Relax to Rich | Week 26 Recap (Ending June 27, 2025)

💡 Investing Doesn’t Have to Be Complicated

Hey everyone,

Welcome to our weekly chat where we focus on building wealth without the stress.

This week was definitely a busy one, with some big headlines stirring up the market, especially around my biggest holding, Tesla. My portfolio had a positive week, with my year-to-date return climbing to 4.92% from 3.01% last week.

You might notice this didn’t quite keep pace with the roaring Nasdaq 100, and that’s by design. A core part of my strategy involves using SPX options as insurance against a market downturn. When the market rallies strongly like it did this week, that hedge naturally erodes some of my unrealized profit. It’s a trade-off I’m perfectly happy with. It allows my portfolio to capture solid returns—right in line with the S&P 500—while having significant downside protection already in place. My strategy remains unchanged: stay patient, focus on high-quality assets, and use options wisely to manage risk.

📌 Weekly Activity

I didn’t buy or sell any stock this week. Instead, I focused on managing my current positions, closing out some Tesla puts and rolling my NVIDIA and QQQ calls to keep risk in check and manage cash flow.

📈 Performance Snapshot

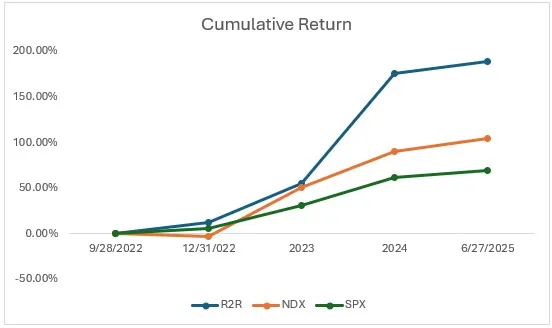

(From Sept 28, 2022, through June 27, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 7/11/2025 | 4.92 | 7.65% | 4.96% | 2.89 | 0.49 |

| Total Return | 188.94% | 104.54% | 69.28% | | 2.75 |

| Annualized Return | 47.18% | 29.78% | 21.13% | | |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV: 2.89

💼 Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 41% | 323.63 | -19.86% |

| 2 | QQQ | 14% | 548.09 | 7.21% |

| 3 | Tencent (700.HK) | 15% | HKD 513.00 | 23.02% |

| 4 | Nvidia (NVDA) | 3% | 157.75 | 17.47% |

| 5 | Others | 6% | | |

| 6 | Cash Equivalents | 21% | | |

| 7 | SPX | -47% | 6173.07 | 4.96% |

💬 Weight includes delta-adjusted stock + options exposure.

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

🔍 Key Events This Week

🚗 Tesla (TSLA)

📌 1. Robotaxi Service Launches in Austin

On June 22, Tesla started a small robotaxi service in Austin with 10-20 Model Ys. These cars are using the latest self-driving software but still have a human safety monitor in the passenger seat.

👉 My Take:

It’s exciting to see the robotaxi idea become a reality, as self-driving is a huge part of Tesla’s long-term story. The market got excited too, pushing the stock up 8% on Monday. However, regulators are already asking questions after some videos showed the cars driving weirdly, and there was a safety incident reported. It’s a reminder that this is just the beginning of a long road, and we’re not at full, driverless autonomy just yet.

📌 2. June Deliveries Expected to Decline

On Friday, reports came out that Tesla’s June deliveries are expected to be down 17% from last year, with around 370,000 cars delivered. This comes after a 13% sales drop last quarter. The decline is being blamed on more competition, brand image issues, and possible cuts to EV credits in Europe.

👉 My Take:

The drop in deliveries shows that Tesla is facing real challenges in its main business of selling cars. Competitors are catching up, especially in big markets like Europe and China, and that’s eating into Tesla’s market share. While the company has plenty of cash to handle this, a continued slump in sales could make investors question its high valuation in short term, which is built on expectations of fast growth.

📌 3. First Fully Autonomous Delivery Completed

On a positive note, Tesla announced on Friday that it completed its first fully autonomous delivery. A Model Y drove itself from the Texas Gigafactory to a customer’s home about 30 minutes away.

👉 My Take:

This is a cool milestone that shows the self-driving tech is making real progress, which helps build confidence in Tesla’s AI story. While one delivery doesn’t change the company’s bottom line, it’s a great proof of concept. It reinforces the long-term vision, even if it doesn’t solve the immediate sales challenges.

🌐 QQQ

📌 1. The NASDAQ 100 had a great week, hitting a new record high and closing around 22,534.

👉 My Take:

The market is clearly feeling confident in big tech right now, with money pouring into companies leading the way in AI. This was helped by falling oil prices, which eased inflation fears, and economic data that, while mixed, kept hopes alive for a future interest rate cut from the Fed.

🐉 Tencent (700.HK)

📌 1. New Game Approval in China

Tencent got a new domestic game approved by Chinese regulators this month. The government has been approving games at a much more regular pace lately, which is great to see.

👉 My Take:

Gaming is the engine of Tencent’s business, making up a huge chunk of its income, so consistent game approvals are crucial. This signals a more stable regulatory environment, which is a big relief for investors.

📌2. Turning Mobile Games into WeChat Mini Games

Tencent is starting to convert popular mobile games, like Brawl Stars from its subsidiary Supercell, into mini-games that can be played right inside the WeChat app.

👉 My Take:

This is a smart move to tap into WeChat’s massive 1.4 billion user base. It makes it easier for people to play and spend money on games, strengthening Tencent’s ecosystem where it has a big advantage over competitors.

💻 NVIDIA (NVDA)

📌 1. Annual Shareholder Meeting

NVIDIA held its annual shareholder meeting online this week. The stock also hit a new record high, closing at about $151.85 on Wednesday.

👉 My Take:

While the meeting itself was pretty standard, the stock hitting an all-time high shows the market’s incredible confidence in NVIDIA’s AI leadership.

📌 2. Expanding AI on Devices

On Thursday, NVIDIA announced support for Google’s new Gemma 3n AI model on its RTX and Jetson platforms, which are used for on-device AI.

👉 My Take:

This helps strengthen NVIDIA’s position beyond its huge data center business and into the growing world of “edge computing” on personal devices. It’s a smaller part of their revenue now, but it’s an important area for future growth.

📌3. New Games on GeForce NOW

NVIDIA added more games, like Dune: Awakening, to its GeForce NOW cloud gaming service and offered a summer discount on memberships.

👉 My Take:

Even though cloud gaming is a small slice of NVIDIA’s business compared to its massive data center sales, these updates help keep subscribers happy and support recurring revenue. It shows they are still committed to the gaming segment

That’s all for this week. Until next time—stay invested, stay relaxed.

—William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

⚠️ Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.