Relax to Rich | Week 38 Recap (Ending Sep 19, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Someone said: “When you start seeing screenshots of portfolio gains all over 𝕏, you know the market’s getting frothy.” That’s not wrong. 🌊 When the tide eventually pulls back, those without pants will be exposed. My goal is different: build a portfolio that can ride through the whole cycle—ups, downs, and everything in between. Keep following these recaps, and you’ll see how I navigate it in real time.

Weekly Activity

Weekly Activity

-

No new stock trades this week

-

Closed several Tesla (TSLA) put options for profit

-

Rolled several Tesla (TSLA) call options to later expirations

-

Rolled QQQ and GOOGL calls to later expirations

-

Closed several META put options for profit

Performance Snapshot

Performance Snapshot

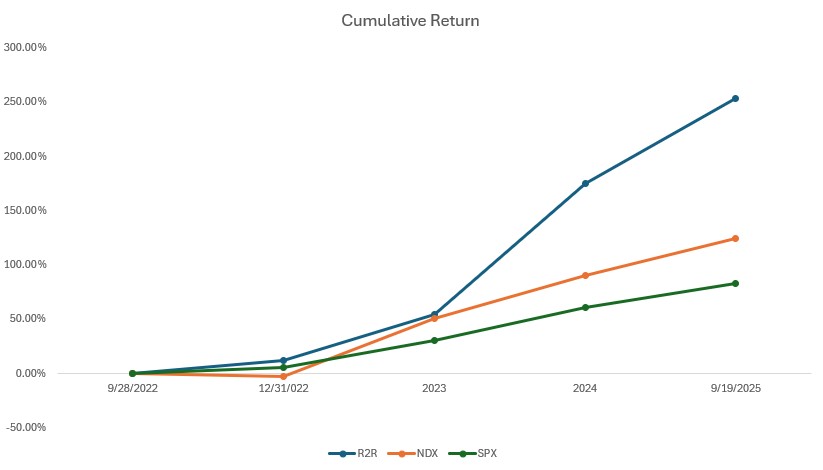

(From Sept 28, 2022, through Sep 19, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 9/19/2025 | 28.24% | 17.89% | 13.31% | 3.53 | 0.72 |

| Total Return | 253.16% | 124.00% | 82.72% | 2.98 | |

| Annualized Return | 52.82% | 31.13% | 22.46% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.53

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 426.07 | 5.50% |

| 2 | QQQ | 9% | 599.35 | 17.24% |

| 3 | Tencent (700.HK) | 19% | HKD 642.50 | 54.08% |

| 4 | Nvidia (NVDA) | 3% | 176.67 | 31.56% |

| 5 | Others | 5% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -76% | 6664.36 | 13.31% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

Musk’s $1B Share Purchase

Tesla’s CEO bought about 2.57 million shares, spending roughly $1 billion, per SEC filings

My Take:

A CEO doubling down reinforces alignment with long-term goals. At a time when Tesla faces demand and margin pressure, this personal commitment strengthens confidence in the AI + robotics transformation thesis.

Robotaxi and FSD Expansions

-

Austin pilot hours extended to 2 a.m.

-

Expanded coverage to airports + Nevada permits

-

Arizona DOT approved testing in Phoenix metro (with monitors)

-

FSD expanded to Australia + New Zealand → now live in six countries

My Take:

These steps push Tesla’s autonomy pillar forward, opening paths for recurring software revenue and mobility services. If adoption scales globally, the valuation upside from network effects could be enormous.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Federal Reserve Interest Rate Decision

On Sep 18, the Fed cut rates by 25 bps and hinted at more cuts in 2025.

My Take:

Lower discount rates = higher multiples for growth stocks. This supports the Nasdaq’s tech-heavy composition and fits my thesis of tech + innovation driving long-term compounding.

Tencent (700.HK)

Tencent (700.HK)

Bond Issuance + Buyback

-

Issued 9B yuan (~$1.27B) offshore bonds for AI expansion

-

Concurrently executed significant share buybacks

My Take

Raising debt while buying back shares signals confidence. Proceeds channeled into AI R&D = strategic reinvestment, while buybacks highlight management’s view that shares are undervalued.

AI Agent Platform Global Rollout

At the Sep 16 Global Digital Ecosystem Summit, Tencent Cloud launched AI Agent Development Platform 3.0

My Take

Tencent is extending beyond gaming into AI + cloud ecosystems. Potential revenue diversification is attractive, but adoption will decide real impact. Execution risk remains, but the direction is shareholder-friendly.

Closing Thought

Closing Thought

That’s a wrap for Week 38wi.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.