Relax to Rich | Week 40 Recap (Ending Oct 3, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Weekly Activity

Weekly Activity

No new stock trades this week.

• Closed several Tesla (TSLA) put options for profit, then reopened new puts.

• Rolled NVIDIA calls to later expirations.

• Closed part of the SPX hedge for profit and reopened new positions.

Deliberate, not dramatic — just steady risk and cash-flow management.

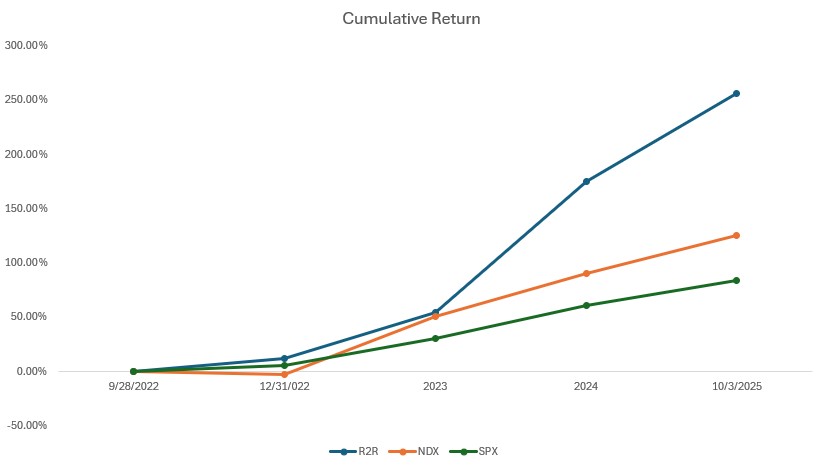

Performance Snapshot

Performance Snapshot

(From Sept 28, 2022, through Oct 3, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 10/3/2025 | 29.47% | 18.72% | 14.18% | 3.57 | 0.76 |

| Total Return | 256.56% | 125.58% | 84.13% | 3.01 | |

| Annualized Return | 52.48% | 30.99% | 22.45% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.57

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 429.83 | 6.44% |

| 2 | QQQ | 9% | 603.18 | 17.99% |

| 3 | Tencent (700.HK) | 19% | HKD 674.500 | 61.51% |

| 4 | Nvidia (NVDA) | 2% | 187.62 | 39.71% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -72% | 6715.79 | 14.18% |

* Weights represent delta-adjusted exposure, which includes both stock and option positions.

💬 Curious about “delta” or “cash equivalents”? Drop me a message, I’ll gladly explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

Q3 Vehicle Deliveries

Tesla delivered 497 099 vehicles globally in Q3 , a new record and +29 % QoQ / +7 % YoY.

U.S. demand surged before the $7 500 federal EV credit expired on Sep 30. YTD deliveries remain -6 % vs 2024.

My Take:

A strong quarter and proof of Tesla’s nimbleness in capturing policy windows. But the credit-driven pull-forward suggests short-term demand distortion. Without fresh incentives, deliveries may normalize lower, keeping margins tight. Long-term, the key is execution on autonomy and Optimus to expand beyond EVs.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Macro vs. Monetary Tailwinds

The U.S. government entered a partial shutdown, delaying jobs data. Consumer confidence slid to a five-month low; ADP private payrolls softened. Markets rallied anyway as “bad news = good news” revived hopes for rate cuts.

My Take:

Markets shrugging off shutdown headlines shows how dependent sentiment is on monetary policy. Every weak data print now fuels the “Fed pivot” narrative. It works for now, but builds fragility if earnings don’t follow through.

AI Momentum: Still the Market’s Heartbeat

NVIDIA and AMD extended gains as AI infrastructure spending stays robust. Partnership news like SK Hynix + OpenAI and Rumble + Perplexity added to the buzz.

My Take:

AI remains the index’s engine. Long-term potential is huge, but valuations are priced for perfection. I prefer participation via core leaders while keeping hedges ready, because even revolutions can correct sharply.

Tencent (700.HK)

Tencent (700.HK)

Buyback & Partnership Momentum

• Repurchased 817 000 shares on Oct 3 → confidence signal.

• Launched Vantage Studios joint venture with Ubisoft to manage major IP like Assassin’s Creed and Far Cry.

My Take:

Smart capital allocation and global gaming expansion, a powerful combo for Tencent’s long-term story. The buyback reinforces management’s belief the stock remains undervalued.

💭 Closing Thought

The market keeps rising on hope for easier money, but discipline matters most when things feel easy. As I like to say:

“When everyone’s celebrating portfolio gains on 𝕏, that’s usually when the tide starts to pull back.”

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.