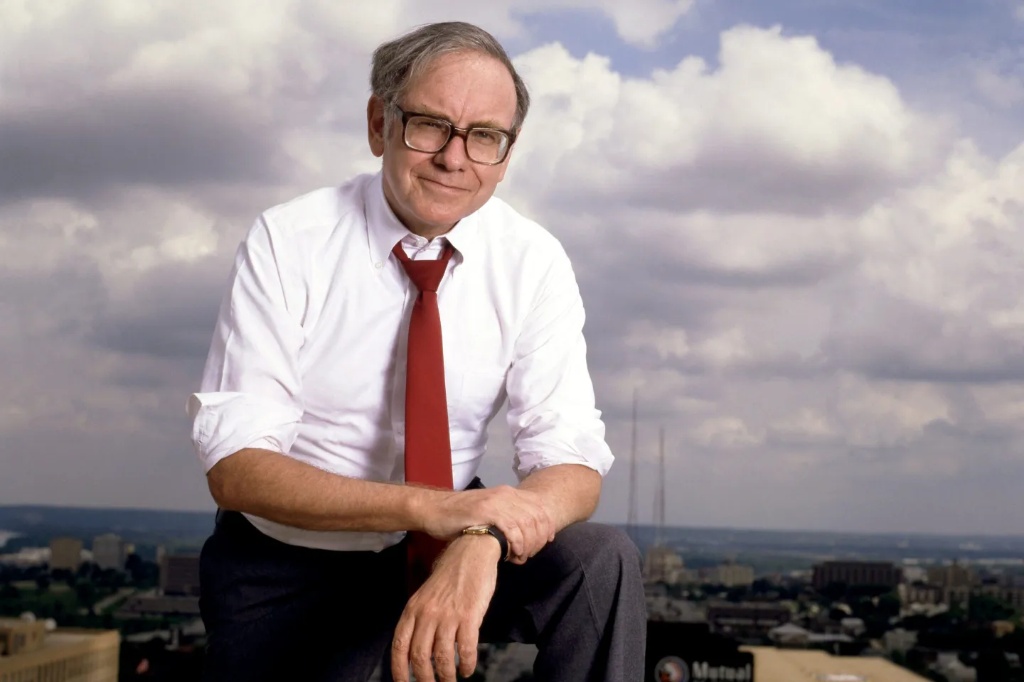

Two Minutes Reading with the Masters of Investing

When Warren Buffett topped the Forbes 400 list back in 1993, he summed up his version of success in one line: 👉 “I don’t have to work with people I don’t like.”

That may sound simple, but for investors, it’s a powerful lesson.

1. Keep Life Simple 🧃

Despite being the richest American at the time, Buffett lived modestly, same house in Omaha, same simple lifestyle, no security guards or limousines. He believed wealth should give you freedom, not complications.

For investors, that means: don’t chase the fanciest, most complex ideas. Often the best results come from buying solid businesses you actually understand. Buffett preferred companies like Coca-Cola, Gillette, and GEICO, everyday businesses with long-lasting demand.

2. Invest in What You Understand 🏦

Buffett avoided hype and stuck to businesses with clear economics. He often repeated: “If you don’t get it, don’t invest.”

Think about Coca-Cola: no matter what happens in technology or politics, billions of people will still drink Coke tomorrow. That kind of predictability is golden for long-term investing.

For retail investors, this means: before buying a stock, ask yourself, would I feel confident holding this company for the next 10 years, even if the market shut down tomorrow?

3. Don’t Spread Yourself Too Thin 🎯

Buffett didn’t believe in buying hundreds of stocks just for diversification. Instead, he picked a smaller number of businesses he deeply understood and trusted. His advice: “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

For example, he put large amounts into Coca-Cola and American Express and held them for decades.

4. Character Matters 💡

Buffett often said he looks for managers with integrity and talent but above all, people he enjoys working with. As he put it: “Why work with people you don’t like? Life’s too short.”

This lesson extends to us as investors: align your money with businesses run by honest, capable leaders. If the CEO’s track record is shaky or built on hype, think twice.

Why This Matters for You

Buffett’s 1993 wisdom is timeless. Markets change, but the core principles simplicity, patience, trust, and working with the right people never go out of style.

If you keep your portfolio filled with companies you understand, trust, and could happily own for years, you’re already following the playbook of the world’s greatest investor.

✨ Follow me for more simple, smart investing strategy. 📈 Join the Relax to Rich Club where we grow wealth the calm, thoughtful way.