Relax to Rich | Week 27 Recap (Ending July 3, 2025)

💡 Investing Doesn’t Have to Be Complicated

Hi friends,

Welcome back to our weekly check-in at Relax to Rich, where we work on growing wealth with clarity and calm.

This week came with some market whiplash and political headlines, especially for Tesla. My portfolio pulled back a bit, largely from Tesla’s slide, but my approach remains unchanged. I don’t let a week of noise dictate a lifetime strategy.

My year-to-date return ticked down slightly to 2.68% (from 2.89% last week), though lagging the Nasdaq 100’s AI-fueled run. My SPX puts continue to provide portfolio insurance—smoothing the ride even when markets shake.

📌 Weekly Activity

No new positions this week, but I did manage risk by rolling SPX and QQQ calls and trimming some TSM puts. It’s all about controlling cash flow and staying balanced.

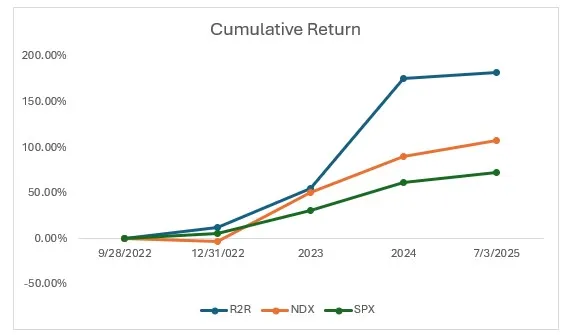

📈 Performance Snapshot

(From Sept 28, 2022, through July 3, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 7/11/2025 | 2.68% | 9.26% | 6.76% | 2.83 | 0.49 |

| Total Return | 182.78% | 107.60% | 72.17% | | 2.75 |

| Annualized Return | 45.70% | 30.28% | 21.74% | | |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV: 2.83.

💼 Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 315.35 | -21.91% |

| 2 | QQQ | 12% | 5546.22 | 8.80% |

| 3 | Tencent (700.HK) | 15% | HKD 496.80 | 19.14% |

| 4 | Nvidia (NVDA) | 3% | 159.34 | 18.65% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -48% | 6279.35 | 6.76% |

💬 Weight includes delta-adjusted stock + options exposure.

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

🔍 Key Events This Week

🚗 Tesla (TSLA)

📌 1. Q2 2025 Production and Delivery Results

Tesla reported Q2 2025 production of 410,244 vehicles and deliveries of 384,122 vehicles. This represents a 13.5% decline in deliveries compared to the same quarter last year. The Model 3 and Model Y accounted for 373,728 of the deliveries, while other models (including Cybertruck, Model S, and Model X) made up 10,394 units. Tesla will release its full Q2 financial results on July 23, 2025.

👉 My Take:

The year-over-year drop in deliveries signals ongoing demand challenges and intensifying competition, especially in key markets like Europe and China. While production levels held steady, the delivery shortfall could impact revenue and margins. The upcoming earnings call will be important for understanding management’s outlook and any planned adjustments to strategy.

📌 2. Launch of Oasis Solar-Powered Supercharger in California

On July 3, Tesla inaugurated the first “Oasis” Supercharger—a solar-powered, off-grid charging station at Lost Hills, CA featuring 168 stalls, an 11 MW solar array, and 10 Megapacks totaling 39 MWh.

👉 My Take:

This project showcases Tesla’s commitment to integrating renewable infrastructure into charging. It adds resilience and PR value. For the investment thesis, scalability is key—if replicable, it strengthens Tesla’s infrastructure moat and could improve energy cost control. But I’ll monitor capital intensity versus network benefits.

📌 3. Elon Musk–Donald Trump Feud Escalates Over Spending Bill

Between June 28 and July 1, Elon Musk publicly criticized former President Trump’s proposed “One Big Beautiful Bill,” calling it “insane and destructive” to the U.S. economy. In response, Trump threatened to revoke federal subsidies for Musk’s companies (including Tesla and SpaceX), hinted at examining Musk’s citizenship status, and suggested he could target DOGE-related ventures. Musk escalated further by announcing plans to form a new political group called the “America Party,” pledging to oppose lawmakers backing Trump’s bill. Tesla stock dropped approximately 5.3% following the public clash.

