Intrinsic Value Is a Range, Not a Number—Here’s Why That Matters

When most people hear “intrinsic value,” they imagine a precise number—something like, “This stock is worth exactly $87.42.” But smart investors like Warren Buffett know that’s not how it works.

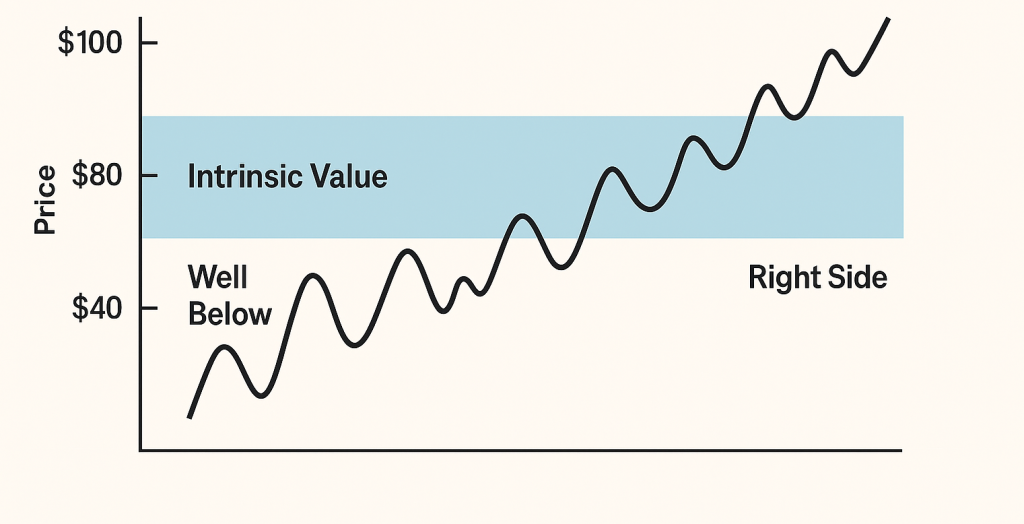

Intrinsic value is always a range, not a point. Why? Because the future is uncertain. Even the best analysis involves assumptions—about growth, margins, interest rates, and more. Small changes in those inputs can shift your estimate by 10%, 20%, or more.

Think of It Like Buying a House

Imagine you’re shopping for a house. Based on its location, condition, and recent sales nearby, you estimate it’s worth somewhere between $450,000 and $500,000. Would you insist on buying only if it were exactly $473,215? Of course not. You’d act if the price were well below your estimated range—say $400,000—and walk away if it were $520,000.

The same logic applies to stocks.

What’s the “Right Side” of Value?

Let’s say your fair value range for a company is $80 to $100 per share. The midpoint is $90. For me, the “right side” means when the market price is around 50% or more below that midpoint—in this case, around $45 or less.

At that level, the odds are in your favor. You’re buying at a steep discount with built-in protection against mistakes in your assumptions. This is your margin of safety.

On the other hand, if the stock is trading at $95 or $100? You’re at the top end of the range—little room for error, limited upside.

Why This Matters

Many investors lose money because they treat value as exact and markets as rational. They wait for the “perfect” price or chase stocks far above their fair value. But if you remember that value is a range, you can focus on what matters: acting decisively when price and value are mismatched.

As Charlie Munger put it: “It’s better to be approximately right than precisely wrong.”

Key Takeaway:

Don’t get hung up on a single number. Estimate a reasonable value range, and be ready to act only when the market gives you a clear bargain—preferably 50% or more below the midpoint of your range. That’s the right side of value.