Ever look at a stock and think, “The numbers look amazing, but something just feels… off?”

Or maybe the opposite: “This stock looks pricey, but I know it’s going to be huge.”

That feeling is the tension between the two most powerful parts of your investing brain. And learning to use both is the secret to long-term success.

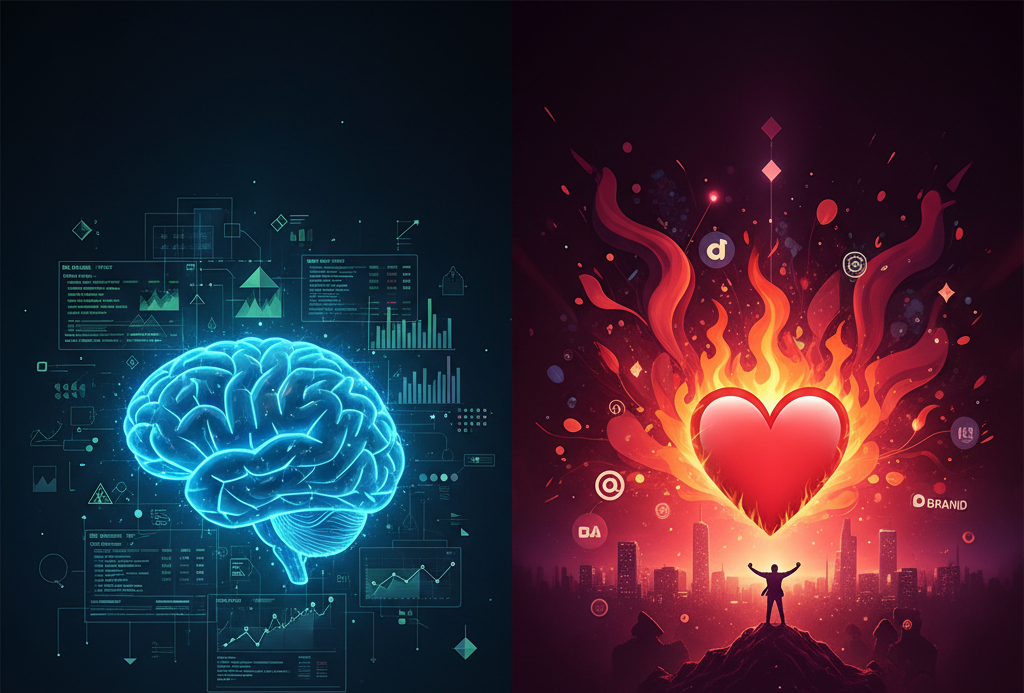

Meet Your Two Inner Investors 🧠 vs. ❤️🔥

Think of it like having two advisors in your head.

1. The Analyst Brain (Explicit Conviction) 🧠

This is your logical side. It loves spreadsheets, data, and hard facts.

It asks questions like:

-

Is the company profitable?

-

Is the stock cheap compared to its earnings?

-

What is its market share?

This is the “book smarts” of investing. It’s crucial for avoiding bad deals and finding solid, undervalued companies.

2. The Gut Feeling (Implicit Conviction) ❤️🔥

This is your intuition. It’s a deeper, more holistic sense of a company’s quality.

It doesn’t show up on a spreadsheet. It’s the feeling you get about:

-

A company’s mission and culture.

-

The loyalty of its customers (think Apple or Tesla fans).

-

The genius of its founder.

This is the “street smarts” of investing. It helps you spot the truly great, world-changing companies before everyone else does.

Why You Need Both

Relying on just one is a recipe for disaster.

-

All Brain, No Gut: You might buy a statistically cheap company that has a toxic culture and is slowly becoming irrelevant. You’ll miss the next big innovator because it looks too expensive on paper.

-

All Gut, No Brain: You might fall in love with a cool story stock that is burning through cash with no path to profitability. A great idea doesn’t always make a great investment.

The investing legends know this. Warren Buffett’s teacher, Benjamin Graham, was a master of the “Analyst Brain.” But Buffett’s biggest wins came when he combined those analytics with a deep, intuitive understanding of a business he felt was special, like GEICO or See’s Candies.

How to Use Both For Smarter Decisions

So, how do you put this into practice?

-

Start with the Brain: Always do your homework. Look at the numbers, understand the financials, and make sure it’s a healthy business.

-

Then, Check in With Your Gut: Ask yourself the big questions. Do I believe in this company’s future? Do I trust its leaders? Would I be proud to be a part-owner for the next 10 years?

When your brain and your gut both give you a green light, you’ve found something special. 🌟

What’s a time your gut and your brain disagreed on an investment? Share your story in the comments!

Follow me for more simple, smart investing strategy.

Join the Relax to Rich Club, where we grow wealth the calm, thoughtful way. ✨