Relax to Rich | Week 30 Recap (Ending July 25, 2025)

Investing Doesn’t Have to Be Complicated

Investing Doesn’t Have to Be Complicated

Hi friends,

At R2R, we keep things simple—and powerful. Our philosophy is grounded in timeless principles:

-

Stay patient

-

Focus on high-quality assets

-

Use options with purpose

-

Let time and compounding do the heavy lifting

This week, portfolio performance was modest—dragged by Tesla’s short-term pullback. But here’s the thing: I don’t invest for headlines or quarters. I invest for decades.

Tesla remains a core conviction, not because of what happens in a single quarter, but because of its potential in autonomy, AI, energy, and global platform dominance. Investing is a marathon, not a 100-meter sprint. My focus is on long-term value creation, not week-to-week volatility.

Each week, I share the journey—my trades, how I manage risk, key market headlines, and the lessons learned. If your goal is to grow wealth with calm confidence, you’re in the right place.

This week was all about balance—managing risk, refining execution, and tuning out the noise.

-

Tesla’s long-term thesis remains rooted in autonomy and innovation.

-

NVIDIA continues to ride strong AI tailwinds.

-

Tencent’s expanding AI ecosystem and global partnerships reinforce my conviction.

Weekly Activity

Weekly Activity

No new stock trades this week. My focus remained on managing risk:

-

Closed select TSLA calls to harvest the profit and generate the cash flow.

It’s not about being busy—it’s about being intentional. Risk management is the core of staying balanced.

Performance Snapshot

Performance Snapshot

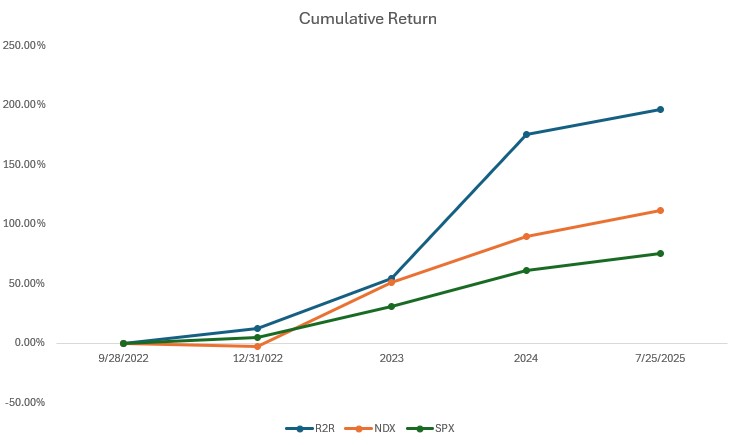

(From Sept 28, 2022, through July 25, 2025)

| Period | R2R Return | Nasdaq 100 | S&P 500 | Net Value | Duration/Year |

|---|---|---|---|---|---|

| 9/28/2022-12/31/2022 | 12.38% | -2.70% | 5.27% | 1.12 | 0.26 |

| 2023 | 37.74% | 55.13% | 24.23% | 1.55 | 1 |

| 2024 | 77.91% | 25.88% | 23.31% | 2.75 | 1 |

| 7/25/2025 | 7.43% | 11.20% | 8.62% | 2.97 | 0.56 |

| Total Return | 196.67% | 111.29% | 75.16% | 2.82 | |

| Annualized Return | 47.01% | 30.35% | 21.97% |

Measured using Time-Weighted Return (TWR). Starting NAV: 1.00. Current NAV: 2.97

Current Portfolio Holdings

Current Portfolio Holdings

| Rank | Holding | Weight* | Close Price | YTD Return |

|---|---|---|---|---|

| 1 | Tesla (TSLA) | 43% | 316.06 | -21.74% |

| 2 | QQQ | 10% | 566.37 | 10.79% |

| 3 | Tencent (700.HK) | 17% | HKD 550.50 | 32.01% |

| 4 | Nvidia (NVDA) | 2% | 173.50 | 29.20% |

| 5 | Others | 6% | ||

| 6 | Cash Equivalents | 21% | ||

| 7 | SPX | -59% | 6388.64 | 8.62% |

Curious about “delta” or “cash equivalents”? Drop me a message—I’ll happily explain.

Key Events This Week

Key Events This Week

Tesla (TSLA)

Tesla (TSLA)

1. Second Quarter Earnings Release

1. Second Quarter Earnings Release

Tesla reported a double-digit decline in adjusted earnings for Q2 2025. Sales dropped 13.5% versus the same quarter last year, marking the second consecutive quarter with a sales decline of at least 13%. Profits declined by 16% over the three months ending in June. The results come amid continued pressure on Tesla’s electric vehicle sales and intensified competition, especially from China’s BYD. Tesla also faces the loss of lucrative regulatory credit revenue due to recent legislative changes

My Take:

My Take:

This earnings report confirms persistent challenges in Tesla’s core EV business. The sustained decline in sales, coupled with the end of regulatory credit income, presents real headwinds for profitability. Competitive pressure is rising globally, especially from rivals with growing market share and lower cost structures. These results warrant a closer review of Tesla’s positioning and profit drivers going into the remainder of 2025.

