💬 Imagine This:

You lend your friend $100 today, and they promise to give you $105 back next year. That extra $5? That’s interest. It’s also your reward for waiting—and taking a little risk that they might not pay you back.

Now zoom out: governments, banks, and investors do this kind of lending all the time. The rates they use—the “interest rates”—don’t just affect your friend’s IOU. They ripple through every corner of the economy, including the stock market, housing, and even the price of groceries.

So what exactly are interest rates? And why do they matter so much for investors?

🏛️ What Is an Interest Rate, Really?

At its core, an interest rate is the price of money over time. It can be seen in three different ways:

- Required return: What investors demand to get paid to take a risk.

- Discount rate: How future cash flows are converted into today’s dollars.

- Opportunity cost: The return you give up by not investing elsewhere.

But interest rates aren’t just pulled out of thin air. They’re shaped by several forces, like:

- The real risk-free rate (what you’d earn with no risk and no inflation)

- Inflation (rising prices eat into your returns)

- Default risk (the chance someone won’t pay you back)

- Liquidity (how easily you can sell your investment)

- Time/maturity (longer waits often demand higher pay)

So when you see a loan, bond, or savings account offering 5%, that number includes all these ingredients mixed together.

📈 Why Investors Obsess Over Interest Rates

Interest rates might seem like a banker’s concern, but they’re a big deal for everyone who invests. Here’s why:

1. They Shape Stock Prices

Higher interest rates make borrowing more expensive and slow down consumer spending—bad news for company profits. Also, future earnings are discounted more heavily, shrinking today’s stock valuations.

2. They Drive Bond Values

Bond prices and interest rates move like a seesaw. When rates rise, existing bond prices fall. That’s because new bonds offer higher yields, making the old ones less attractive.

3. They Influence Sector Performance

- Rising rates? Financial stocks often shine (they earn more on loans), but REITs and tech can stumble.

- Falling rates? Long-term bonds, growth stocks, and real estate often do well.

4. They Signal Where the Economy’s Headed

The Fed doesn’t raise or cut rates for fun—it’s steering the economy. Rate hikes often aim to cool inflation, while rate cuts are meant to stimulate growth. These shifts can act like turning points for market cycles.

🕰️ What History Teaches Us

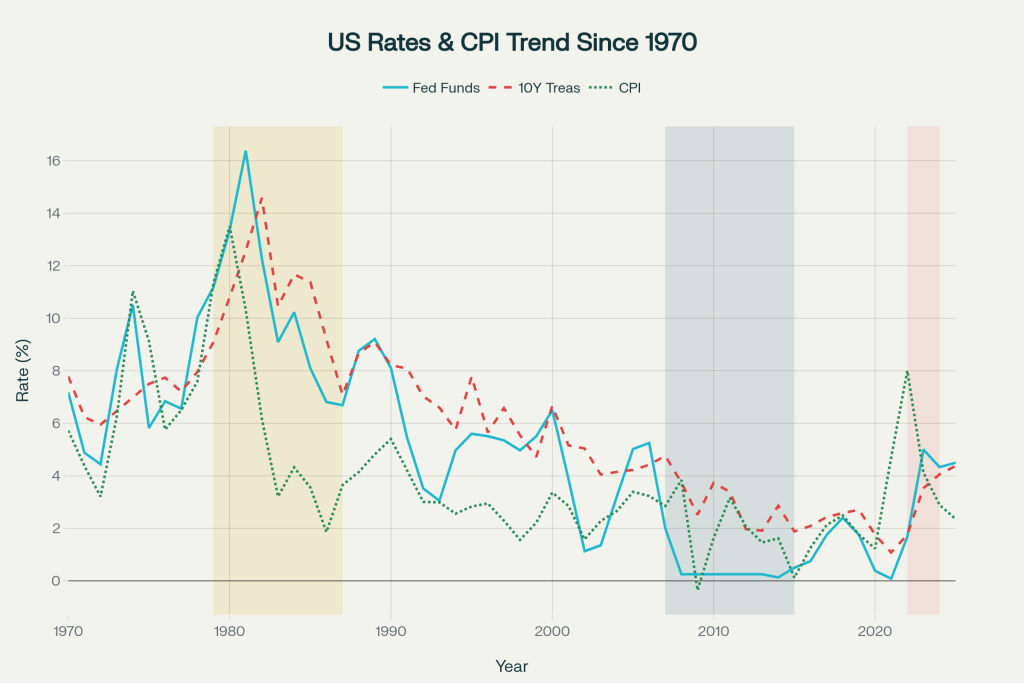

U.S. interest rates have seen wild swings—from over 16% in the early 1980s (hello inflation!) to near zero after the 2008 crisis and again in 2020. Each period taught us:

- In high-inflation times, cash and commodities (like gold and oil) may shine.

- When rates fall, growth stocks and long-term bonds tend to outperform.

- Trying to time rate changes is hard—it’s smarter to prepare for cycles than predict them.

🛠️ How to Invest Smarter with This Knowledge

- Consider bond ladders or shorter durations when rates are rising.

- Use diversification across assets and geographies to smooth out surprises.

- Focus on companies with pricing power when inflation creeps up.

- Think long term—don’t try to outguess the Fed.

☕ Final Thought: Interest Rates Are Like Gravity

You can’t see them, but they affect everything that moves in the financial world. Understanding them—even just the basics—can help you become a more thoughtful, prepared investor.

🔔 Want more simple, smart investing tips? Follow us for future updates. Let’s go from “Relax” to “Rich”—one clear concept at a time. 💸