This is a real, live portfolio—actively managed and fully transparent. All data comes directly from Brokers and can be independently verified

Relax to Rich | Week 31 Recap (Ending August 1, 2025)

Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

This week, the market pulled back—but I wasn’t surprised. I actually posted an early-week reflection asking, Is This the Market Peak? based on 100 years of P/E ratio trends.

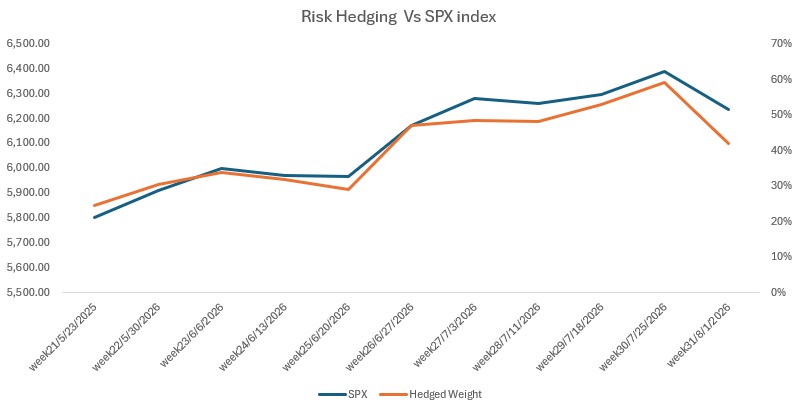

The drawdown didn’t hit me too hard, thanks to consistent hedging. At peak, I had nearly 60% of the portfolio hedged—and with 20% in cash equivalents, that means about 75% of my exposure was protected. That’s what I call investing intentionally.

Even though TSLA is down 25% YTD and makes up 40%+ of my holdings, I remain confident. This is a pivotal moment—where Tesla begins its transition from automaker to AI platform. I believe FSD will succeed; it’s just a matter of when—one year, maybe three. Volatility in the meantime doesn’t shake my conviction.

Weekly Activity

Weekly Activity

No new stock trades this week. I focused on risk management:

-

✅ Rolled several NVDA call options

It’s not about being busy—it’s about being intentional. Options are not just income tools; they’re levers for stability.

Performance Snapshot

Performance Snapshot

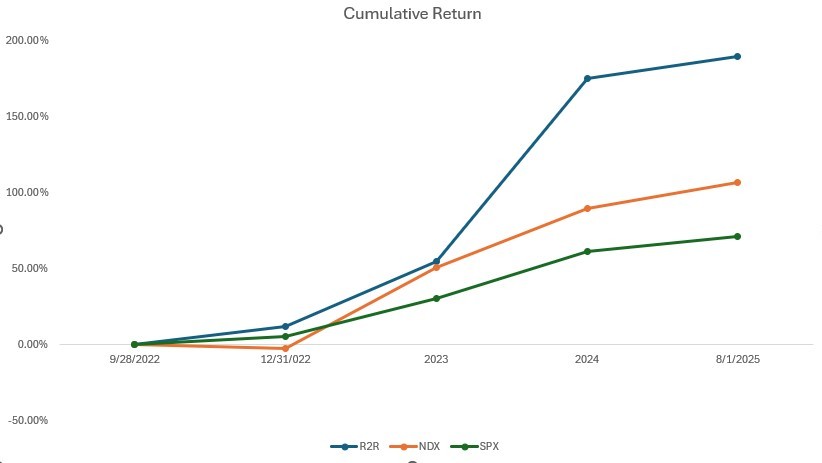

(From Sept 28, 2022, through August 1, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 8/1/2025 | 5.3% | 8.79% | 6.06% | 2.90 | 0.58 |

| Total Return | 189.98% | 106.70% | 71.03% | 2.84 | |

| Annualized Return | 45.46% | 29.12% | 20.79% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV: 2.90

