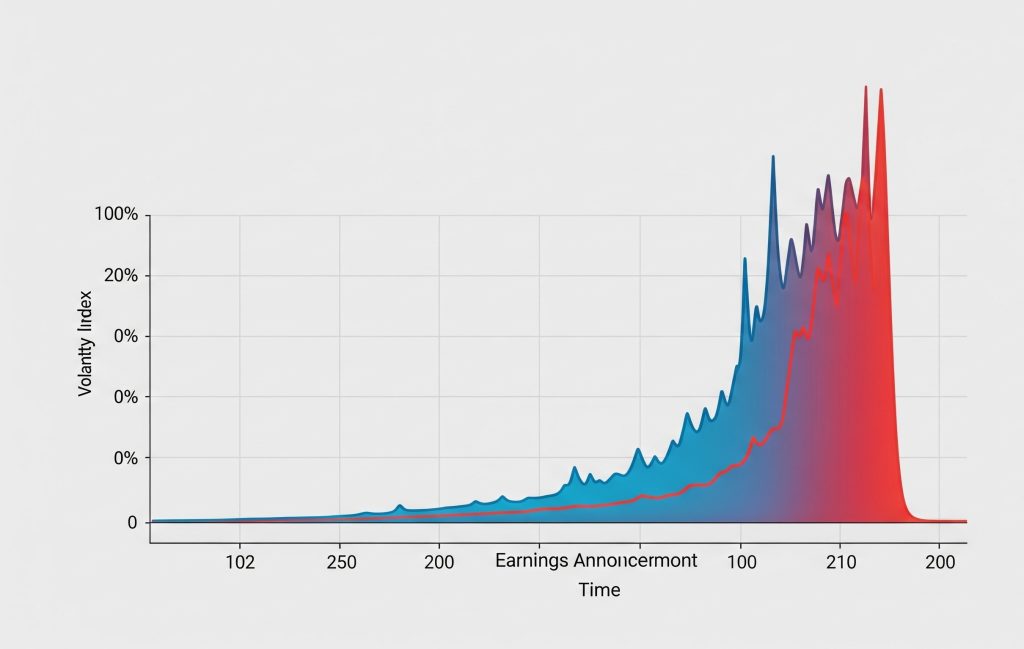

When a company is about to report earnings, everyone on Wall Street gets a little nervous or excited — or both. No one knows for sure whether the company will beat expectations, disappoint, or drop a surprise. This uncertainty drives up demand for options, which are contracts that let investors bet on big price moves — or protect against them.

This demand inflates something called implied volatility (IV).

What is Implied Volatility?

Think of IV as the market’s forecast of how much a stock might move in the future. It doesn’t predict direction (up or down) — just how much. High IV means the market expects a big move. Low IV means the market expects calm waters.

Earnings = IV Spike

Before earnings:

- Speculators buy options hoping to profit from a big move.

- Hedgers buy options to protect against losses.

This flood of demand for calls and puts pushes up IV, making option prices expensive.

What Happens After Earnings?

Once the report is out, the mystery is gone. IV typically drops sharply — this is called the “IV crush.”

Even if the stock moves the way you expected, you might still lose money on your options trade if the actual move isn’t big enough to justify the high premium you paid.

🔍 Example: You buy a call option before earnings because you think the stock will go up. Earnings beat expectations, and the stock rises 3%. But you lose money on the option because the market had priced in a 7% move. That’s IV crush in action.

Why This Matters to You

If you’re trading options around earnings:

- Be aware of inflated IV.

- Know that you’re not just betting on direction, but also on magnitude.

- Consider strategies like selling options (if experienced) to take advantage of the high premiums.

- Or wait until after earnings, when prices may be more reasonable.

Final Takeaway

Before earnings, options get expensive because fear, hope, and uncertainty drive up implied volatility. It’s not just what the company reports — it’s how big the move is versus what the market already expected.

📈 So don’t just ask: “Will the stock go up?”

Also ask: “Will it go up enough to beat the IV?”

That’s how smart investors think about earnings season.

Here is the Podcast for this topic:

IV Crush_ Navigating the Most Dangerous Time for Options Traders During Earnings Season – R2R Club