Relax to Rich | Week 24 Recap (Ending June 13, 2025)

No hype. No panic. Just calm, thoughtful investing.

💡 Investing Doesn’t Have to Be Complicated

R2R is built on simple, time-tested principles: ✅ Stay patient ✅ Focus on high-quality assets ✅ Use options wisely ✅ Let time and compounding do the heavy lifting

Each week, I share what’s happening in my personal portfolio and how I’m responding—wins, losses, and lessons. If you’re here to grow wealth calmly and intentionally, you’re in the right place.

📌 Weekly Activity

No stock purchases or sales this week, but I stayed active on the options side:

- ✅ Closed and rolled QQQ puts and calls (ongoing hedging + income strategy)

- 🔁 Rolled TSM covered calls

No drama—just deliberate risk and cash flow management.

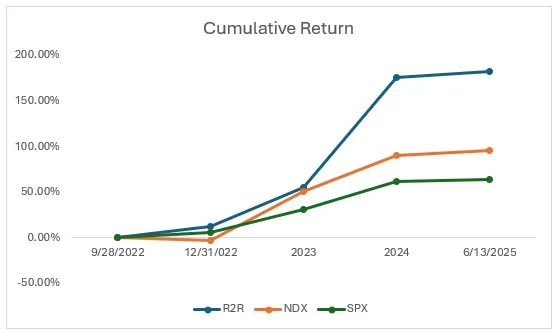

📈 Performance Snapshot

(From Sept 28, 2022, through June 13, 2025)

Measured using time-weighted return (TWR). NAV: 1.00 → 2.82

📊 Current Portfolio Holdings

*Includes delta-adjusted stock + options exposure. 💬 Curious about “delta” or “cash equivalents”? Drop me a message—I’m happy to explain.

🔍 Key Events This Week

🚗 TESLA

1. Musk–Trump Feud Softens Musk expressed regret for prior Trump-related tweets, including a deleted Epstein reference. Trump, in turn, dialed down threats and said there were “no hard feelings.” 🔍 My take: These political spats create perception risk. Every time Elon headlines instead of Tesla’s innovation, the stock pays a “volatility tax.” I stay focused on product, not politics.

2. Robotaxi Service to Launch June 22 in Austin Finally. Musk confirmed Tesla’s autonomous ride-hailing service goes live in Austin on June 22. 🔍 My take: Huge milestone. Curious to see how people react to getting into a driverless Tesla.

3. Texas Testing & Approval Tesla received official operator status in Austin. Real-world testing is well underway. 🔍 My take: Encouraging to see both testing and regulatory coordination progressing hand-in-hand.

4. FSD Progress in Europe Momentum in the Netherlands and Norway, but EU-wide approval remains cautious. 🔍 My take: Patience needed. Global regulatory buy-in takes time—but Tesla’s persistence is a good sign.

5. Model S/X Refresh New design tweaks and camera tech launched—with a $5K price bump. 🔍 My take: Nice upgrades, but price sensitivity might mute demand. Let’s see how the market responds.

6. Production Milestone: 8 Million Vehicles Giga Berlin pumped out Tesla’s 8 millionth vehicle—another Model Y. 🔍 My take: Incredible scale-up. Makes me wonder when we’ll hit 10 million.

📉 QQQ (NASDAQ 100)

1. Middle East Tensions Slam Markets The Israel–Iran conflict intensified, sparking a market selloff. On June 13, the Nasdaq dropped 1.3%, erasing earlier weekly gains. 🔍 My take: Geopolitical shocks are reminders of why I manage risk with options.

2. U.S.–China Trade Talks Early optimism around tariff negotiations in London faded as talks stalled. 🔍 My take: Markets hate mixed signals. Until we see resolution, expect choppiness in globally exposed names.

🎧 TENCENT

1. Tencent Music Buys Ximalaya for $2.4B A major content expansion play: $1.26B in cash + 5.2% stock to acquire China’s leading audio platform. 🔍 My take: Smart strategic move—more engagement = more monetization.

🤖 NVIDIA

1. EU Expansion: Industrial AI Push NVIDIA teams up with governments and telcos across Europe to launch national AI “factories.” Highlight: a German cloud built with Deutsche Telekom and 10,000 NVIDIA chips. 🔍 My take: This is NVIDIA exporting not just chips—but infrastructure.

2. Quantum + AI Vision Huang calls AI “the great equalizer” and says quantum is near an inflection point. 🔍 My take: Bold claims—but NVIDIA’s record suggests they’re not just hype.

3. Shareholder Meeting Set for June 25 Fully virtual again this year.

That wraps up Week 24.

Until next time—

Stay invested. Stay relaxed. —William | Relax to Rich Club

⚠️ Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.