When people think of Warren Buffett, they imagine a genius stock picker. True but the real secret behind Berkshire Hathaway’s empire is something most investors overlook: insurance float.

It’s how Buffett has quietly built up $170 billion in investable cash without borrowing from banks.

What Is “Float”? 💡

Insurance companies collect premiums upfront. They don’t always pay claims right away sometimes not for years. In the meantime, they hold that money and can invest it.

-

Example: You pay car insurance today. Your insurer invests that premium. If you don’t file a claim, the insurer keeps the investment gains and your premium.

This pool of money is called float.

Buffett realized decades ago that float is essentially “other people’s money” (OPM) and if used wisely, it’s almost like a permanent, interest-free loan.

The Early Move 📜

In 1967, Berkshire bought two small Omaha insurers for just $8.5 million. That tiny purchase planted the seed for what would become one of the largest sources of investment capital in history.

-

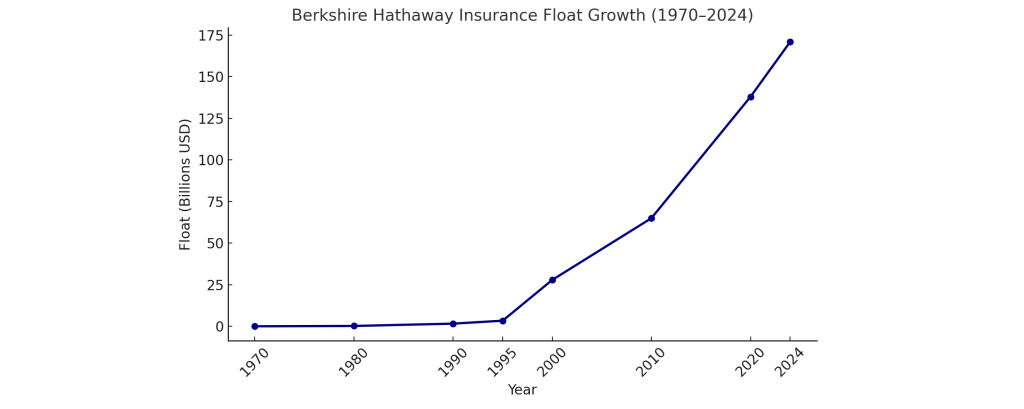

By 1995, float had grown to about $3.4 billion.

-

After buying General Re in 1998, float jumped massively.

-

Today, Berkshire controls about $170 billion in float.

That money has helped Buffett invest in stocks like Coca-Cola, Apple, and even buy entire businesses like Geico and BNSF Railway.

Betting on Catastrophes 🌪️

Berkshire also became a powerhouse in catastrophe insurance policies that cover massive disasters like hurricanes or earthquakes.

-

If nothing happens, Berkshire keeps the premium.

-

If disaster strikes, Berkshire pays up but over the long run, the odds work in its favor.

Charlie Munger put it bluntly: even if one bad year costs billions, the decades of steady gains far outweigh the losses.

Why Float Is Buffett’s Edge 🎯

Here’s why it’s so powerful:

-

Cost of capital: Often close to zero or even negative since Berkshire sometimes earns more in premiums than it pays in claims.

-

Scale: $170B invested alongside shareholder money amplifies compounding.

-

Discipline: Unlike investors on margin, Berkshire never faces a margin call.

It’s like running your portfolio with a massive, low-cost loan except the lender (insurance customers) is happy to keep paying you every year.

The Takeaway

Buffett’s secret weapon isn’t just brilliant stock picking. It’s the float an ever-growing river of other people’s money that he invests with patience and discipline.

That’s how $8.5 million in 1967 turned into hundreds of billions today.

👉 Lesson for us: You don’t need $170B, but you can win the same way by keeping costs low, avoiding debt traps, and letting compounding do the work.

Follow me for more simple, smart investing strategy. Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