What Is a Rate of Return, Really?

Imagine you plant a seed in your backyard. A few months later, a tree sprouts—its branches heavy with fruit. You didn’t just keep your seed—you grew it.

That’s what investing is all about. And the “rate of return” is simply a way of measuring how much your financial seed has grown over time.

Put simply:

Rate of return = What you earned ÷ What you started with

If you invest $100 and end up with $110 a year later, your return is 10%. Easy.

🍊 The Flavors of Returns

Not all returns are created equal. Like your favorite smoothie, they come in different blends:

1. Holding Period Return

This is your total return over a specific time frame. It includes both:

- Any income you received (like dividends)

- Any change in the value of your investment

Example:

You bought a stock at $100. It goes up to $105 and pays you a $2 dividend.

Your holding period return = (105 – 100 + 2) / 100 = 7%

2. Arithmetic vs. Geometric Mean

If you invest over many years, averaging gets trickier.

- Arithmetic Mean = Just the average of annual returns. Easy but misleading.

- Geometric Mean = Think compounding. It tells you the real “growth rate.”

If your returns are volatile (big ups and downs), geometric gives the truer picture.

3. Money-Weighted vs. Time-Weighted Return

These sound intimidating but here’s the gist:

- Money-Weighted Return = What you personally earned, based on when you added or withdrew money.

- Time-Weighted Return = What the investment earned, regardless of your deposits or withdrawals. Great for comparing managers.

💡 Why Does This Matter?

Because real life is messy.

Returns can be:

- Annualized (converted to a per-year number)

- Gross or net (before or after fees)

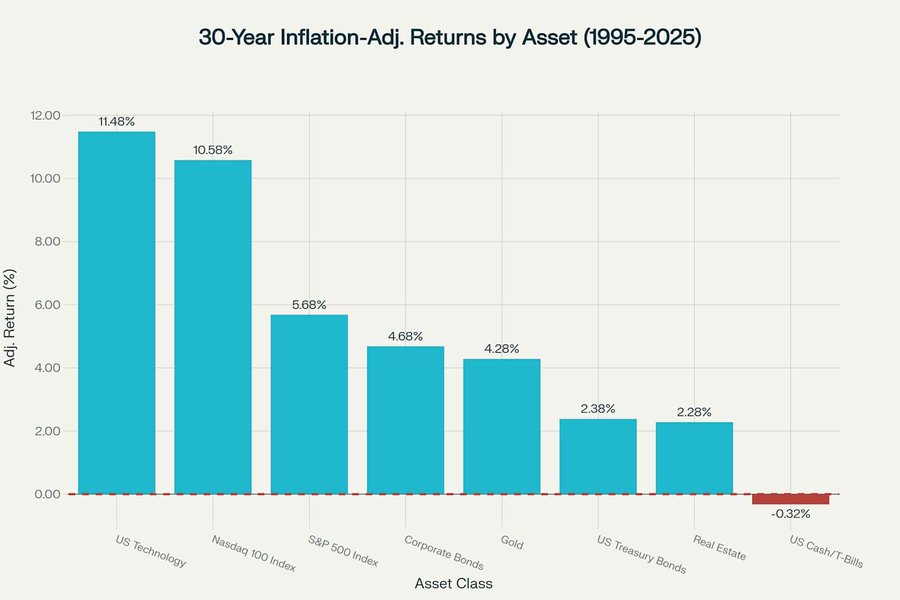

- Nominal or real (before or after inflation)

Knowing which “return” you’re looking at helps you compare apples to apples.

And in the long run, even a 1% difference in return can add up to tens of thousands of dollars. That’s not small change—it’s your future lifestyle.

🛠️ Everyday Analogy

Think of return like mileage on your car.

- Holding period return = “How far did I drive this trip?”

- Annualized return = “How many miles per year, if I kept going like this?”

- Geometric mean = “On average, how efficiently did I drive the whole way?”

🧭 What Should You Do?

Here’s your mini action plan:

- 📊 When reading about investment returns, check:

Is this gross or net? Is it annualized? Is inflation considered? - 🧠 Remember: Arithmetic is easy, geometric is truer.

- 🪜 Start simple, then build. A savings account teaches holding period return. A mutual fund teaches time-weighted.

- 🧘 And most importantly… relax. You don’t need to master all of this at once. You just need to start.

🌱 Final Thought: Let Time and Math Work for You

Warren Buffett once said:

“The stock market is a device for transferring money from the impatient to the patient.”

Returns are your reward for patience. They’re how your money does the heavy lifting—so one day, you don’t have to.

🔔 Follow for More

If you found this helpful, follow along for more 3-minute guides that help you Relax to Rich—with calm, thoughtful investing.