Relax to Rich | Week 41 Recap (Ending Oct 10, 2025)

Hi friends,

The philosophy behind Relax to Rich (R2R) is simple:

Friday, NASDAQ dropped 3.48%, causing some panic across market.

It didn’t bother me, because more than half of my portfolio is hedged.

The decline temporarily pulled down the total return, but I actually welcome it.

Corrections release built-up risk and reset expectations; they keep the market healthy.

Weekly Activity

Weekly Activity

No new stock trades this week.

• Rolled NVIDIA (NVDA) and TSMC (TSM) calls to later expirations

• Closed part of the QQQ put hedge for profit and reopened new positions

Deliberate, not dramatic , steady risk and cash-flow management.

Performance Snapshot

Performance Snapshot

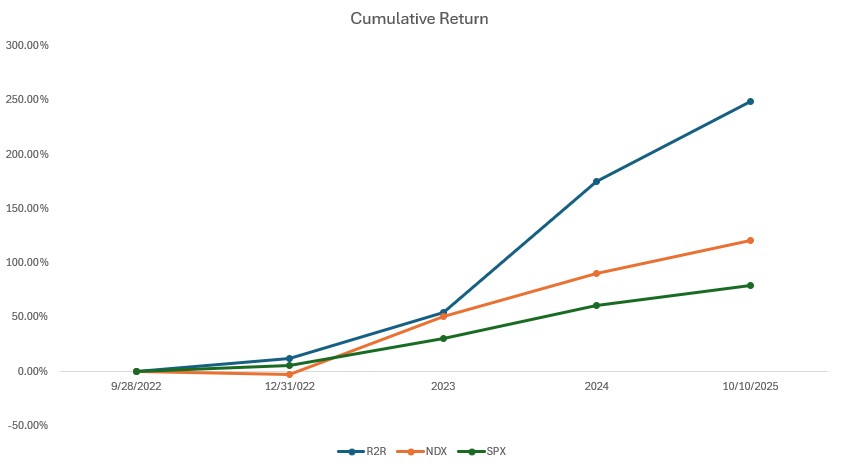

(From Sept 28, 2022, through Oct 10, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 10/10/2025 | 26.76% | 16.06% | 11.41% | 3.49 | 0.78 |

| Total Return | 249.09% | 120.51% | 79.65% | 3.03 | |

| Annualized Return | 51.01% | 29.79% | 21.31% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV:3.49

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 413.49 | 2.39% |

| 2 | QQQ | 11% | 589.50 | 15.31% |

| 3 | Tencent (700.HK) | 18% | HKD 651.50 | 56.24% |

| 4 | Nvidia (NVDA) | 3% | 183.16 | 36.39% |

| 5 | Others | 7% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -52% | 6552.51 | 11.41% |

* Weights represent delta-adjusted exposure, which includes both stock and option positions.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

FSD v14 and Regulatory Scrutiny

Tesla rolled out FSD v14 On Oct 9, AI Chief Ashok Elluswamy confirmed a Cybertruck timeline while the NHTSA opened an investigation into FSD traffic-violation reports.

My Take:

Continuous software iteration is Tesla’s moat, but the regulatory risk remains a speed bump. The real question is whether FSD can prove safety at scale, because that’s the gateway to the Robotaxi economy.

QQQ / Nasdaq 100

QQQ / Nasdaq 100

Powell Warns, Tariffs Bite

Fed Chair Powell called U.S. equities “fairly highly valued.” Soon after, Trump’s threat of new China tariffs sparked a -3.6% Nasdaq sell-off.

My Take:

Markets are leaning hard on the “Fed pivot” story. That works until earnings stop delivering. Powell’s warning and tariff noise show how fragile multiple expansion has been. For me, hedges stay on and AI remains core.

Tencent (700.HK)

Tencent (700.HK)

AI Leadership Strengthens

Tencent’s Hunyuan Image 3.0 model topped a global AI leaderboard this week.

My Take:

A quiet but meaningful win. Dominating AI benchmarks cements Tencent’s position beyond gaming, into enterprise AI and cloud ecosystems. That diversification supports higher valuation multiples over time.

Closing Thought

Closing Thought

Friday’s sell-off reminded me why I hedge, not because I expect every dip, but because I respect risk. Markets need these pauses to release pressure. I’d rather give up a little upside than lose sleep over drawdowns.

“When the crowd panics, the calm investor collects the future’s bargains.”

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.