Two Minutes Reading with the Masters of Investing 🕰️

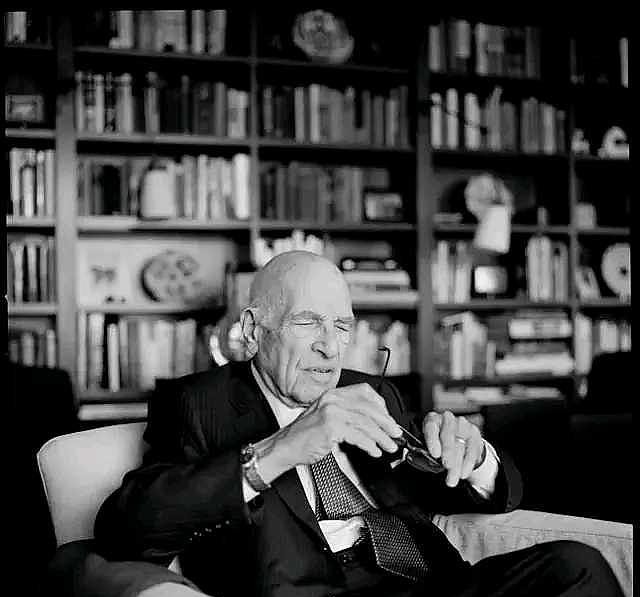

Most people think you need an Ivy League degree or insider tips to succeed in investing. Walter Schloss proved the opposite.

📖 His Story

-

No college degree. Learned investing in night school from Benjamin Graham.

-

Started his own partnership in 1956 with just $100,000.

-

Ran it for 47 years—quietly compounding wealth far above the market.

💡 His Method

-

Core belief: Buying a stock means buying part of a business.

-

His mindset: “Pay 40 cents for a dollar’s worth of value.”

-

Deep in the annual reports: not just screening numbers—he recalculated assets himself to strip out “water” and arrive at his own true book values.

-

Evolution of strategy: Early: Buy companies at ⅔ of net current asset value (classic Graham net-nets). Post-1960: Such bargains disappeared, so he turned to companies trading below tangible book value. Later: Bought stocks at ½ of book value, or if rare, at ⅔ of book value. In the end: Would buy even at book value, but almost never higher—unless the company had a true moat.

-

Diversified heavily—holding 100+ stocks at a time.

-

No rumors, no forecasts, just patient digging in balance sheets.

📈 The Results

-

47 years of 20.1% annual returns.

-

$10,000 → about $55 million.

-

Buffett called his method “cigar butt investing”: You find a discarded, soggy cigarette on the ground. It’s free, ugly, but still has one last puff of value. That puff is pure profit.

-

His fund stayed small (~$100–200 million) because “cigar butts” can’t absorb giant capital, so he returned cash to investors regularly.

-

And remember: Buffett himself started on this very path—picking cigar butts before evolving to buy wonderful businesses at fair prices.

✨ The Lesson

-

Schloss’s standards changed with the times, but one thing never changed: he only bought companies cheaper than their assets.

-

Even in the worst case—if the company went bankrupt—he asked: “How much value is left after liquidation?”

-

He proved: You don’t need Wall Street connections. You don’t need an MBA. You need patience, discipline, and the courage to trust numbers over noise.

🌱 Why It Matters to You

Schloss showed that an ordinary person—with no degree, no insider network—could become a superinvestor. If he could do it, so can you.

💡 Everyone can be rich—if you buy value with a margin of safety, diversify, and let compounding do the work.

🔔 Join the Relax to Rich Club: Don’t chase. Don’t panic. Buy value, hold patiently, and let time be your ally.

✨ Follow me for more simple, smart investing strategy.