Relax to Rich | Week 21 Recap (Ending May 23, 2025)

Investing doesn’t have to be stressful or complicated. With a long-term mindset grounded in value investing, and the prudent use of options to enhance returns or manage risk, you can grow your wealth steadily—without chasing hype or making impulsive moves.

Starting this week, I’ll be sharing a brief weekly recap of my personal portfolio, which I call Relax to Rich (R2R). The philosophy is simple: stay patient, focus on fundamentally strong assets, use options thoughtfully when the opportunity makes sense, and let time and compounding work in your favor.

I hope this weekly journey provides useful insights, encouragement, and maybe even a little inspiration for anyone looking to build wealth the calm, disciplined way.

📌Weekly Activity

• No stock trades this week

• Closed several Tesla call and put option positions

📈Performance Snapshot

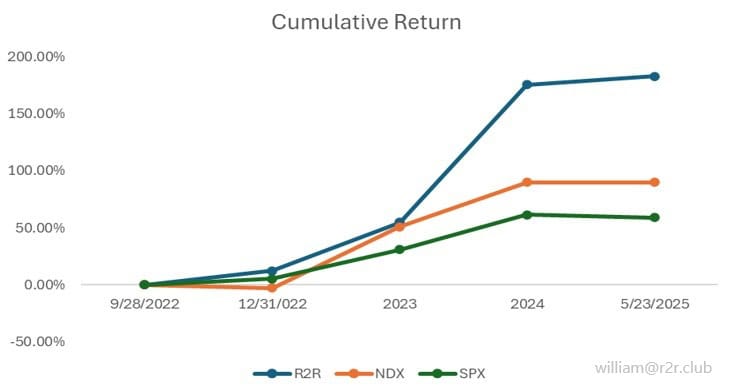

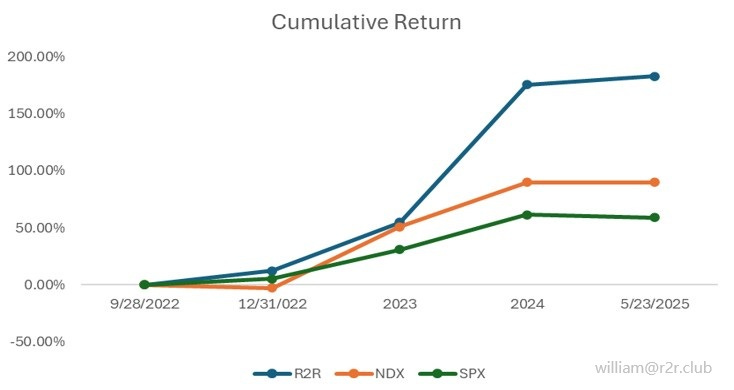

The investment returns from September 28, 2022, through May 23, 2025, are as follows:

Performance Comparison: R2R vs. NDX and SPX Over the Same Period

Note:

- The performance is measured using the Time-Weighted Return (TWR) method. All data is based on actual results from Interactive Brokers.

- R2R started on September 28, 2022, with an assumed initial net asset value (NAV) of 1. As of now, the NAV has grown to 2.83. This calculation is based on return rates provided by Interactive Brokers.

- NDX refers to the Nasdaq-100 Index.

- SPX refers to the S&P 500 Index.

📊 Current Portfolio Holdings

Note:

- Holding Weight = Portfolio Delta $ / Total Portfolio Delta $. Because prices move, this changes even without trading. Delta exposure includes stock + options like covered calls and cash-secured puts.

- “Portfolio Delta $” is a concept used in investment management, particularly when dealing with options. It represents the equivalent value of stocks purchased within a portfolio. If you’d like to learn more about this, please leave a message, and I will provide a special introduction.

- “Others” includes watchlist positions with very small individual weightings. These are primarily for monitoring and waiting for the right opportunity.

- Cash Equivalents refers to cash or cash-like assets used for liquidity and cash management purposes. If you’re interested in learning more, feel free to leave a comment—I’d be happy to share a detailed explanation.