👉 My Take:

This feud adds a new layer of political risk to Tesla’s outlook. Musk’s break from Trump—once a political ally—could strain Tesla’s access to federal support, subsidies, and regulatory goodwill. The market reaction shows investor concern about potential retaliation affecting Tesla or its sister ventures. Musk’s shift into overt political activism may also distract management focus and heighten volatility in the near term. For now, I’m closely watching whether this confrontation triggers any concrete legislative or regulatory changes that affect Tesla’s operations or cost structure.

🌐 QQQ

📌 1. Nasdaq 100 Index Reaches Record High

The Nasdaq 100 Index closed at 22,641.89 on July 2, 2025, up from 22,534.20 on June 27, 2025, reflecting a weekly gain of approximately 0.5%. The index reached new record highs during the week, supported by strong performances from major technology companies. The broader Nasdaq Composite also closed at a record high of 20,393.13 on July 3, 2025.

👉 My Take:

The index’s new highs suggest continued strength in large-cap technology stocks, which remain the primary drivers of the Nasdaq 100. This performance reinforces the index’s positioning as a leader in the U.S. equity market, but also highlights its concentration risk. Sustained gains may depend on ongoing earnings growth and the ability of tech leaders to maintain their competitive edge.

📌 2. Mixed Sector Performance Amid Tariff and Economic Data

During the week ending July 4, 2025, the Nasdaq 100 saw varied sector performance. Technology and communication services led gains, with semiconductors (e.g., Nvidia, AMD) and consumer discretionary (e.g., Amazon) outperforming. Healthcare and consumer staples lagged, as reported by Nasdaq’s May 2025 review, with similar trends continuing into early July. Market sentiment was influenced by de-escalating U.S.-China tariff tensions and a strong March jobs report, though consumer confidence remained low. The CBOE Nasdaq-100 Volatility Index (VXN) stayed elevated, indicating ongoing market uncertainty.

👉 My Take:

The divergence in sector performance highlights the Nasdaq 100’s dependence on technology and communication services, which account for over 55% of the index’s weight. Strong semiconductor and consumer discretionary performance aligns with AI-driven growth and resilient consumer spending, but lagging healthcare and staples sectors suggest investor caution amid macroeconomic uncertainties, such as tariff impacts and rising Treasury yields. The elevated VXN reflects market sensitivity to external shocks, which could affect the index’s stability if economic data (e.g., upcoming nonfarm payrolls) or trade policies shift unexpectedly. The index’s exposure to high-growth sectors supports its long-term growth thesis, but short-term risks from uneven sector performance and macroeconomic headwinds may test its resilience.

🐉 Tencent (700.HK)

📌 1. Consistent and Significant Share Repurchases

Tencent continued its program of daily share repurchases on the Hong Kong Stock Exchange. On July 4, 2025, the company repurchased 1.007 million shares for approximately HK$500 million. This follows a pattern of daily buybacks. Since the current mandate was approved by shareholders on May 14, 2025, Tencent has cumulatively repurchased over 33.46 million shares.

👉 My Take:

The aggressive and consistent share buyback program is a significant use of the company’s capital. This action reduces the number of outstanding shares, which can have an accretive effect on earnings per share. From an analytical standpoint, it signals management’s confidence in the company’s current valuation and future prospects. It provides a degree of support for the share price, but the primary focus remains on the fundamental performance of the company’s core business segments for long-term value creation.

💻 NVIDIA (NVDA)

📌 1. NVIDIA Announces GeForce NOW Summer Sale and New Game Titles

On July 3, 2025, NVIDIA announced a 40% discount on six-month GeForce NOW Performance memberships as part of its Summer Sale. The company also highlighted six new games available for streaming on GeForce NOW, including Figment and Little Nightmares II, with RTX-powered performance. The announcement emphasized low-latency streaming and compatibility with devices like Steam Deck, supporting over 2,200 games.