This quarter’s emphasis on AI, robotics, and energy storage reinforces the investment thesis around Tesla as a technology platform rather than just an automaker, which may influence valuation multiples tied to software and services. The focus on global market expansion and battery production onshoring could improve supply chain resilience and cost structures, impacting future growth in emerging regions and margins.

2.Opening of Tesla Diner and Supercharger in Los Angeles

2.Opening of Tesla Diner and Supercharger in Los Angeles

On July 21, 2025, Tesla announced the opening of its retro-futuristic Tesla Diner and Supercharger site in West Hollywood, Los Angeles, operating 24/7 with 80 V4 Supercharger stalls accessible to all NACS-compatible EVs. The site includes dining options, entertainment via megascreens, and merchandise, with orders available through vehicle touchscreens or the Tesla Diner app.

My Take:

My Take:

I view this as an extension of Tesla’s ecosystem beyond core vehicle sales, potentially strengthening brand loyalty and creating new revenue streams from charging and services.

QQQ

QQQ

1. Record-High Index Performance

1. Record-High Index Performance

The NASDAQ 100 index closed the week at a new all-time high, finishing at 23,204.66 on July 25, 2025. Throughout the week, the index posted multiple record closes and ended up about 0.2-0.3% on Friday. The strong performance was driven by robust Q2 earnings from technology companies and continued optimism around major trade negotiations, especially with the August 1 tariff deadline approaching. Roughly 83% of reporting S&P 500 companies, many of which are major NASDAQ 100 constituents, have exceeded analyst profit forecasts for Q2.

My Take:

My Take:

The slight upward movement for the week, despite volatility, suggests a market that is cautiously optimistic.

2. Market Context: Trade and Tariff Developments

2. Market Context: Trade and Tariff Developments

Renewed optimism around U.S. trade deals spurred market momentum, with President Trump aiming to finalize reciprocal tariff agreements with Japan and the European Union before the August 1 deadline. This optimism helped U.S. indexes outpace European counterparts, where uncertainty and weaker earnings were a drag.

My Take:

My Take:

Trade developments have been a tailwind for U.S. large-cap tech, given how globally exposed many NASDAQ 100 members are. Reduced trade uncertainty could unlock more capital flows into risk assets, yet looming tariff deadlines create a source of short-term volatility. Investors should monitor the outcome of trade negotiations and assess how tariff resolutions or escalations could affect tech sector supply chains, margins, and global demand..

Tencent (700.HK)

Tencent (700.HK)

1. Announcement of Partnership with PayPal for Cross-Border Payments

1. Announcement of Partnership with PayPal for Cross-Border Payments

On July 23, 2025, PayPal announced the upcoming launch of PayPal World, a platform designed to simplify cross-border payments through integration with Tencent’s Tenpay, alongside other international wallets like Venmo, India’s UPI, and Mercado Pago.

My Take:

My Take:

This integration expands Tencent’s role in global digital payments, aligning with the investment thesis on ecosystem growth beyond China. It could influence valuation by enhancing revenue from fintech services, strengthen market positioning in international transactions, and support future growth prospects through increased user adoption in cross-border commerce.

2. Launch of AI-Powered Programming Tool CodeBuddy IDE

2. Launch of AI-Powered Programming Tool CodeBuddy IDE

On July 24, 2025, Tencent released CodeBuddy IDE, an AI-powered programming tool that automates app development, enabling non-technical users to create applications via conversational interfaces

My Take:

My Take:

The tool highlights Tencent’s advancements in AI applications, reinforcing the investment thesis around technology innovation as a core driver. It may affect valuation through potential new software service revenues, improve market positioning in developer tools, and contribute to future growth prospects by attracting enterprise users seeking efficient development solutions.

3. Launch of Weixin Mini Program with Uber

3. Launch of Weixin Mini Program with Uber

On July 22, 2025, Uber launched a Weixin Mini Program in collaboration with Tencent, allowing Chinese users to access seamless global travel services directly through the platform.

My Take:

My Take:

This collaboration extends Weixin’s utility in mobility services, supporting the investment thesis on platform integration for user retention. It could impact valuation by boosting ecosystem transaction volumes, enhance market positioning in lifestyle apps, and aid future growth prospects via partnerships that expand overseas user engagement.

That’s a wrap for Week 30.

Stay invested. Stay relaxed.

— William | Relax to Rich Club

#RelaxToRich #ValueInvesting #OptionsWithPurpose

Disclaimer

Disclaimer

I am not a licensed financial advisor, and the information shared here reflects my personal investment decisions and opinions only. This content is for informational and educational purposes and should not be construed as financial, investment, or trading advice. Past performance is not indicative of future results. Investing involves risks, including the potential loss of capital.