Relax to Rich | Week 29 Recap (Ending July 18, 2025)

🧘 Investing Doesn’t Have to Be Complicated

Hi friends,

At R2R, we keep things simple—and powerful. Our philosophy is grounded in timeless investing principles:

-

Stay patient

-

Focus on high-quality assets

-

Use options with purpose

-

Let time and compounding do the heavy lifting

Every week, I share the journey—my trades, how I manage risk, key market headlines, and the lessons learned. If your goal is to build wealth with calm confidence, you’re in the right place.

This week was all about balance—managing risk, refining execution, and tuning out the noise. Tesla’s long-term thesis remains firmly rooted in autonomy and innovation. NVIDIA continues to ride strong AI tailwinds. Tencent’s AI ambition only strengthens my conviction.

Weekly Activity

Weekly Activity

No new stock trades this week. Instead, I focused on risk management:

-

Rolled NVDA and QQQ calls

-

Closed some QQQ puts

It’s all about controlling cash flow and staying balanced.

Performance Snapshot

Performance Snapshot

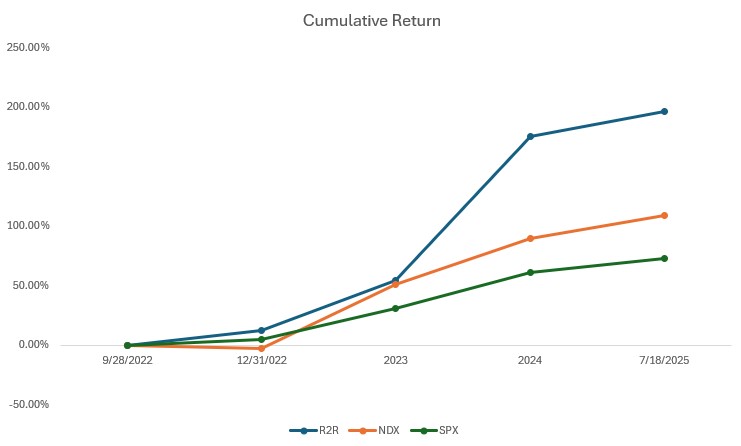

(From Sept 28, 2022, through July 18, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 7/18/2025 | 7.8% | 10.21% | 7.06% | 2.97 | 0.55 |

| Total Return | 196.87% | 109.41% | 72.64% | 2.80 | |

| Annualized Return | 47.44% | 30.18% | 21.51% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV: 2.97

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 41% | 329.65 | -18.37% |

| 2 | QQQ | 11% | 561.26 | 9.79% |

| 3 | Tencent (700.HK) | 16% | HKD 519.00 | 24.46% |

| 4 | Nvidia (NVDA) | 3% | 172.41 | 28.39% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 22% | ||

| 7 | SPX | -53% | 6296.79 | 7.06% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. In-Car Artificial Intelligence Integration

1. In-Car Artificial Intelligence Integration

On July 12, 2025, Tesla began rolling out a major software update (2025.26) that integrates a beta version of ‘Grok’, a conversational AI developed by Elon Musk’s xAI startup. The feature is available in new vehicles and as an over-the-air update for existing models with the AMD infotainment processor. The AI can be activated via the App Launcher or a long-press of the voice command button on the steering wheel. Currently, Grok functions as a chat-style assistant and does not have the ability to control vehicle functions like climate or navigation, which remain separate.

My Take:

My Take:

The integration of Grok is a tangible step in creating a more software-defined vehicle and leveraging synergies between the Elon’s companies. While its current utility is limited to conversation, it lays the groundwork for a more advanced in-car AI assistant. This development is less about immediate functionality and more about the long-term narrative that Tesla is an AI company, not just a car manufacturer. The ability to collect data and refine the AI based on real-world user interaction is a significant asset. The key metric to watch will be the speed at which Grok’s capabilities expand to include vehicle command and control, which would be a true differentiator in the user experience.

2. Opening of First Showroom in India

2. Opening of First Showroom in India

Tesla opened its first showroom in Mumbai, India, on July 15, 2025.finance.yahoo.com Tesla India shared a video of the Model Y in Mumbai on July 19, 2025.

My Take:

My Take:

Entering the Indian market could diversify revenue streams beyond established regions like China and the US, potentially supporting the thesis of global EV adoption. However, high import taxes at 70% may limit initial volumes, impacting short-term valuation while testing long-term positioning in emerging economies. Growth prospects hinge on local manufacturing to reduce costs and scale.

NVIDIA (NVDA)

NVIDIA (NVDA)

1.Chip Sales Resumption to China

1.Chip Sales Resumption to China

On Tuesday, July 15, NVIDIA announced it had received assurances from the White House that it could resume shipments of its H20 Artificial Intelligence (AI) chips to customers in China. The company stated it was filing for the necessary licenses with the expectation of approval. This development reverses a previous restriction on these sales. The announcement coincided with CEO Jensen Huang’s visit to China for the China International Supply Chain Expo

My Take:

My Take:

This is a significant development from a market access perspective. The China market, despite US restrictions, remains a substantial source of demand for AI hardware. Gaining clearance to sell the H20 chip, which was specifically designed to comply with US export rules, removes a key geopolitical overhang and re-opens a revenue stream that had been closed. This adds a degree of predictability to the company’s data center revenue forecast and mitigates the risk of ceding the entire compliant-chip market in China to local competitors. The core investment thesis is heavily tied to the total addressable market for AI, and this week, that market effectively expanded.

That’s a wrap for Week 29.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.