Relax to Rich | Week 39 Recap (Ending Sep 26, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Weekly Activity

Weekly Activity

-

No new stock trades this week

-

Closed several Tesla (TSLA) put options for profit, and reopen put options

-

Rolled QQQ and AAPL calls to later expirations

Performance Snapshot

Performance Snapshot

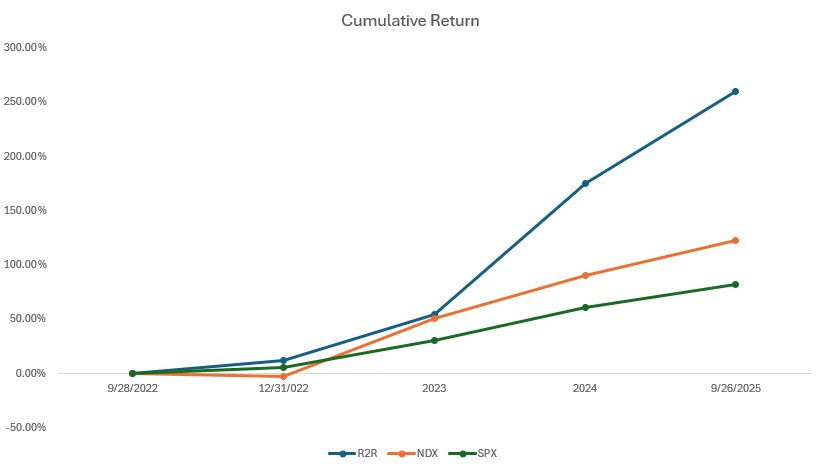

(From Sept 28, 2022, through Sep 26, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 9/26/2025 | 30.74% | 17.34% | 12.96% | 3.60 | 0.74 |

| Total Return | 260.05% | 122.95% | 82.15% | 2.99 | |

| Annualized Return | 53.39% | 30.70% | 22.17% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.60

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 41% | 440.40 | 9.05% |

| 2 | QQQ | 11% | 595.97 | 16.58% |

| 3 | Tencent (700.HK) | 19% | HKD 644.00 | 54.44% |

| 4 | Nvidia (NVDA) | 3% | 178.19 | 32.69% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -73% | 6643.70 | 12.96% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

-

Registrations in key European markets rose meaningfully in the third week of September, the best weekly performance of Q3 so far.

-

The refreshed Model Y drove this surge.

-

Still, YTD deliveries in Europe are ~20% below 2024, and the broader EV market is growing faster.

My Take:

The refreshed Model Y is gaining traction, which could lift Q3 numbers. But the year-over-year decline underscores the competitive headwinds in Europe. Performance also varies by country (Norway strong, Sweden weak). actually, i do not care about those short-term number changes.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

-

Structural change proposed: Invesco wants to convert QQQ from a UIT to an open-end ETF. Vote scheduled Oct 24.

-

Benefits: securities lending, lower expenses, and more flexibility.

-

Recent index updates: Shopify (SHOP) replaced MongoDB (MDB); Palantir (PLTR) and MicroStrategy (MSTR) added in Dec 2024, replacing Illumina (ILMN) and Moderna (MRNA).

My Take:

The shift to an ETF structure could improve QQQ’s long-term efficiency and returns. And I love that QQQ evolves new leaders get added while laggards rotate out. That’s one reason I hold it: QQQ adapts with the times.

Tencent (700.HK)

Tencent (700.HK)

-

Game approvals: Chinese regulators approved 156 new games in September, including Tencent titles. Signals stability returning to gaming.

-

Healthcare innovation: Tencent announced “Brain Training,” a gamified therapeutic tool certified as a medical device in China, aimed at cognitive health and Alzheimer’s prevention.

My Take

The steady cadence of game approvals reduces regulatory overhang good for Tencent’s core. The healthcare initiative isn’t a near-term driver, but it shows Tencent’s R&D is probing new markets. Think of it as long-term optionality, while gaming, social, and fintech remain the core growth engines.

Closing Thought

Closing Thought

That’s a wrap for Week 38wi.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.