👉 My Take:

The GeForce NOW Summer Sale and new game additions strengthen NVIDIA’s position in the cloud gaming market, a segment with growing demand as gaming shifts toward streaming platforms. The 40% discount could drive user acquisition and retention, potentially increasing recurring revenue from subscriptions, though the financial impact may be modest compared to NVIDIA’s core AI and GPU businesses. Expanding GeForce NOW’s library and device compatibility enhances its competitive edge against rivals like Xbox Cloud Gaming and Amazon Luna. However, cloud gaming remains a small part of NVIDIA’s revenue, and its contribution to overall valuation is limited. The focus on RTX-powered streaming aligns with NVIDIA’s broader strategy to leverage its GPU technology across multiple sectors, supporting long-term growth prospects in diversified applications.

📌 2. NVIDIA Highlights AI and Cloud Gaming at London Tech Week

On July 2, 2025, NVIDIA’s newsroom reported CEO Jensen Huang’s participation in London Tech Week, where he discussed new partnerships with German Chancellor Friedrich Merz. The event emphasized NVIDIA’s advancements in AI and cloud gaming, including a 40% discount on GeForce NOW Performance Day Passes for premium cloud gaming with RTX ON. The announcement highlighted NVIDIA’s role in driving AI and gaming innovation in Europe.

👉 My Take:

Huang’s high-profile engagement at London Tech Week reinforces NVIDIA’s leadership in AI and gaming, key pillars of its investment thesis. The focus on European partnerships could open new markets for NVIDIA’s AI infrastructure and cloud gaming services, particularly in enterprise and public sectors. The GeForce NOW discount aligns with efforts to scale its cloud gaming user base, though its revenue impact is likely secondary to NVIDIA’s data center and AI chip segments, which accounted for 87% of Q2 2025 revenue. Strengthening NVIDIA’s European presence may mitigate risks from U.S.-China trade tensions and diversify its geographic revenue streams. However, the lack of specific partnership details limits visibility into their potential scale and impact on valuation or market positioning.

📌 3. NVIDIA Stock Performance and Market Sentiment

NVIDIA’s stock rose 3.8% intraday on June 25, 2025, reaching a record high, as reported on X. The gain was partly driven by a bullish analyst report and CEO Jensen Huang’s comments on CNBC, emphasizing AI and robotics as NVIDIA’s largest growth opportunities. The stock’s performance contributed to NVIDIA’s market capitalization surpassing Microsoft’s, making it the largest by market cap among tech giants.

👉 My Take:

The 3.8% stock gain reflects strong market confidence in NVIDIA’s AI and robotics growth narrative, which underpins its premium valuation with a forward P/E ratio above 40. Huang’s emphasis on AI and robotics aligns with NVIDIA’s strategic shift toward diversified revenue streams beyond traditional GPUs, with data center revenue growing 154% year-over-year in Q2 2025. The record market cap highlights NVIDIA’s dominance in the AI chip market, but it also raises concerns about valuation sustainability given competitive pressures from AMD and emerging AI models like DeepSeek’s, which require less computing power. The bullish analyst sentiment supports NVIDIA’s long-term growth prospects, but short-term volatility could arise from macroeconomic factors like potential U.S. tariffs on semiconductors or shifts in AI infrastructure spending.

📌 4. NVIDIA Supports Gemma 3n and Advances AI Model Deployment

On July 2, 2025, NVIDIA announced support for the general availability of Gemma 3n on NVIDIA RTX and Jetson platforms. Gemma, previewed by Google DeepMind, includes two new models optimized for multi-modal, on-device AI deployment. The announcement was part of NVIDIA’s broader push to enable developers to prototype and deploy large AI models on desktops and edge devices.

👉 My Take:

NVIDIA’s support for Gemma 3n enhances its ecosystem for on-device AI, a growing segment as enterprises and developers seek localized AI solutions. By integrating Gemma with RTX and Jetson platforms, NVIDIA strengthens its value proposition for edge computing, which could drive demand for its professional and consumer GPUs. This move supports NVIDIA’s investment thesis of leading the AI infrastructure market, particularly in edge-to-cloud computing, where it holds a 98% share in data center GPUs. However, the financial impact of on-device AI deployments may be gradual, as enterprise adoption scales. Competition from open-source AI models and alternative hardware providers like AMD could challenge NVIDIA’s margins in this segment. The focus on developer enablement positions NVIDIA for long-term growth in AI applications, though near-term valuation will likely remain driven by data center GPU demand.

That’s all for this week. Until next time—stay invested, stay relaxed.

—William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

⚠️ Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.