- SPX options are used to hedge downside risk.

🔍 Key Events This Week

🚗 TESLA

1. Elon’s Commitment Elon Musk said he’ll stay CEO of Tesla for at least 5 more years, shifting his focus back to Tesla, xAI, and Optimus.

I think when Elon is all-in, it’s like having your smartest teammate fully focused on a group project. That’s great news for Tesla—and for shareholders like me.

2. Robotaxi Progress

- Internal use of driverless tech in Texas is already happening.

- Public ride-sharing service coming to Austin by June 2025.

- Filed trademarks for “Cybercab” and “Robotaxi”.

- U.S. Secretary of Transportation took a ride in a fully autonomous Tesla.

This marks a big new phase. Tesla wouldn’t start unless they’re ready, but some hiccups are expected early on.

3. Optimus Robot Tesla updated a video of its humanoid robot doing chores like taking out trash using AI trained on human videos.

If Optimus works, Tesla could go from a car company to a robotics giant. Still early, but exciting.

4. Corporate Governance

- Jack Hartung (ex-CFO of Chipotle) joins Tesla’s board.

- Shareholder lawsuit threshold raised to 3% of shares (~$34B).

Honestly, it feels like they want to keep Elon focused—and I get it. Elon matters a lot to Tesla’s future. His compensation package is a big part of that conversation, and making sure he stays fully committed to Tesla seems to be the goal here.

5. Global Expansion

- U.S.–China agreed to ease EV tariffs. Tesla resumed importing key parts.

- Exploring land in India for local assembly.

Great strategic moves. Helps supply chain and opens a massive new market.

6. European Sales + Protests

- Sales dropped, with protests (#TeslaTakedown) on May 23–24.

These are short-term distractions. Long-term, Tesla’s innovation and growth matter more.

💹 QQQ / Nasdaq 100

1. Tariff Concerns

- Trump proposed new tariffs (50% on EU goods, 25% on non-U.S. iPhones) starting June 1.

This adds market stress but raises options premiums. Short-term negative, long-term manageable.

2. U.S. Credit Downgrade

- Moody’s downgraded the U.S. credit rating to Aa1.

- Bond yields jumped: 10Y at 4.6%, 30Y at 5.08%, triggering a sell-off.

3. Index Update

- Shopify replaced MongoDB in the Nasdaq-100 (May 19).

Shows Shopify’s growing influence in tech.

🎮 TENCENT

1. Strong Q1 Earnings

- Revenue: ¥180B (~$25.1B), up 13% YoY

- Net Profit: ¥47.8B (~$6.7B), up 14% YoY

- Gaming revenue up 24% (domestic) and 23% (international)

- AI investment up 91% to ¥27.5B

Tencent is investing smartly for long-term growth. I’ll share a full Q1 breakdown later.

2. Share Buyback

- Repurchased over 900,000 shares daily for 5 days; 970,000 on May 23.

Strong sign of management confidence.

3. Strategic AI + Gaming Moves

- Announced open-source AI gaming tools (e.g., Hunyuan-Game).

- Tencent Cloud teamed up with WeRide for robotaxi expansion.

With its huge user base and track record, Tencent could really surprise in AI.

🧠 NVIDIA

1. COMPUTEX 2025 Highlights CEO Jensen Huang announced major AI and data center innovations:

- NVLink Fusion: Lets companies build custom AI systems

- DGX Spark/Station: Personal AI supercomputers

- DGX Cloud Lepton: GPU marketplace

- RTX PRO Servers: AI-optimized enterprise servers

- Industrial AI + Robotics: Digital twins for factories (TSMC, Foxconn)

- Quantum Computing: Global R&D hub launched for quantum AI

NVIDIA’s innovation streak is impressive. Their open ecosystem strategy is smart. Still, the China chip restrictions ($5.5B hit) are a concern. I’m bullish going into Q1 earnings on May 28, but I’ll be watching geopolitical risks closely.

⚠️Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.