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 42% | 302.63 | -25.06% |

| 2 | QQQ | 13% | 553.88 | 8.34% |

| 3 | Tencent (700.HK) | 16% | HKD 535.00 | 28.03% |

| 4 | Nvidia (NVDA) | 3% | 173.72 | 29.236% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 20% | ||

| 7 | SPX | -42% | 6238.01 | 6.06% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. Proposed Regulatory Framework for Autonomous Driving

1. Proposed Regulatory Framework for Autonomous Driving

On Wednesday, July 30, 2025, the U.S. National Highway Traffic Safety Administration (NHTSA) and the European Union Aviation Safety Agency (EASA) jointly published a proposed regulatory framework for Level 3 autonomous driving systems. The draft outlines requirements for system hardware redundancy, fail-safe operational modes, driver monitoring systems, and the defined conditions under which the system can operate, known as the Operational Design Domain (ODD). The document is open for public comment for the next 90 days.

My Take:

My Take:

The introduction of a formal regulatory path is a double-edged sword. On one hand, it reduces the long-term uncertainty that has surrounded the commercialization of autonomous technology. A clear set of rules provides a defined target for our engineering teams. On the other hand, the specific requirements outlined could necessitate changes to our current hardware and software architecture. The key variables for the investment thesis are the potential costs and timeline associated with meeting these proposed global standards. This development will directly influence the valuation models for the autonomy and robotaxi segments of the business.

2. Robotaxi Service Expansion to Bay Area

2. Robotaxi Service Expansion to Bay Area

On July 31, 2025, Tesla expanded its ride-hailing service, branded as Robotaxi, to the San Francisco Bay Area, operating with human safety drivers due to lack of permits for fully autonomous operation.

My Take:

My Take:

The expansion supports the investment thesis emphasizing Tesla’s ambition in autonomous mobility, which could diversify revenue beyond vehicle sales. It may influence valuation by providing real-world data to refine software, but regulatory hurdles could delay full autonomy, affecting market positioning against competitors in ride-sharing. This step might bolster future growth if it accelerates adoption and network effects in urban areas.

3. Jury Verdict in Autopilot Crash Case

3. Jury Verdict in Autopilot Crash Case

On August 1, 2025, a Miami jury found Tesla 33% liable for a fatal 2019 crash in Key Largo, Florida, involving a Model S on Enhanced Autopilot, awarding $329 million in total damages ($129 million compensatory and $200 million punitive), with Tesla responsible for approximately $243 million. Tesla stated it plans to appeal the decision

My Take:

My Take:

This ruling challenges the investment thesis by highlighting potential liabilities in Tesla’s driver-assistance technologies, which could increase legal costs and insurance premiums, impacting valuation through higher provisions for contingencies. It may weaken market positioning if it erodes consumer trust in Autopilot features, but an successful appeal or software improvements could mitigate effects on future growth in autonomous driving segments.

QQQ

QQQ

1. US-EU Trade Deal Announcement

1. US-EU Trade Deal Announcement

On July 27, 2025, President Donald Trump and European Commission President Ursula von der Leyen announced a trade deal imposing 15% tariffs on most European goods entering the US, with exemptions for aircraft, components, certain chemicals, and pharmaceuticals. The EU agreed to purchase $750 billion in US energy, invest an additional $600 billion in the US, and buy unspecified amounts of military equipment.

My Take:

My Take:

This deal fits into the investment thesis for the NASDAQ 100 by potentially benefiting US tech firms through increased EU investments and reduced tariff threats compared to higher proposed rates. It could support valuation by enhancing export opportunities for index components in energy and tech sectors, while strengthening market positioning against global trade uncertainties. However, the tariffs may raise costs for imported components, which could pressure future growth if supply chains adjust slowly.

🔭 Looking Ahead

-

My hedge is still strong: ~42% of the portfolio is delta-hedged with Options.

-

Tencent continues to quietly impress—its AI adoption and share buybacks are boosting conviction.

-

I still believe in Tesla. FSD is coming. It’s not if, but when. One year? Three? I’m staying the course.

That’s a wrap for Week 31.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.